INTRADAY TECHNICAL ANALYSIS July 07th (observation as of 08:00 UTC)

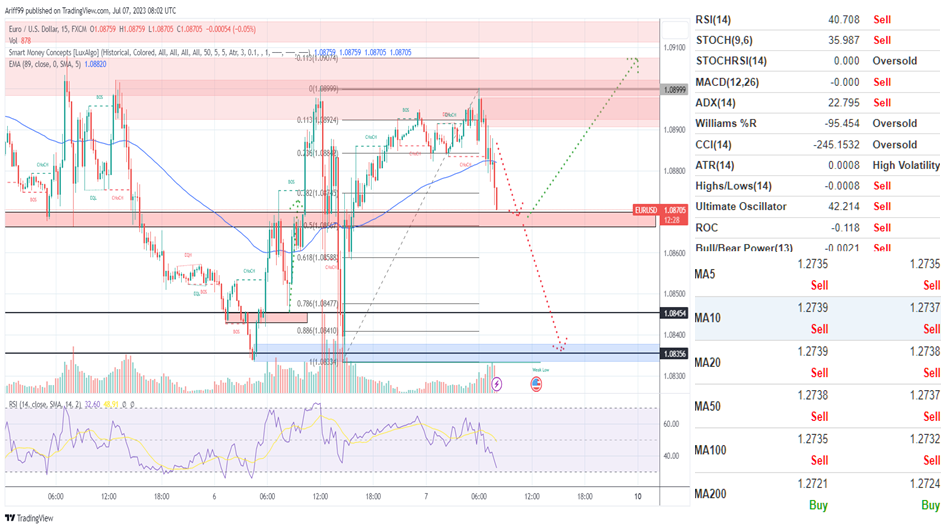

[EURUSD]

Important Levels to Watch for:

- Resistance line of 1.08999

- Support line of 1. 08666

Commentary/ Reason:

1. The price tested its previous resistance but unable to break above while making a triple top on the same resistance level while double bottom was observed at support 1.08356 which suggests the pair is in wide range sideways pattern.

2. Economic data from the U.S. are closely observed as labour market are not softening as expected by the Feds thus cementing expectations of a rate hike while Germany industrial production reported lower.

3. The upcoming US nonfarm payroll and unemployment rate are expected to move the market while there is no significant economic data from eurozone.

4. The price is expected to trade lower but may rebound upward to resistance line where any break above or below will become its direction of trends.

5. Technical indicators are positive with mostly sells and some oversold as do moving averages except SMA200.

[USDCHF]

Important Levels to Watch for:

- Resistance line of 0.89794

- Support line of 0.89563

Commentary/ Reason:

1. The pair were on a steady downtrend as it is making lower highs but the price break above supposed highs trendline which suggests a reversal as triple bottom already emerged as a catalyst.

2. Swiss unemployment rate was reported flat although investor expect it to be lower while the US unwavering labour market may push the price higher.

3. The upcoming US nonfarm payroll and unemployment rate are expected to move the market while there is no significant economic data from the Swiss.

4. The price is expected to retreat to its support line before continuing upward based on established triple bottom.

5. Technical indicators are mostly buy and neutral while all moving averages are mixed with longer term moving average calling sell while shorter term are all on buy.

[USDJPY]

Important Levels to Watch for:

- Resistance line of 143.708

- Support line of 142.946

Commentary/ Reason:

1. The pair were on a strong downtrend as it breaks below support that is now resistance without rebounding indicating strong momentum downward.

2. The Japanese yen gained as Japanese wages exceeded expectations, reducing the threshold for the Bank of Japan to adjust its ultra-loose monetary policy.

3. The upcoming US nonfarm payroll and unemployment rate are expected to move the market while there is no significant economic data from Japan.

4. The price is expected to continue its downward trend to Fibonacci level of 168% from its previous rally as there is a strong support area near the Fibonacci level.

5. Technical indicators are mostly sell although some are already oversold as well as moving averages.

[GBPUSD]

Important Levels to Watch for:

- Resistance line of 1.27577

- Support line of 1.27354

Commentary/ Reason:

1. The pair have been on a volatile move as it dropped and quickly recovered before moving in a short range sideways with higher highs and lower lows.

2. Sterling risen to a two-week high of on Thursday, as markets bet the Bank of England would raise interest rates to 6.5% early next year, up from a previous expected peak of 6.25% but fell right after on strong U.S. labour data.

3. The upcoming US nonfarm payroll and unemployment rate are expected to move the market while the UK reported higher than expected but lower than previous labour productivity.

4. The price is expected to continue upward if it does break above its immediate resistance.

5. Technical indicator is certain with sell although some are already on oversold while most moving averages are on sell except SMA200.