INTRADAY TECHNICAL ANALYSIS MAY 19th (observation as of 08:00 UTC)

[EURUSD]

Important Levels to Watch for:

- Resistance line of 1.07889

- Support line of 1. 07742

Commentary/ Reason:

1. The price is in a strong downtrend that have seen it dive into lowest level since March 2023 with a strong technical compliance in its price movement.

2. The pair was on a strong downtrend because of USD streaks of strengthening pushing euro lower with every wave structure rebounding 38.2% before continuing downward.

3. The US labour market was lower than expected and Philly fed manufacturing index came better than expected, catalyst to higher USD price.

4. The price is expected to trade lower as USD is expected to strengthen further but there is a possibility that the price will rebounded to Fibonacci 38.2% before continuing downward as it has before in the current market structure.

5. Technical indicator however is suggesting buy signals as most of indicators are bullish but longer term moving average are telling it is still in a downtrend, making the suggestion price action likely to rebound before continuing.

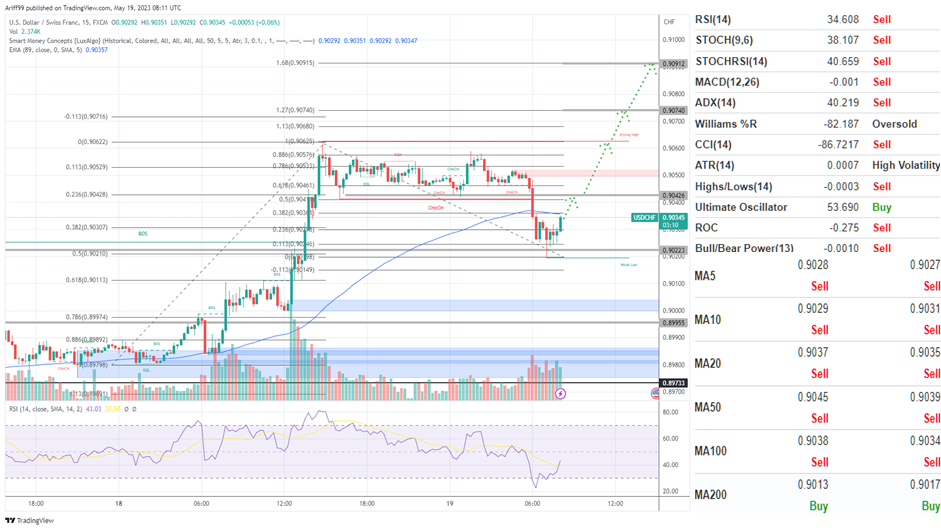

[USDCHF]

Important Levels to Watch for:

- Resistance line of 0.90426

- Support line of 0.90223

Commentary/ Reason:

1. The pair have been in strong longer term uptrend but recently down as part of profit taking and retracement of USD after streaks of upward movement.

2. The price is still on uptrend as there is no end seen to the strengthening of the greenback while there is no offsetting factors to CHF.

3. The fed chairman Powell speech is expected to be the main market-moving factors.

4. The price is expected to move further upward on strengthening dollar to resistance level.

5. Technical indicators is blaring with selling signals but it is now at oversold and rebounded a bit indicating potential for higher price as long-term moving average is still a buy.

[USDJPY]

Important Levels to Watch for:

- Resistance line of 138.381

- Support line of 137.940

Commentary/ Reason:

1. The pair were on a strong uptrend but retraced to about 50% of the rally.

2. The price was affected by strengthening USD that pushed it upward but a pullback paused the rally but it is expected to continue upward.

3. There was strong economic data from the US and inflation data from Japan shows that CPI is higher than before at 0.6% MoM compared to 0.4% last month.

4. The price is expected to reverse to uptrend as the price tested the 50% Fibonacci level and sideways indicating readiness to reverse trend.

5. Technical indicators are showing neutral and sell while moving average suggesting buy for shortest term, sell for medium term and buy for the longer term indicating the start of buying spree.

[GBPUSD]

Important Levels to Watch for:

- Resistance line of 1.24217

- Support line of 1.24094

Commentary/ Reason:

1. The pair have been on a strong downtrend but recently went out of parallel channel bound.

2. The price have became oversold and and upward movement is imminent as USD is strengthening and weakening pound.

3. There was strong economic data from the US but nothing significant from the united kingdom.

4. The price is expected to keep hiking higher to at least 50% of the last downtrend price action before facing difficulties to continue.

5. Technical indicator is blaring with buying signals but more sensitive indicators is neutral and longer term moving average telling to sell indicating long term trend is downtrend.