PAST WEEK'S NEWS (APRIL 17 - APRIL 21, 2023)

Crude oil trade between Russia and China is settled in Chinese Yuan as more countries is moving away from US dollar and accepting sovereign currency of China.

Ukrainian officials in energy sector are holding talks in hope of opening new oil production facility as tension arise in the region after OPEC production cut is opening the gate to a new energy crisis. Exxon, Halliburton, and Chevron among top candidates for operation lease in the energy project.

Chile announced plan to nationalize their lithium production as the second largest worldwide producer and world largest lithium mine reserve in an ever-demanding environment of electric vehicle and ban on the alternatives.

Apple, the largest American company contributing to 7% of the main Wall Street board announced its collaboration with Goldman Sachs to offer high-yielding savings account, further putting pressure on regional banking crisis that saw customer deposits shift to bigger bank for safety.

SpaceX recently launched their first integrated Starship rocket, the biggest in the world, and successfully reaching Max-Q before disintegrating in an “unscheduled rapid disassembly”. The private spaceflight company called it a tremendous success as the benchmark for the launch is ascension beyond the launching tower.

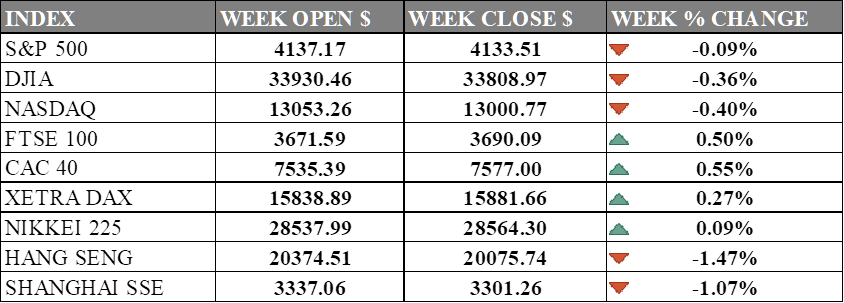

INDICES PERFORMANCE

The table above displays the performance of major stock market indices for the week. The S&P 500, DJIA, and NASDAQ all experienced a slight decline ranging from -0.09% to -0.40%. This indicates that the U.S. stock market remained relatively stable during the week, despite some fluctuations.

On the other hand, European markets showed a more positive trend, with the FTSE 100, CAC 40, and XETRA DAX all ending the week with gains ranging from 0.27% to 0.55%. This suggests that the European stock market was performing well during the week.

In contrast, Asian markets experienced more significant declines, with the Hang Seng and Shanghai SSE both ending the week with losses of -1.47% and -1.07%, respectively.

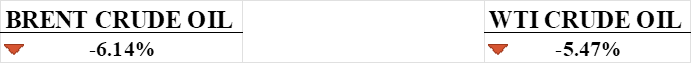

CRUDE OIL PERFORMANCE

The expectations for a recovery in demand this year were significantly impacted by concerns regarding the increase in interest rates and a slowdown in economic growth. The price of oil almost returned to before OPEC announce additional production cut but data from China is promising as March have been shown to be the highest amount of crude oil imported by the country. The upcoming May Day holiday are expected to boost jet fuel demand as more people travel inside and out of the country with long-haul airfares soaring and not enough flights available.

OTHER IMPORTANT MACRO DATA AND EVENTS

76% of S&P 500 companies beat analysts' quarterly net income expectations, slightly lower than the 5-year average. The consumer discretionary and industrials sectors are expected to have the strongest earnings growth.

According to the National Association of Realtors, the median sale price of existing U.S. homes has fallen for two months in a row, which marks the first time in 11 years, with the price dropping 0.9% from the previous year to $375,000 in March.

Investors were anxious due to the latest partisan battle over the U.S. debt ceiling in Washington, where House Republicans proposed a bill to increase the ceiling for a year in exchange for federal spending cuts, while the government took special measures to prevent a default.

China's first-quarter GDP grew at an annual rate of 4.5%, indicating a boost from the removal of the zero-COVID policies, whereas the growth figure for 2022 was 3%, below the government's expected target of about 5.5%.

What Can We Expect From The Market This Week

Consumer Confidence Data is expected to be slightly lower at 104 down from 104.2. Any numbers above 100 is a show of confidence in the economic activity, and the number we are currently at shows that investor is confident that the economic activity is hot considering strong labour market.

New home sales data points to new single-family homes that is sold in the month of March which saw a steady increase since October last year and is expected to reverse with slight decline. It was reported higher at 640,000 in the month of February and expected to decrease to 630,000.

Q1 2023 GDP data will tell investor whether the economy is in slight decline or at dangerous level as it measures growth which economist agrees that negative growth for 2 quarter is a recessionary period. However, the expected 2% growth is far from negative and will be vital for the direction of policymakers and portfolio rebalancing activities.

March PCE inflation data will be vital to the Fed May meeting. Previous data shown that inflation is sticky or not wanting to go down and the consensus for PCE price index is the same at 0.3% month-on-month which is a neutral stance as the growth of inflation is ought to cool after 0.6% figure reported in January and 0.3% in the month after.

Mega-cap tech report earnings are due this week including Microsoft, Google, META, and others. The ongoing high-interest rate environment is damaging to the health of tech company thus the consensus for earnings have been lowered compared to previous quarter. Additionally, recent layoffs in majority of tech company may help to boost their income statements in a more positive lights.