PAST WEEK'S NEWS (July 28 – August 01)

The Federal Reserve, in its latest meeting, held interest rates at 4.25-4.5% even with pressure from the Trump administration, reiterating the central bank's independence by stating it does not consider government financing needs when setting monetary policy but the mandate from Congress. The tide is slowly turning, given two dissenting officials started to favour a quarter-point cut, boosting the dollar to a two-month high as bond yields shot back up. President Trump continues to criticise Powell's stance, arguing that high rates are costing the government billions in excess debt servicing costs, with annual interest payments now reaching $1.1 trillion. Bets for a September rate cut went down from 63.4% to just 45.7% following Powell's warning that tariff-driven inflation could prove more persistent than initially thought. Although GDP growth exceeds projections at 3.0%, underlying domestic demand shows weakness, and services inflation declines even as goods prices rise due to trade tariffs. Powell emphasised that with inflation above target and tariff impacts creating uncertainty, the central bank will maintain its "modestly restrictive" stance until the dual mandate of price stability and full employment is fully achieved.

After several months of going back-and-forth, the United States and the European Union finally reached a trade agreement, settling on 15% tariffs on EU goods entering the U.S., averting the previously threatened 30% tariffs that were set to take effect August 1st. The deal includes EU commitments to purchase $750 billion in U.S. energy and invest $600 billion in the American economy, along with major military equipment purchases. German Chancellor Friedrich Merz acknowledged the agreement reduces automotive tariffs from 27.5% to 15% but is concerned that the remaining tariffs will burden Germany's export-dependent economy. European Commission President Ursula von der Leyen confirmed the 15% tariffs will apply across the board, including pharmaceuticals, though Trump continues to threaten steeper drug tariffs up to 200%, claiming that Americans purchase indirectly subsidised European prices for the same medication. The deal provides stability during a critical week featuring major corporate earnings, key economic data, and the Federal Reserve's interest rate decision.

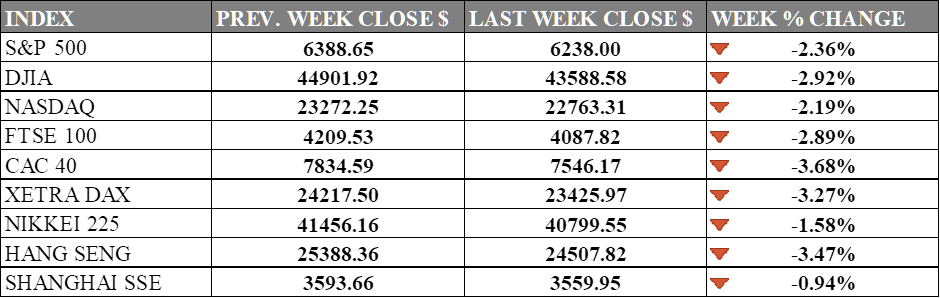

INDICES PERFORMANCE

Wall Street major indices posted significant declines as market sentiment deteriorated. The S&P 500 fell by 2.36%, closing at 6238.00, reflecting growing concerns in the broader market. The Dow Jones Industrial Average (DJIA) delivered weak performance with a loss of 2.92%, finishing at 43588.58. The Nasdaq showed similar negative performance among major US indices with a 2.19% decrease, closing at 22763.31, as investors lost confidence in tech stocks. Market is affected by massive revision in job data.

European markets showed uniformly negative results during the period, with losses across all major indices. The UK's FTSE 100 declined by 2.89%, closing at 4087.82. France's CAC 40 posted the steepest loss of 3.68%, ending at 7546.17, while Germany's XETRA DAX fell by 3.27%, closing at 23425.97. European markets were dragged along the US market though its loss were exacerbated.

Asian markets displayed mixed but generally weak performance with notable declines across most of the region. Japan's Nikkei 225 posted a modest decline of 1.58%, closing at 40799.55, reflecting some resilience despite regional headwinds. Hong Kong's Hang Seng Index delivered poor regional performance with a 3.47% drop, finishing at 24507.82, while mainland China's Shanghai Composite Index showed relative strength with only a 0.94% decline, ending at 3559.95, as Chinese markets demonstrated more resilience compared to other regional markets amid challenging sentiment.

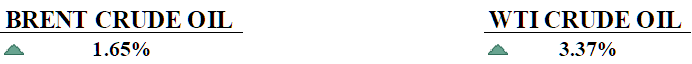

CRUDE OIL PERFORMANCE

Crude benchmarks open lower earlier in the Asian sessions, amplifying prior session sell-offs, although last week cut off with an overall price gain. OPEC+'s confirmation of a 547,000 bpd September output hike pressured prices despite the cartel's confidence in market absorption capacity as part of its accelerated 2.5 million bpd supply restoration. Asian demand deterioration, evidenced by July's regional import decline to 25.0 million bpd from June's 27.88 million bpd, contradicts OPEC+'s optimistic supply expansion narrative. Geopolitical conditions worsen as Trump's threatened 100% Russian oil tariffs and Middle Eastern volatility inject risk premiums, partially offsetting bearish supply dynamics. Goldman Sachs' Q4 Brent projection of $64 reflects oversupply concerns and projected 800,000 bpd demand erasure from prospective trade levies. The commodity remains precariously balanced between aggressive OPEC+ normalisation and fragile demand fundamentals.

OTHER IMPORTANT MACRO DATA AND EVENTS

Trump fired a labour official over weak jobs data as the S&P 500 fell 1.6%, while Fed Governor Kugler’s resignation gave him an early chance to reshape the Fed.

Trump’s new tariffs, the steepest since the 1930s, sent global markets sliding and key partners seeking talks, while U.S. stocks fell on inflation concerns.

What Can We Expect from The Market This Week

BoE Interest Decision: The Bank of England has been implementing a gradual easing cycle, cutting rates from 5.25% in August 2024 to the current level of 4.25%, with cuts occurring in August and November 2024 and again in February and May 2025. Markets expect further quarterly cuts in August and November 2025, potentially bringing rates down to 3.75% by year-end.

ISM Non-Manufacturing PMI: The ISM Services PMI registered 50.8 in June 2025, a return to expansion after it went into contraction in May. This reading reflects continued resilience in America's dominant services economy, though it's at a slight moderation from earlier peaks in November 2024.

Caixin Services PMI: China's Caixin Services PMI came in at 50.6 in June, showing continued expansion in the private sector services activity. However, the index declined from 51.0 in May, a slight bump in services growth momentum.

China CPI: China's Consumer Price Index is barely scraping by, rising just 0.1% year-on-year in June after 4 months in the negative territory. This deflationary status shows weak domestic demand in the world's second-largest economy even with government stimulus efforts.

S&P Global Services PMI: The S&P Global US Services PMI reached 55.2 in July according to preliminary data, showing faster expansion than ISM data. This strong performance reflects robust business activity and optimism in the US services sector.