PAST WEEK'S NEWS (Oct 25 – Oct 31, 2021)

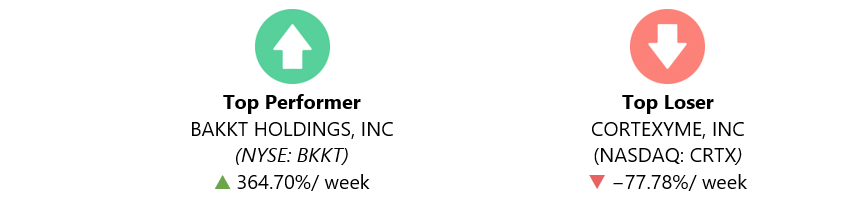

Bakkt's share price abruptly skyrocketed to a record high of $42.88, after two big partnerships brought the company soaring. The company announced it was working with Mastercard and Fiserv, to bring expansion related to cryptocurrency services.

Cortexyme Inc lead losses for the week after its experimental oral pill failed to meet the main goals of improving cognitive and functional abilities in patients with mild-to-moderate Alzheimer's disease in a study.

Stocks Performance

Most of the major indexes recorded gains and reached new highs last week, driven by the busiest of the third-quarter earnings reporting season, with several technology and internet-related giants announcing results, helping keeping trading volumes elevated.

It was a big week for earnings, with most companies exceeded EPS estimates, although commentary was littered with supply chain issues and higher costs, expected to persist in the fourth quarter. Microsoft and Alphabet were the earnings winners for the week with 7% weekly gains. Tesla, though, was the biggest winner with a 22.5% gain that was jumpstarted by an agreement to sell 100,000 vehicles to Hertz Global. Tesla reached a $1 trillion market capitalization.

Investors also appeared to react to political and economic factors, with hope for additional fiscal stimulus appeared to bolster sentiment. President Joe Biden on Thursday unveiled a framework for a $1.75 trillion tax and spending package his administration. The advance Q3 U.S. GDP report meanwhile was weaker than expected.

Consumer discretionary and technology services sectors fared best. Energy underperformed as oil prices fell back from multiyear highs.

Indices Performance

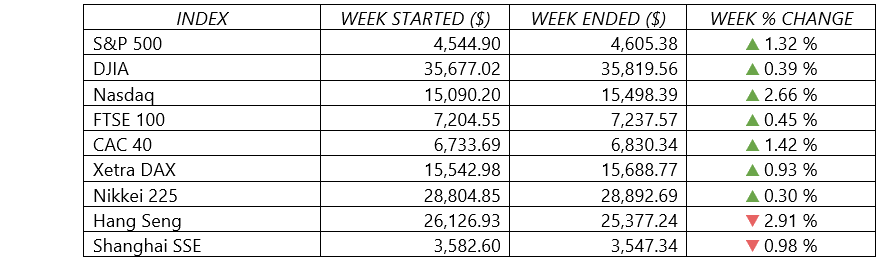

The major U.S. stock indexes rose for the fourth week in a row. The NASDAQ added nearly 3%, outperforming its peers by wide margins and besting a record that it had set about seven weeks earlier.

Shares in Europe also rallied, supported by solid corporate earnings that may have helped to offset concerns about inflation and the potential for central banks reining in some of their accommodative policies.

China’s stock markets retreated amid continued concerns about the strength of the property sector. The property sector, which accounts for about one-third of China’s overall economy, has stirred investor anxiety in recent weeks following defaults, credit rating downgrades and, most recently, a proposed tax plan as authorities seek to reduce leverage among leading developers.

Oil Sector Performance

Oil market recorded its first weekly losses in more than two months after U.S. oil stocks rose more than expected, and Iran flagged it was resuming talks with Western powers on its nuclear programme which could lead to an end to sanctions.

Iran's top nuclear negotiator Ali Bagheri Kani on Wednesday said the country's talks with six world powers to try to revive a 2015 nuclear deal will resume by the end of November. A deal could pave the way to lifting harsh sanctions imposed by former U.S. President Trump on Iran's oil exports in late 2018.

