Oil is Not Well

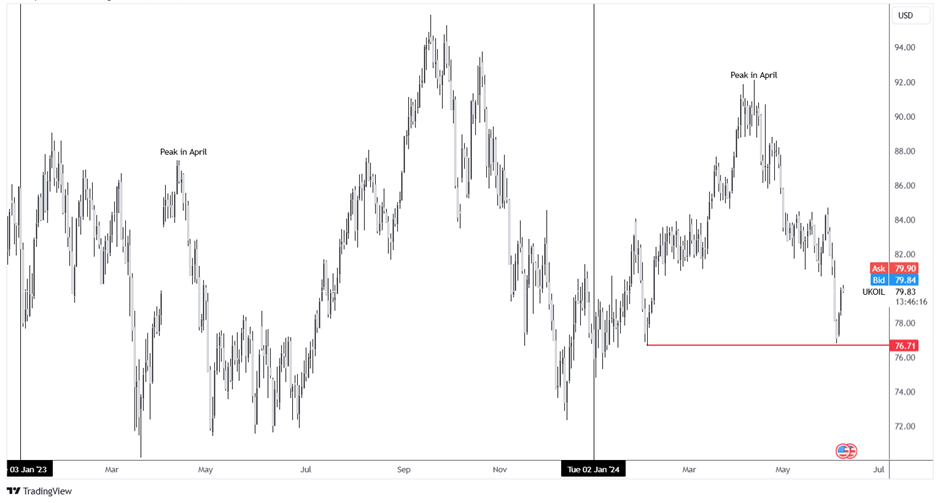

In recent months, the global oil market has been nothing but a tempest of volatility, with Brent having fallen from a peak of $92 per barrel in mid-April to just $76 early this month. This worsening market is driven by a confluence of economic, geopolitical, and environmental factors although last year prices show a similar pattern where prices peak in April and started to climb at the end of June to mid-August, peaking in September. In recent times, the industry is grappling with expanding U.S. inventories, fluctuating production decisions from OPEC+, and the relentless march of climate change campaigns. It is uncertain whether oil prices can repeat last year pattern, possibly hitting $100+ per barrel if it does as bottom in June is higher in 2024.

The Fed's Influence

The dollar has been volatile lately, with the Federal Reserve's keeping rate higher longer and changing expectations of rate cuts with every new set of data. While the general expectation of two interest rate cuts has injected a dose of optimism into the market, the data-dependency approach shows that it is far from attainable. Lower interest rates generally reduce the cost of borrowing, driving economic activity and, by extension, increasing demand for oil and raising prices against the cheaper dollar. Lately, the U.S. services sector's return to growth after a contraction poses a potential hurdle to the Fed’s promised rate cuts, among many other economic indicators.

OPEC+ Decisions

The Organisation of the Petroleum Exporting Countries and its allies (OPEC+) play a vital role in shaping the oil market dynamics and preventing oil prices from going too low. Their recent decision to extend most oil output cuts into 2025, while allowing some voluntary cuts to be gradually reversed, reflects a strategic balancing act. Analysts like Emril Jamil from LSEG Oil Research suggest that this move could put pressure on oil prices, especially as it coincides with a notable build-up in U.S. inventories. Moreover, Saudi Arabia’s decision to cut its official selling prices for July crude adds another layer of complexity, suggesting potential oversupply and weaker profit margins for refiners in Asia, although it could open up arbitrage opportunities. Not to mention countries like India and China rerouting Russian oil that was heavily sanctioned to European countries.

Climate and economic pressures

The oil industry is not only contending with market dynamics but also facing increasing scrutiny and pressure from climate advocates and policymakers. UN Secretary-General Antonio Guterres has vociferously called for special taxes on oil companies to fund the global energy transition into green energy, measuring everything by carbon emissions. Labelling the fossil fuel industry as “the godfathers of climate chaos,” Guterres highlights the urgent need for a shift away from hydrocarbons. This sentiment is echoed in various global policies aiming to reduce carbon footprints and promote renewable energy sources, creating a challenging environment for oil producers who must balance both regulatory pressures and the financial imperatives of their operations.

The future of energy

As the world struggle with the dual challenges of meeting energy demands and addressing climate change, the conversation increasingly shifts towards diversification and transition. The Biden Administration’s efforts to rejuvenate nuclear energy as a zero-emissions power source highlight a broader strategy to reduce reliance on fossil fuels, taking France as an example of a cheaper energy producer that is unaffected by the war in Ukraine where Russian oil was sanctioned. Similarly, other European nations are making significant investments in nuclear energy to meet their net-zero targets. However, changes are hard and not without challenges, including regulatory hurdles, public perception, and high setup costs. With rising energy usage, it is quite inevitable for countries to diversify into nuclear among many other while fusion energy is still far from completion.