PAST WEEK'S NEWS (September 22 – September 26)

With few days left before the September 30th funding deadline, the United States might face another government shutdown, considering President Trump and congressional Democrats remain locked in a standoff over healthcare spending, with Trump cancelling planned meetings with Democratic leaders and ordering federal agencies to prepare mass layoff plans. Disagreements arise after Democrats insist on rolling back Medicaid cuts and extending expiring Obamacare subsidies, which Republicans dismiss as partisan demands. It's a complete role reversal from typical impasse, with Democrats now willing to force a closure over healthcare issues while Republicans push for a "clean" continuing resolution. Federal agencies have not published standard contingency plans, leaving hundreds of thousands of workers uncertain about their employment status as the deadline approaches. With both chambers of Congress having left for recess and no clear path forward, the shutdown appears increasingly inevitable.

It almost looks like China has been forced into submission in this tariff battle, with the purchase of Boeing jets serving as a symbolic concession. For years, aircraft deals have been used as bargaining chips in U.S. trade negotiations, often showcased as proof of "goodwill", though more likely to be used to keep other deals under cover. The agreement could go up to 500 planes, and Boeing, which has struggled to secure major Chinese orders since Trump’s first term, now finds itself at the centre of this geopolitical transaction. Yet the aircraft deal is just the headline, as U.S. lawmakers and Chinese officials also touched on military dialogue, nuclear arsenal communication, semiconductor restrictions, and tech governance. So the “planes” may dominate the headlines, but the real negotiations touch on the balance of power across defence, tech, and global trade.

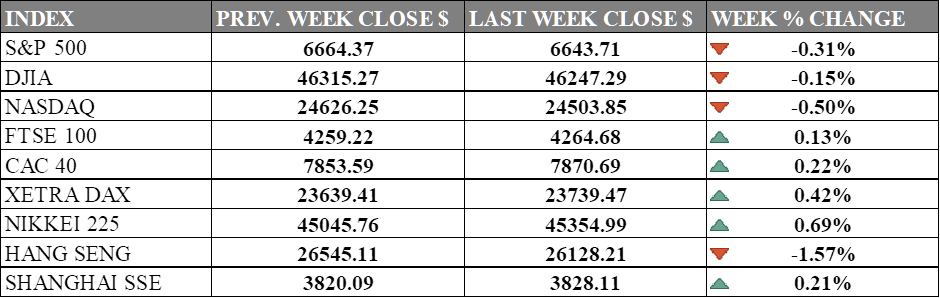

INDICES PERFORMANCE

Wall Street's major indices experienced a slight pullback this week as markets consolidated recent gains. The S&P 500 declined 0.31% to 6,643.71, while the Dow Jones Industrial Average edged down 0.15% to 46,247.29. The Nasdaq fell 0.50% to 24,503.85, with technology stocks giving back some of their recent outperformance as investors took profits following the previous week's strong rally.

European markets posted modest gains, maintaining positive momentum. The UK's FTSE 100 rose 0.13% to 4,264.68, while France's CAC 40 gained 0.22% to 7,870.69. Germany's XETRA DAX advanced 0.42% to 23,739.47, reversing the previous week's decline as investors digested regional economic data and global market developments.

Asian markets showed mixed performance. Japan's Nikkei 225 rose 0.69% to 45,354.99, continuing its upward trajectory supported by export optimism and a weaker yen. Hong Kong's Hang Seng Index fell sharply by 1.57% to 26,128.21, reversing the previous week's gains amid profit-taking and renewed concerns over China's economic outlook. In contrast, China's Shanghai Composite posted a modest gain of 0.21% to 3,828.11, recovering slightly from the previous week's losses.

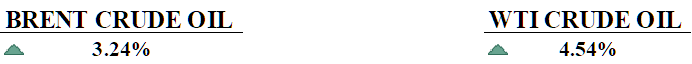

CRUDE OIL PERFORMANCE

Oil prices posted their strongest weekly gains since mid-June, with Brent crude up 3.24% and WTI up 4.54% primarily due to escalating supply disruptions from Ukraine's intensifying drone attacks on Russian energy infrastructure and Moscow's subsequent extension of diesel and gasoline export bans through year-end. Geopolitical tensions further supported prices as NATO warned of responses to airspace violations and President Trump pressured India and Turkey to reduce Russian oil imports, though analysts warn that any supply shifts could redirect Russian crude to other markets. OPEC+ is expected to approve another modest production increase of at least 137,000 barrels per day at its October 5 online meeting though actual output gains have fallen short of targets due to member capacity constraints. Saudi Arabia is forecasted to raise its November official selling prices to Asia modestly amid tightening Middle East benchmarks and heightened sanctions risk, though the kingdom remains cautious about aggressive hikes during ongoing 2026 term supply negotiations with key Asian clients.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. core inflation held steady at 2.9% annually in August while consumer spending rose 0.6%, leaving the door open for cautious interest rate cuts amid mixed economic signals.

The U.S. economy grew at a revised 3.8% annual rate in Q2 2025, driven by strong consumer spending, an AI-inflated business investment boom, and a record narrowing of the trade deficit, though slowing momentum and policy uncertainties (tariffs, immigration) now threaten second-half growth.

What Can We Expect from The Market This Week

RBA Interest Rate Decision: The Reserve Bank of Australia is widely expected to hold its cash rate steady at 3.60% after cutting last July, with all major bank economists predicting no change after three rate cuts earlier this year.

German CPI: Germany's inflation estimate for September is due for release following August's inflation reading of 2.2% year-over-year, which marked a five-month high, with an expectation of a slightly higher reading at 2.3% annually.

US Nonfarm Payrolls: The US employment report is likely to report modest job growth, with economists forecasting between 43,000 and 85,000 new positions after August's weak job creation of just 22,000 positions, while the unemployment rate is expected to remain high at 4.2%.

ISM Non-Manufacturing PMI: The August ISM Services PMI improved to 52.0 from July's 50.1, marking the strongest expansion in the services sector in six months and beating forecasts of 51.0, though expectations for September stay muted.

China Manufacturing PMI: China's official manufacturing PMI showed mixed signals in recent data, with the private Caixin PMI rising to 50.5 in August from 49.5 in July, the fastest factory activity growth in five months. However, September data due may show renewed weakness with ongoing domestic demand challenges and trade tensions.