PAST WEEK'S NEWS (October 27 – October 31)

In a move that surprised no one on Wall Street, the Federal Reserve slashed interest rates by another quarter point Wednesday, bringing its benchmark rate down to 3.75-4.00%, the lowest level since 2022, marking the second cut this year as the central bank attempts to cushion a weakening economy and increasingly fragile labour market. But the real story is found in Fed Chair Jerome Powell's press conference, where he threw cold water on hopes for a December rate cut, declaring it's "not a foregone conclusion", language that signals the Fed is approaching a policy inflection point where further easing becomes politically and economically treacherous. The 10-2 vote reveals cracks in the committee's consensus, and based on current economic trajectories, the Fed will likely pause rate cuts entirely by year-end, adopting a "wait-and-see" posture through at least the first quarter of 2026, leaving rates elevated longer than markets wanted, disappointing both consumers hoping for meaningful relief on mortgages and credit cards and investors betting on aggressive monetary easing.

China and the 11-member ASEAN bloc signed an upgraded free trade agreement Tuesday in Malaysia, expanding cooperation in digital economy, green technology, and pharmaceuticals worth $771 billion annually. The deal has been in progress since November 2022 as Beijing seeks to counter U.S. trade pressures, while Xi-Trump is expected to meet in Seoul on October 31st. Chinese Premier Li Qiang pushed for accelerated trade liberalisation, while Singapore's Prime Minister Lawrence Wong praised the agreement's potential to unlock new growth opportunities. Yet economic gains were overshadowed by security tensions as Philippine President Ferdinand Marcos Jr blasted Chinese aggression in the South China Sea, a concern all Southeast Asians feel that China is actively ignoring. Beijing's sweeping territorial claims clash with multiple ASEAN members, and negotiations on a binding code of conduct remain stalled.

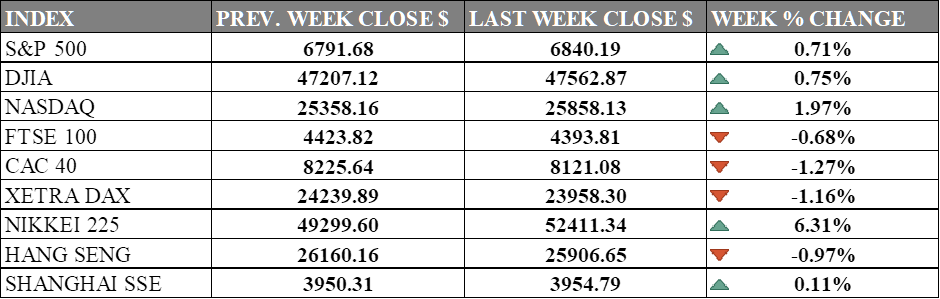

INDICES PERFORMANCE

Wall Street's major indices extended their gains this week, with technology stocks continuing to drive the rally. The S&P 500 rose 0.71% to 6,840.19, while the Dow Jones Industrial Average gained 0.75% to 47,562.87. The Nasdaq advanced 1.97% to 25,858.13, as investors maintained their appetite for growth stocks amid positive market sentiment.

European markets showed mixed performance across the region. The UK's FTSE 100 declined 0.68% to 4,393.81, while Germany's XETRA DAX retreated 1.16% to 23,958.30, extending the previous week's decline. France's CAC 40 showed the weakest performance among major European indices, falling 1.79% to 8,121.08.

Asian markets delivered mixed results this week. Japan's Nikkei 225 surged 6.31% to 52,411.34, marking one of the strongest performances globally as investors returned to Japanese equities. Hong Kong's Hang Seng Index reversed course with a 0.97% decline to 25,906.65, reflecting cautious sentiment in the region. China's Shanghai Composite posted a modest gain of 0.11% to 3,954.79, as mainland equities showed relatively stable trading.

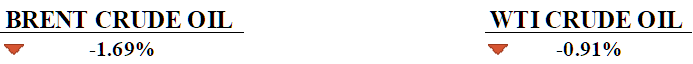

CRUDE OIL PERFORMANCE

Oil prices traded in a choppy range last week, with WTI settling around $61 per barrel and Brent near $65, as markets digested conflicting signals about global supply dynamics. OPEC+ announced Sunday it would add just 137,000 barrels per day in December before pausing production increases entirely through the first quarter of 2026, a strategic retreat amid mounting predictions of a supply glut that could reach up to 3 million barrels daily next year. New U.S. and British sanctions on Russian oil giants Rosneft and Lukoil complicated the cartel's market-share recovery strategy, while major Western producers including Exxon and Chevron continued ramping up Permian Basin output despite weakening demand signals. Both benchmarks ended October with monthly losses as traders weighed ample supply against slower global demand growth. Analysts now forecast Brent will average $68 per barrel in 2025, with the first quarter traditionally representing the weakest period for oil consumption..

OTHER IMPORTANT MACRO DATA AND EVENTS

China's manufacturing sector contracted for a seventh consecutive month in October, with the official PMI missing forecasts and signalling ongoing weakness with hopes for recovery following a recent trade truce with the U.S.

Crypto market ended October with significant losses, marking the first monthly decline since 2018 and breaking the so-called "uptober" streak, leading to a 5% drop in Bitcoin’s price and a negative Coinbase premium.

What Can We Expect from The Market This Week

RBA Interest Rate Decision: The Reserve Bank of Australia is widely expected to keep its official cash rate unchanged at 3.6%, with all major Australian banks predicting rates will remain on hold for the rest of 2025. Headline inflation is seen to spike to 3.2% in Q3, way above target and ground for prolonged restrictive monetary policy.

ISM Manufacturing PMI: Manufacturing as reported by ISM forecasts a reading of 49.4 for October, slightly above last month's figure but still in contraction territory. September's reading came in at 49.1, marking the sixth consecutive month of contraction, though new orders and production showed mixed signals.

BoE Interest Rate Decision: The Bank of England is widely expected to maintain its benchmark interest rate at 4%, pausing its rate-cutting measures as policymakers await greater clarity on inflation trends following the UK's autumn budget. Markets bet only a one-in-three chance of a rate cut, with most economists waiting for the next cut in February 2026.

JOLTs Job Openings: The latest JOLTS report for August showed job openings increasing slightly to 7.227 million, exceeding expectations but remaining well below historical peaks with a clear downtrend since May 2022.

ISM Non-Manufacturing PMI: Services PMI dropped 2 points to 50.0 in September from 52.0 in August, falling short of the 51.7 forecast, suggesting that the U.S. services sector stalled at the expansion threshold, though the forecast for October is positive at 51.