[EURUSD]

Important Levels to Watch for:

- Resistance line of 1.22058 and 1.22321.

- Support line of 1.21207 and 1.20945.

Commentary/ Reason:

- The euro was largely steady at $1.2142 after slipping to 1.2132 in the previous session for the first time since Dec. 21.

- The underlying source of the dollar revival has been the on the aftermath of the Senate elections and as the markets anticipating more fiscal support for the U.S. economy. The support from rising yields has so far trumped worries that the extra spending could trigger faster inflation, which ordinarily would make the greenback less attractive.

- EUR/USD also slipped on the weaker-than-expected Eurozone economic data, as concern that economic growth will slow as European countries are forced to tighten and extend lockdowns to slow the surging COVID-19 pandemic infection.

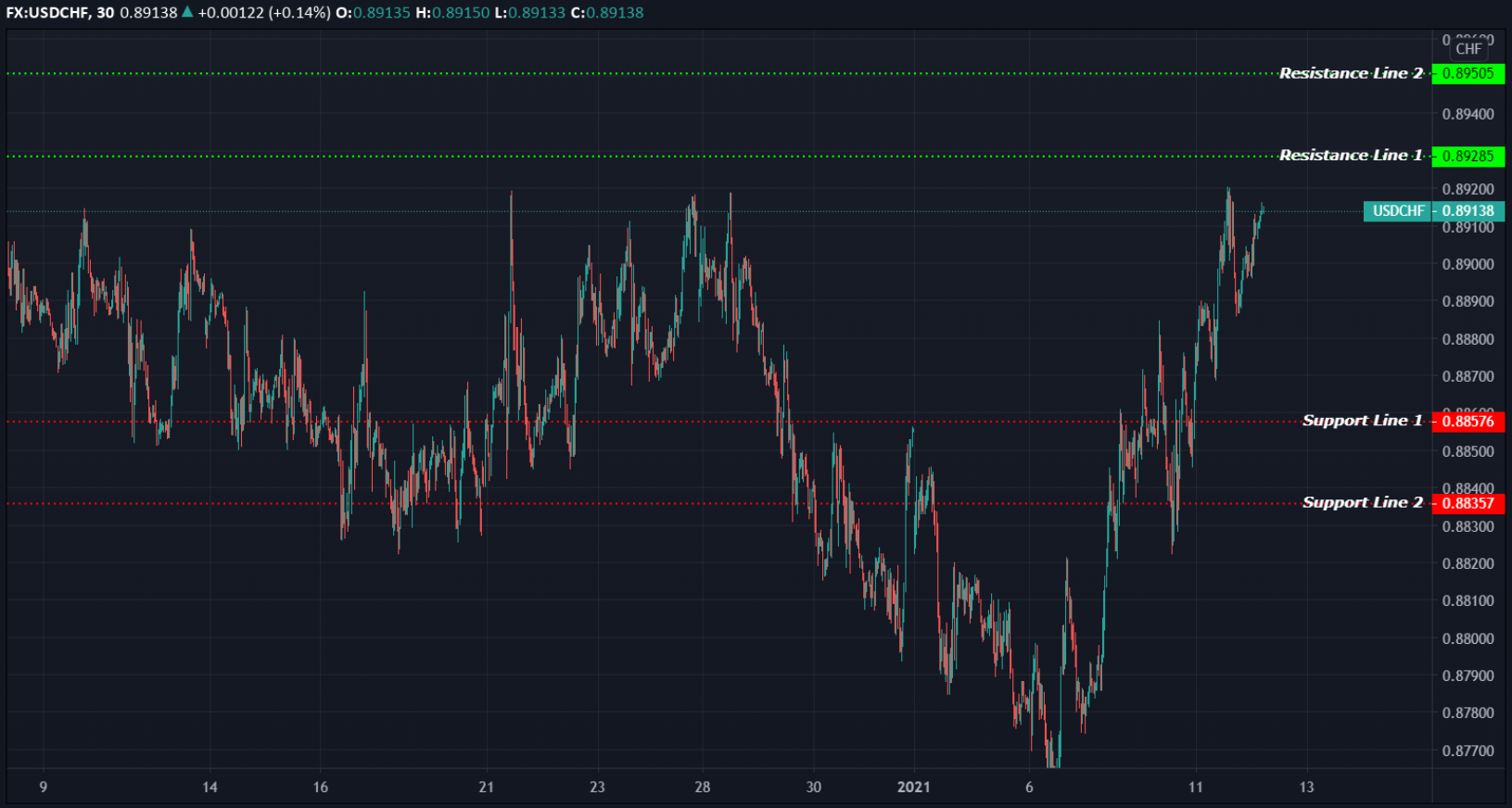

[USDCHF]

Important Levels to Watch for:

- Resistance line of 0.89285 and 0.89505.

- Support line of 0.88576 and 0.88357.

Commentary/ Reason:

- The dollar last trading at 0.8913 against the Swiss franc, rose 0.14% on Tuesday, after hit its weekly high against the Swiss franc overnight.

- The dollar gains as the treasury yields were at 10-month highs as President-elect Joe Biden is due to announce plans for “trillions” in new relief bills this week, much of which will be paid for by increased borrowing.

[GBPUSD]

Important Levels to Watch for:

- Resistance line of 1.35552 and 1.35967.

- Support line of 1.34501 and 1.34177.

Commentary/ Reason:

- Sterling was last trading at $1.3516, gains 0.10% on the day, after touched its 2-week lows on Monday.

- The dollar holding to the British pound, as the support from rising yields has so far outshone worries that the extra stimulus spending from the new administration could trigger faster inflation, which ordinarily would make the greenback less attractive.