Although the weekly decline was modest, the price of U.S. crude oil fell below $84 per barrel, snapping a 10-week string of gains that had pushed the price to a seven-year high. While recorded the first decline in eight weeks for Brent.

U.S. crude oil stockpiles rose by 4.3 million barrels last week, the U.S. Energy Department said, more than double the 1.9-million-barrel gain forecasted. Gasoline stocks fell by 2 million barrels to the lowest in nearly four years.

Other Important Macro Data and Events

The Treasury market was mixed throughout the week. The 2-yr yield finished two basis points higher at 0.49%, while the 10-yr yield dropped ten basis points to 1.56%. A hawkish signal from some foreign governments and central banks helped drive long-term yields lower and contributed to flattening moves along the yield curve by pulling short-term rates higher.

The third quarter earnings have overall been a pleasant surprise to the upside. With about 55% of S&P 500 companies having reported so far, third quarter earnings growth is up a robust 36% year-on-year, well ahead of the expectation for 28% growth predicted at the end of September. This upward revision in earnings has broadly supported the positive market tone.

The week’s economic data were mixed. The Commerce Department revealed that the U.S. economy expanded at an annual rate of 2.0% in the Q3, below most economists’ expectations and marking the slowest quarterly growth since the pandemic triggered a sharp decline in early 2020. A decline in auto sales and a slowdown in spending on food services and accommodations—seemingly due to the delta variant of the coronavirus—were largely to blame. Pending home sales also fell unexpectedly.

On the bright side, there’s continued improvement in U.S. jobless claims, which dropped 10,000 to a seasonally adjusted 281,000 last week, remaining below the 300,000 threshold for the third straight week. Investors also reassured that the flipside of slowing growth appeared to be moderating inflation pressures. The core PCE rose 3.6% over the annual period, slightly below consensus and unchanged from the prior month’s pace.

Core eurozone yields rebounded after ECB President Christine Lagarde did little to push back against markets pricing two rate hikes next year, contrary to expectations. The ECB maintained its existing policies and indicated that it would continue buying assets under the auspices of its PEPP at the somewhat moderated rate announced in September.

The eurozone’s economic growth in the Q3 outpaced the GDP gains in the U.S. Data released on Friday showed that GDP in the 19-nation eurozone grew at a seasonally adjusted annualized rate of 9.1%. In comparison, the U.S. growth rate was just 2.0%. Among the major economies in the euro area, France and Italy posted stronger-than-expected growth in the GDP.

Bank of Japan maintained its stance, keeping interest rates and its asset purchase program unchanged at its October monetary policy meeting. While other major central banks have begun to unwind their easing policies, the BoJ does not look set to pursue a path toward the normalization of policy anytime soon, given price momentum in Japan is much weaker than in other countries.

Beijing’s clampdown on the tech sector continued as the country’s internet watchdog proposed restrictions on companies with more than 1 million users with a security review before they can send user-related data abroad. China also has said it will roll out a pilot real estate tax in some regions, adding to existing investor concerns about real estate in the mainland.

Concern over more tension between Beijing and Washington also continue to be watched, after the U.S. Federal Communications Commission voted to revoke the authorization for China Telecom's U.S. subsidiary to operate in the States after nearly two decades, citing national security.

Ethereum jumped to a new high on Friday. In the week ahead, the VanEck's Bitcoin futures ETF (XBTC) is expected to launch.

What Can We Expect from the Market this Week

Investors have big meetings with the Federal Reserve and OPEC to track. Earnings reports continue to roll in.

At its two-day meeting that concludes on Wednesday, the U.S. Fed could release details of its plan to begin trimming its bond-purchasing stimulus program. The meeting will come less than two weeks after Fed Chair Jerome Powell publicly said that the central bank remained on track to begin tapering the $120 billion in bond purchases that it’s been making each month.

In Washington, policymakers are also looking to get the bill passed in the weeks ahead, along with a vote on the $1.2 trillion infrastructure package in the House.

Also on Wednesday, the OPEC+ is due to discuss whether to approve another modest increase of 400,000 barrels a day, restoring another tranche of the supplies shuttered last May.

Another important economic data being released this week include construction spending, ADP employment report, trade balance, consumer credit, and jobs and unemployment data.