PAST WEEK'S NEWS (February 24 – February 28)

President Trump has been busy reshaping U.S. strategic interests through a mineral deal with Ukraine, oil licence cancellation in Venezuela, and selling a golden card toward U.S. citizenship, each with significant implications while China sees opportunities. On Friday, he will meet Ukrainian President Zelensky in Washington to sign an agreement granting the U.S. access to Ukraine’s vast rare earth mineral deposits—such as graphite, titanium, and lithium—aiming to reduce America’s reliance on China for these critical resources while providing security through American worker presence in the region. Trump recently announced the reversal of a concession agreement that allowed Chevron to operate in Venezuela’s oil sector, aiming to cripple Venezuela’s production. While the mineral deal could weaken China’s leverage over the U.S. in resource supply, the Venezuela decision might counteract this by offering China a chance to fill the energy vacuum. These actions illustrate Trump’s “America First” approach, prioritising U.S. economic and strategic gains, but they also risk destabilising alliances and power holds.

Market conditions have been seen tilting toward caution with escalation expected in the China market following the U.S. move to restrict Chinese investments in American technology and infrastructure, causing Hong Kong's Hang Seng Index to open almost 3% lower today. Alibaba Group was hit the most, closing 10% lower on Monday after announcing a massive investment of at least 380 billion yuan in cloud computing and AI infrastructure over the next three years. The Hang Seng Tech Index opened 4.4% lower and recovered to only losing 1.6%. Analysts warn that geopolitical risks, along with China’s low inflation and weak consumer confidence, remain primary concerns for market stability. Meanwhile, the People's Bank of China injected CNY 300 billion via a one-year medium-term lending facility, although this fell short of offsetting maturing loans, tightening overall liquidity. There are hopes of fewer regulatory crackdowns on tech following President Xi Jinping’s meeting with business leaders like Alibaba co-founder Jack Ma Yun.

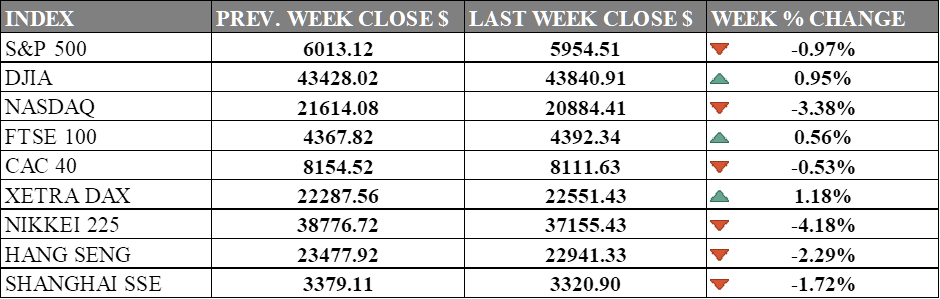

INDICES PERFORMANCE

Wall Street ended the week mixed. The S&P 500 fell by 0.97%, closing at 5954.51, reflecting broad market weakness. The Dow Jones Industrial Average (DJIA) experienced a gain of 0.95%, finishing at 43840.91, showing resilience amid market volatility. Meanwhile, the Nasdaq decreased by 3.38%, closing at 20884.41, as the tech-heavy index faced heavy selling pressure. Falling consumer confidence, rising jobless claims, and slowing price growth—and heightened geopolitical risks after a tense Oval Office exchange between President Trump and President Zelensky has raised market volatility index to fearful.

European markets showed mixed results, with minimal movement overall. The UK's FTSE 100 managed a modest gain of 0.56%, closing at 4392.34, showing resilience amid broader market uncertainty. France's CAC 40 experienced a minor decline of 0.53%, ending at 8111.63, while Germany's XETRA DAX rose by 1.18%, closing at 22551.43. This if far better performance than expected given U.S. takes on Ukraine situation.

Asian markets displayed broadly negative trends. Japan's Nikkei 225 declined significantly by 4.18%, closing at 37155.43, representing one of the steepest drops among global markets due to tariff. Hong Kong's Hang Seng Index also weakened, falling by 2.29%, finishing at 22941.33. In mainland China, the Shanghai Composite Index posted a decline of 1.72%, ending at 3320.90. The weakness in Asian markets suggests growing concerns on Trump tariff plan and more importantly retaliatory measures from Chinese government that would be devastating.

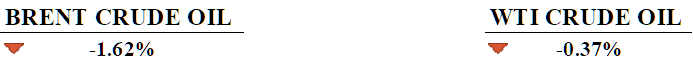

CRUDE OIL PERFORMANCE

Oil prices broadly fell on the weekly although brent fell more than WTI, marking their first monthly drop since November, as markets reacted to geopolitical tensions and policy shifts such as ongoing U.S.-Ukraine talk, new tariffs, and Iraq’s decision to resume Kurdish oil exports. Analysts noted that these developments could favor Russia’s oil market position and raise uncertainties about global demand, with tariff wars potentially slowing growth and suppressing crude demand. Meanwhile, OPEC+ faces a dilemma over whether to delay planned output increases, as Iraq’s export resumption raises questions about compliance with production quotas. Despite recent volatility, Brent prices are projected to average $75 this year, though downside risks include weak economic activity and higher OPEC+ output. Over the medium term, analysts foresee balanced oil markets but warn of potential price spikes from geopolitical tensions or EV sales slowdowns.

OTHER IMPORTANT MACRO DATA AND EVENTS

Inflation held at 0.3% in January, with annual PCE easing to 2.5% while consumer spending unexpectedly fell by 0.2%. Worsening consumer confidence and rising jobless claims complicate the Fed's outlook even as markets eye potential rate cuts in June.

New U.S. single-family home sales fell by 10.5% in January due to high mortgage rates and severe winter weather, indicating a slowdown in housing market and overall economic activity. The median house price increased to a two-year high despite rising inventory, with growth estimates for the first quarter mostly below a 2% annualized rate.

What Can We Expect from The Market This Week

US Nonfarm Payrolls: January data suggest a significant slowdown in job growth with only 143,000 jobs, well below expectations, alongside a slight unemployment rate decline to 4.0% and higher wage growth of 4.1% annually. Unemployment claims data last week had also risen greatly to 242,000, signalling continued weakness in the labour market.

ECB Interest Rate Decision: The ECB had consistently enacted consecutive 25 basis point rate cuts since October, aiming to continue with the same pace. However, this can change if the inflation data that are coming earlier make it impossible for the ECB to justify it.

Eurozone GDP Q4: Eurozone's second GDP release shows expansion slightly at 0.1%, marking a slowdown from Q3’s 0.4% growth and falling short of expectations as contractions in Germany and France were only partially offset by gains in Spain and Portugal.

ISM Non-Manufacturing PMI: Key U.S. services sector indicator still shows an expansion, although declining to 52.8 in January from December’s 54.1 as business activity and new orders weakened while employment and easing price pressures offered some support while manufacturing PMI just entered an expansion phase after 10 months.

Eurozone CPI February: February Eurozone flash estimates show a modest easing in inflation with headline rates at 2.3% and core inflation at 2.6%, attributed to cooling services and declining energy prices even with a rebound in food inflation. This data supports expectations for the ECB's approach as it steadily works toward its 2% inflation target.