PAST WEEK'S NEWS (July 04 – August 08)

U.S. President Donald Trump's latest tariff target has been India over its purchase of Russian oil right after it retargeted its sanction toward Russia's "shadow fleet" mainly selling to India and China. India's foreign ministry responded defiantly, calling Trump's targeting "unjustified and unreasonable" and vowing to protect its national interests and economic security. India defended its Russian oil imports as a necessity after traditional supplies were diverted to Europe after the Ukraine conflict spread, while pointing out Western hypocrisy by noting that EU trade with Russia significantly exceeds India's total trade with Russia. The dispute has already impacted India's currency, with the rupee hitting a record low against the dollar, though Indian refiners have reportedly paused Russian oil purchases due to narrowing price discounts. This escalation between the U.S. and India in trade came after Trump imposed 25% tariffs on Indian imports over its membership in the BRICS group. India's unexpected response shows its determination to pursue an independent foreign policy without succumbing to American pressure, a significant shift from the traditionally diplomatic tone in bilateral relations.

The trend leader, Apple, is pouring $600 billion into U.S. manufacturing from 2025 to 2029, expanding its original $500B plan by another $100B this August under its new American Manufacturing Program (AMP). This isn’t just PR since Apple is teaming up with major players like TSMC, Texas Instruments, Corning, and Samsung to build everything from semiconductors to iPhone glass, all on U.S. soil. A new 250,000 sq ft AI server factory is coming to Houston in 2026, alongside expanded glass production in Kentucky and chip operations in Arizona and Texas, projected to put out 20,000 new jobs and support nearly half a million others nationwide. It’s a coast-to-coast move, with key sites in Texas, Arizona, Kentucky, Michigan, and even North Carolina getting major upgrades. Apple isn’t just making products anymore; it’s building the backbone of an American tech supply chain and leading a trend that could reshape the global manufacturing map.

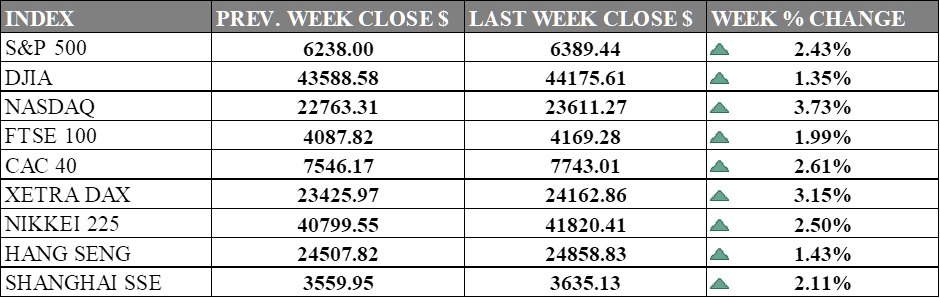

INDICES PERFORMANCE

Wall Street major indices posted solid gains as market sentiment improved. The S&P 500 rose by 2.43%, closing at 6389.44, reflecting renewed optimism in the broader market. The Dow Jones Industrial Average (DJIA) delivered steady performance with a gain of 1.35%, finishing at 44175.61. The Nasdaq outperformed other major US indices with a 3.73% increase, closing at 23611.27, as investors showed strong confidence in tech stocks.

European markets also posted positive results during the period, with gains across all major indices. The UK's FTSE 100 advanced by 1.99%, closing at 4169.28. France's CAC 40 rose by 2.61%, ending at 7743.01, while Germany's XETRA DAX gained 3.15%, closing at 24162.86. European markets benefited from the upbeat sentiment in the US.

Asian markets showed consistent strength, posting broad-based gains across the region. Japan's Nikkei 225 climbed 2.50%, closing at 41820.41, reflecting resilience despite global uncertainties. Hong Kong's Hang Seng Index rose by 1.43%, finishing at 24858.83, while mainland China's Shanghai Composite Index gained 2.11%, ending at 3635.13, as Chinese markets continued to show steady momentum.

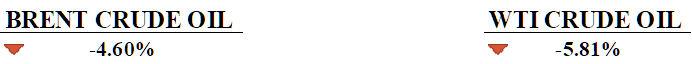

CRUDE OIL PERFORMANCE

WTI crude plunged over 5% this week to $63.92, hitting two-month lows as OPEC+ plan to unleash 547,000 bpd of additional supply starting September, adding fire to growing oversupply fears. President Trump's tariff warfare escalated dramatically, doubling Indian levies to 50% over Russian crude purchases while threatening triple-digit tariffs on Russian oil without a Ukraine ceasefire. Potential US-Russia peace talks initially crashed prices on sanction-relief prospects, though scepticism about Putin's territorial demands quickly reversed sentiment. The IEA's stark warning of a 1.5% global surplus by Q4-2025 combined with surging inventory builds crushed bullish momentum despite tight US stockpiles. JPMorgan warned that enforced Russian oil tariffs could trigger supply shocks given limited OPEC spare capacity, creating a dangerous policy tightrope. Despite supportive factors like dollar weakness and falling floating storage, supply-side pressures and tariff uncertainties delivered crushing weekly losses across the crude complex.

OTHER IMPORTANT MACRO DATA AND EVENTS

Initial Jobless Claims rose to 226K, exceeding both the forecast of 221K and the previous figure of 219K, indicating potential instability in the U.S. job market and posing a bearish sign for the USD.

China's July trade surplus plunged to $98.24 billion, missing expectations, as imports soared by 4.1% and exports jumped by 7.2%, signalling a rebound in domestic demand and easing trade tensions with the U.S.

What Can We Expect from The Market This Week

US CPI: Headline inflation rose 2.7% annually in June, up from 2.4% in May and expected to be 2.8% for July, primarily driven by shelter and energy costs. This confirms Fed worries on reinflation that might delay rate cuts if it goes beyond expectation, with core CPI (excluding food and energy) rising 2.9% annually, while the monthly increase was 0.3%.

RBA Interest Rate Decision: The Reserve Bank of Australia is widely expected to cut the cash rate by 25 basis points from 3.85% to 3.6% at its August meeting, following sustained economic data supporting easing monetary policy. All major Australian banks and economists are forecasting this third rate cut of 2025, despite the RBA holding rates steady in July.

UK GDP Q2: The UK's second quarter preliminary economic growth data is scheduled for release, with preliminary estimates suggesting modest growth following a strong Q1 expansion of 0.7%. Monthly data through May showed some softening with a 0.1% contraction, projecting that Q2 growth may decelerate from the strong start to the year.

Japan GDP Q2: Preliminary estimates are expected to show a return to positive growth after the economy contracted 0.2% (annualised) in Q1 2025, with economists projecting minimal growth of around 0.01% annually. The recovery is seen to be modest, with consumption and capital expenditure remaining key areas of concern for sustained economic momentum.

US Retail Sales: Consumption grew 0.6% in June, far above forecasts of a 0.1% gain and reversing the previous month's 0.9% loss. Year-over-year, retail sales grew 3.92%, reaching $720.1 billion, with non-store retailers and food service establishments showing solid performance, evidence of robust consumer spending.