PAST WEEK'S NEWS (Feb 7– Feb 13, 2022)

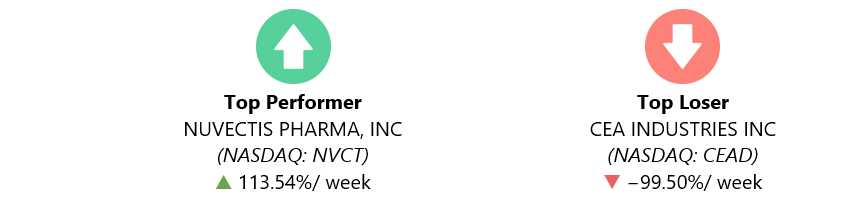

Nuvectis Pharma shares soared mostly on Monday after tumbling during their market debut the week before. The shares of the oncology drug developer made its market debut opening at $3.95 after pricing its IPO at $5 per share. Shares then trended upward to close at $6.94 on Friday.

Stocks Performance

Last week market narrative and performance were shaped by renewed hot inflation reading, the pace of monetary tightening, and geopolitical conflict in Ukraine. The tug of war between healthy earnings growth and fears over monetary tightening continued to dominate sentiment. Warnings from U.S. officials that a Russian invasion of Ukraine might be imminent may have also contributed to a late-week sell-off.

The U.S. Labor Department reported that the headline CPI advanced 7.5% over the year ended January, more than consensus expectations and its highest annual gain since February 1982. Hawkish sentiment also combined with comments from St. Louis Federal Reserve Bank President James Bullard, who told Bloomberg that he supports the Fed hike rates by 100 basis points by July 1, including one hike being 50 basis points.

Declines in mega-cap technology stocks—including Facebook parent Meta Platforms, Microsoft, and Google parent Alphabet—weighed on the broader indexes, though the so-called reopening trade helped stocks regain their footing at midweek. Shares in restaurants, hotels, casinos, air and cruise lines, and online travel agency stocks all rallied.

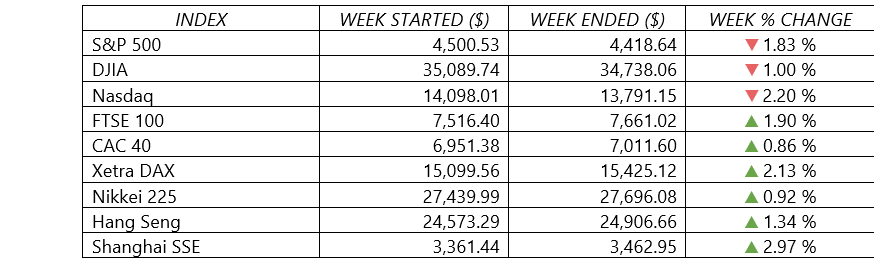

Indices Performance

The major U.S. stock indexes slipped, after recording two positive weeks in a row before. Stocks climbed on Tuesday and Wednesday, only to fall the next two days following inflation data on Thursday. The technology-heavy Nasdaq Composite fared worst and ended the week down roughly 15% from its recent peak, still in correction territory.

Shares in Europe rallied, buoyed by strong corporate earnings, and better-than-expected economic data.

Chinese stocks rose amid supportive official comments and a perception that the country’s regulatory crackdown cycle had peaked. The Shanghai Composite Index gained 3% since January 28, the last day of trading before a weeklong Lunar New Year holiday. Japan’s stock markets generated a positive return in a holiday-shortened week, supported by solid corporate earnings.

Crude Oil Performance

Oil benchmarks marks their eight straight weekly gain, though gains were smaller compared with previous weeks, as investors taking profits after signs of progress in U.S.-Iran nuclear talks could lead to the removal of sanctions on Iranian oil sales.

Resumption of talks between the U.S. and Iran could revive an international nuclear agreement and allow more oil exports from the OPEC producer. A deal could return more than 1 million bpd of Iranian oil to the market, boosting global supply by about 1%.

A big drawdown in U.S. inventories underscored the ongoing tightness in the market. U.S. crude inventories fell 4.8 million barrels in the week to Feb. 4, dropping to 410.4 million barrels - their lowest for commercial inventories since October 2018, report by EIA on Wednesday showed.

Geopolitical tensions in Eastern Europe kept oil's gains fuelled, buoyed both the benchmarks to a seven-year high earlier in the week.

Other Important Macro Data and Events

Investors monitored moves in U.S. bond yields, after the U.S. CPI for January showed a hotter-than-expected rise. The inflation number likely puts more pressure on the U.S. Fed to act more aggressively with rate hikes.

The benchmark U.S. 10-year Treasury yield broke past the 2% mark for the first time since 2019 after starting the year at 1.51%. On Friday, the yield closed at about 1.95%. The two-year notes, which typically move in step with interest rate expectations, also shot up after the data.

The U.S. government reported that inflation accelerated at a 7.5% annual rate in January—the highest since 1982. That figure was above December’s 7.0% increase and well above the 1.8% annual rate for inflation in 2019, prior to the pandemic.

Core and peripheral eurozone government bond yields also rose on the higher-than-expected inflation forecast issued by the European Commission (EC) and an upside surprise in U.S. inflation. UK gilt yields increased after data indicated that the economy contracted less than expected in December and grew 1% in the Q4. This resilience appeared to contribute to market expectations for the Bank of England to increase interest rates again.

The Bank of Russia on Friday became the latest major central bank to lift interest rates. The move came after Russia’s annual inflation rate rose to 8.7% in January, and as the nation faces the threat of Western economic sanctions amid the military face-off on Russia’s border with Ukraine.

The price of Bitcoin rose for the third week in a row, regaining much of the ground lost in a January sell-off. The cryptocurrency was trading at around $42,600 on Friday afternoon, up 28% from a recent low. However, that price was still 37% below Bitcoin’s record high achieved last November.

The safe haven gold rose for about 1% in the week, the highest since early January, as inflationary risks and geopolitical tensions lifted demand.

What Can We Expect from the Market this Week

Markets will continue to focus on inflation and how central banks respond to it. Between the recently released January jobs report and last week's inflation data, it's become clear that the Fed needs to quickly shift away from its ultra-loose monetary policy and start hiking interest rates.

A government report scheduled to be released on Wednesday will show whether U.S. retail sales recovered in January in the wake of the Omicron variant’s emergence at the peak of holiday shopping season. A month ago, the government reported that December retail sales fell 1.9%.

Other agenda in U.S. economic calendar in the week ahead also features updates on producer prices, retail sales, housing starts, existing home sales, and unemployment claims. FOMC minutes are also due out on February 16.

Big earnings reports from companies like Walmart, Nvidia and ViacomCBS will pour in in the week.