PAST WEEK'S NEWS (Dec 13 – Dec 19, 2021)

Galera Therapeutics Inc. shares surged in last week trading after the corrected results from its Phase 3 trial of avasopasem for the treatment of RT-induced severe oral mucositis in patients with locally advanced head and neck cancer showed major results. The company previously announced the trial didn't achieve statistical significance on the primary endpoint.

Adagio Therapeutics stock crashed after announced that its antibody therapy ADG20 was much less effective against the Omicron variant than previously reported.

Stocks Performance

Stocks ended lower for the week, as the prospect of central bank tightening and fears over the impact of the Omicron variant of the coronavirus sparked considerable volatility.

The Federal Reserve’s monetary policy meeting on Tuesday and Wednesday appeared to dominate sentiment for much of the week. As expected, the Fed left the target range for the fed funds rate unchanged at 0.00-0.25%, said it will double the reduction of asset purchases to $30 billion per month ($20 billion for Treasuries and $10 billion for agency MBS), and signaled three rate hikes in 2022 amid expectations for continued inflation pressures.

Elsewhere, the Bank of England increased its bank rate by 15 basis points to 0.25% in a surprise move. The European Central Bank and Bank of Japan left rates unchanged, as expected, and announced a further tapering of asset purchases.

The market fumbled after the FOMC policy decision, leaving the sectors mixed by week's end. The information technology, consumer discretionary, and energy sectors were the weakest performers with losses over 4.0%. The defensive-oriented health care, real estate, consumer staples, and utilities sectors managed gains, rose more than 1.0%.

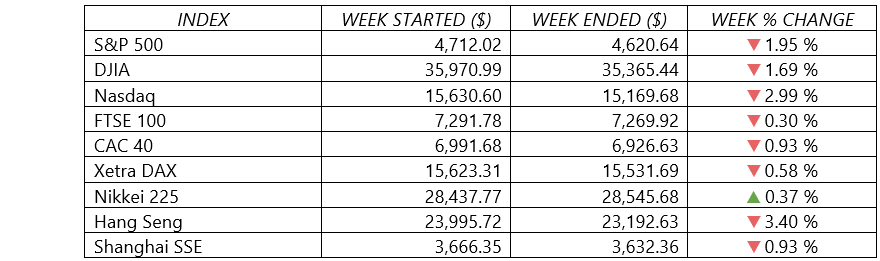

Indices Performance

After rallying in previous week, the major U.S. stock indexes retreated for the third week out of the past four. Trading was choppy throughout the week, with the NASDAQ underperformed the S&P 500 and the Dow by wide margins.

Shares in Europe fell as governments tightened restrictions to curb the spread of the coronavirus and central banks became more hawkish.

The Danish and Norwegian governments tightened restrictions on social activity and recommended working from home to contain the coronavirus. The German and UK parliaments voted in favor of mandatory vaccines for health workers. The UK also approved stricter measures, including passes showing proof of vaccination to enter entertainment venues. France severely limited travel to and from the UK.

Japanese equities rose over the week. Investor sentiment was lifted by the U.S. Fed’s tapering decision, as many feel that the move signals confidence in the post-pandemic economy, and Japan’s open market is highly leveraged to the global economic recovery.

Chinese markets fell for the week amid the resurgence in global COVID-19 cases and U.S.-China tensions after Washington placed investment and export restrictions on dozens of Chinese companies for their role in allegedly repressing China’s Muslim minorities and in supporting Beijing’s military.

Crude Oil Performance

Oil prices edged lower, as surging cases of the Omicron coronavirus variant raised fears new curbs may hit fuel demand.

The International Energy Agency (IEA) on Tuesday said a surge in COVID-19 cases with the emergence of the Omicron variant will dent global demand for oil at the same time that crude output is set to increase, especially in the U.S., with supply set to exceed demand through at least the end of next year.

In contrast, the OPEC on Monday raised its world oil demand forecast for the first quarter of 2022. The cartel boosted estimates for consumption in the period by 1.1 million bpd - equivalent to annual world consumption growth in a typical year before the pandemic - according to a monthly report from the group’s research department.

Other Important Macro Data and Events

As expected, the U.S. Federal Reserve accelerated the pace at which it will phase out its pandemic-era program that’s been purchasing $120 billion in bonds each month. The Fed taper is now expected to end by March 2022 instead of next June. In addition, most Fed officials now see three interest-rate increases as likely in 2022, up from the single increase that had been projected a few months ago.

In a week when investors digested a shift in U.S. monetary policy and headlines surrounding Omicron, prices of government bonds rose, sending yields lower. The yield of the 10-year U.S. Treasury bond pushed belos 1.40% on Friday for the first time in nearly two weeks, down from 1.49% at the end of the previous week of trading.

The U.S. Federal Reserve wasn’t the only major central bank to announce a policy shift in response to inflation concerns. The Bank of England raised its key interest rate on Thursday, becoming the first major central bank to do so during the pandemic. The Norwegian central bank also lifted its main interest rate by another 25 basis points to 0.5%

The ECB kept its main policy rates at existing levels. It also said it would end its emergency asset purchase program in March but temporarily increase its Asset Purchase Program to smooth the transition. The ECB signaled that any exit from ultra-easy monetary policy would be slow, as the pandemic was again depressing business and consumer sentiment and

The Swiss central bank kept an ultra-loose monetary policy in place and its key rate at -0.75%, saying inflation was lower in the country than elsewhere in Europe. Bank of Japan remains among the world’s most dovish central banks, maintained short-term interest rates at -0.1% and the target for 10-year JGBs at around 0%, as widely expected.

Turkish equity market index sustained such a steep decline on Friday that it twice triggered circuit breakers that temporarily halted trading. The benchmark dropped 8.5% amid instability for Turkey’s currency, the lira, and surging inflation.

What Can We Expect from the Market this Week

A short trading week is ahead for investors as Christmas holiday approaches, although it is not likely to be a quiet week with the rapid increase of the omicron COVID variant threatening some industries. The whipsaw action could continue as the impact of the Federal Reserve's plan to raise interest rates is fully digested. A possible wildcard could come earlier in the week from China if the PBOC lowers benchmark lending rates.

Important economic data being released this week include leading indicators, personal income, and the PCE index.

Nike (NYSE:NKE), Micron Technologies (NASDAQ:MU) and Rite Aid (NYSE:RAD) are among the biggest names to report earnings.