PAST WEEK'S NEWS (November 03 – November 07)

Nvidia CEO Jensen Huang had come out and told the Financial Times that "China is going to win the AI race," citing the country's lower energy costs and looser regulations before later softening his tone to assert that America must "race ahead" to maintain its lead. The comments come as Huang's company faces a complete market freeze in China, with Beijing conducting national security reviews that have reduced Nvidia's market share there to zero, using access as leverage to gain advantage in trade negotiations. Meanwhile, OpenAI's spending spree through its Stargate project had pushed other related stocks high, with plans to invest over $400 billion across the next three years toward nearly 7 gigawatts of AI data centre capacity, putting the company ahead of schedule to meet its ambitious $500 billion, 10-gigawatt commitment. The flagship Stargate campus in Abilene, Texas, is already operational and running on Oracle Cloud Infrastructure, with additional major sites selected in Michigan's Saline Township, a multi-billion dollar, 1-gigawatt facility expected to begin construction in early 2026, along with locations in Ohio, New Mexico, Wisconsin, and multiple Texas counties.

Banks borrowed a record $50.35 billion from the Federal Reserve's Standing Repo Facility (SRF) last Friday on the 31st, the highest utilisation since the facility's creation in 2021, while simultaneously parking $52 billion in the Fed's reverse repo facility, essentially offsetting flows that reflected typical month-end and quarter-end liquidity pressures. The spike came as short-term repo rates climbed above 4%, offering profitable arbitrage opportunities for banks to borrow from the Fed at 4.0% and lend to money markets at higher rates, exactly as the facility was designed to function. The Fed responded proactively by announcing it would end quantitative tightening on December 1st, a date earlier than widely expected, noting its intention to preserve adequate bank reserves and prevent funding market stress, signalling confidence that the banking system has reached appropriate liquidity levels rather than crisis conditions. Dallas Fed President Lorie Logan even expressed satisfaction that banks finally used the SRF "as designed", though she noted disappointment that adoption took so long.

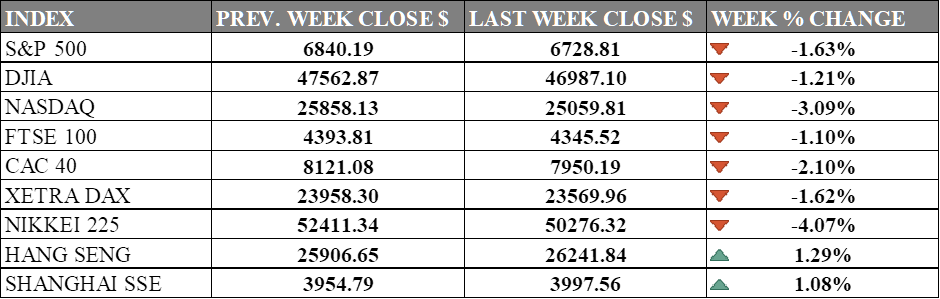

INDICES PERFORMANCE

Wall Street's major indices fell this week, with losses across all major benchmarks. The S&P 500 declined 1.63% to 6,728.81, while the Dow Jones Industrial Average dropped 1.21% to 46,987.10. The Nasdaq posted the steepest decline, falling 3.09% to 25,059.81, as technology stocks pulled back from recent highs.

European markets also showed weakness across the region. The UK's FTSE 100 declined 1.10% to 4,345.52, while Germany's XETRA DAX retreated 1.62% to 23,569.96, extending the previous week's losses. France's CAC 40 fell 2.10% to 7,950.19, marking the weakest performance among major European indices.

Asian markets delivered mixed results this week. Japan's Nikkei 225 declined 4.07% to 50,276.32, marking one of the sharpest drops globally as investors pulled back from Japanese equities. Hong Kong's Hang Seng Index bucked the regional trend with a 1.29% gain to 26,241.84, showing resilience amid the broader market weakness. China's Shanghai Composite posted a modest gain of 1.08% to 3,997.56, as mainland equities showed positive momentum.

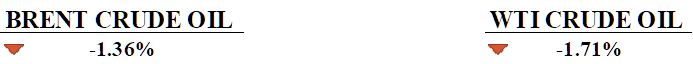

CRUDE OIL PERFORMANCE

Crude oil prices fell more than 1% last week, marking their second consecutive weekly decline with mounting concerns over supply glut. The primary driver was a buildups in U.S. crude inventories, stacking 5.2 million barrels, far exceeding analysts' expectations as refineries underwent seasonal maintenance and imports increased. OPEC+ pressured markets by announcing a modest production increase of 137,000 barrels per day for December, though the cartel paused additional hikes for the first quarter of 2026. Additional bearish sentiment emerged from Canada's decision to scrap emissions caps on oil and gas production, raising fears of even greater supply availability. However, some support came from stronger U.S. gasoline demand, with inventories dropping by 4.7 million barrels, and Ukrainian drone attacks on Russian refineries and U.S. sanctions disrupting oil flows from Russia and Iran. Even with these supply disruptions, the overarching narrative of abundant supply and moderate demand growth continues to weigh heavily on crude prices heading into the final months of 2025.

OTHER IMPORTANT MACRO DATA AND EVENTS

the HCOB Eurozone Composite PMI rose to 52.5, marking the 10th consecutive month of growth and reaching its highest level in 29 months.

The U.S. services sector expanded to an eight-month high in October with solid new orders, but weak employment growth and economic uncertainty from tariffs and the government shutdown looms.

What Can We Expect from The Market This Week

US CPI October: Headline inflation for September was 3.0%, slightly lower than the 3.1% forecasted but still the highest inflation rate since January 2025. The main driver was fuel cost along with a moderate cost increase in shelter and food price.

UK GDP September: The UK economy grew 0.3% in the three months to August this year, with the biggest monthly GDP expansion in July, attributed primarily to the service sector. The IMF forecasts UK GDP growth of 1.3% for 2025, making it the second-fastest-growing major economy, though EY recently upgraded its forecast to 1.5%.

US Initial Jobless Claims: Unemployment claims rise to approximately 229,000 from a revised 219,500 in the prior week, according to preliminary state-level data analysed by investment banks. The official data, though, reported claims at 218,000 for the week ending September 20, a relatively stable labour market considering weaker private payrolls data.

German CPI October: Germany's preliminary inflation rate shows an annual 2.3% in October from 2.4% in September, with the harmonised consumer price index showing monthly growth of 0.3%. Core inflation (excluding energy and food) is high at 2.8%, with the next CPI update to confirm final figures for October.

US 30-year Bond Auction: The US Treasury is set to auction $25 billion in 30-year bonds with the current rate 20 basis points higher before the cut at the end of October. The Treasury announced it plans to hold note and bond sales steady for several quarters while preparing for potential future increases in auction sizes.