PAST WEEK'S NEWS (August 22 – August 28, 2022)

Stocks moved sharply lower as investors became less optimistic that the Federal Reserve will be able to tame inflation without causing a significant economic slowdown. The common catalyst was Fed Chair Powell's policy speech at the Jackson Hole Economic Policy Symposium.

U.S. stock indexes fell more than 3% on Friday after U.S. Federal Reserve Chair Jerome Powell said the Fed remains committed to extending its policy of aggressively raising interest rates, even at the risk of fuelling a potential recession. Powell said recent data showing a cooling of inflation “falls far short” of what the Fed “will need to see before we are confident that inflation is moving down.”

The Fed Chair openly acknowledged that the effort to reduce inflation "will also bring some pain to households and businesses" and that the "historical record cautions strongly against prematurely loosening policy."

The totality of his remarks was not surprising, but his terse manner was, as it suggested the Fed is not going to pander to the stock market's interest rate wishes - certainly not at this juncture anyway with the inflation rate still well above the Fed's target.

The information technology (-5.6%), communication services (-4.8%), and consumer discretionary are among sectors that were the biggest laggards for the week. Rising oil prices fed into inflation worries but also boosted energy stocks.

Indices Performance

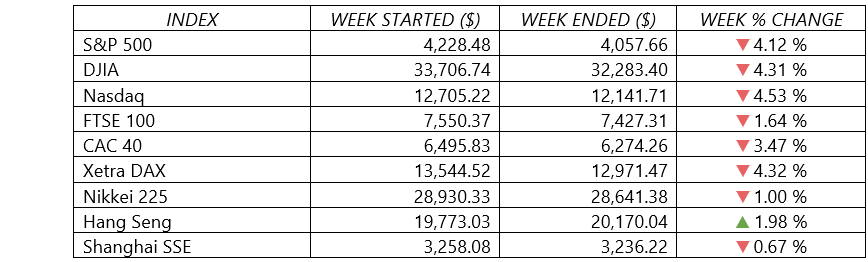

A difficult week for most indices, as only the Hang Seng showed signs of strength, on the back of strong results from some large companies in that index.

The major U.S. stock indexes started and ended the week with steep daily declines, sending the S&P 500, the NASDAQ, and the Dow down around 4% overall. It was the second weekly setback in a row for the S&P 500, interrupting the positive momentum that had lifted the index more than 17% from mid-June to mid-August.

Shares in Europe fell as fears intensified that the efforts of key central banks to subdue inflation could deepen an economic downturn. Germany’s DAX Index tumbled 4.23%, France’s CAC 40 Index declined 3.47%, and the UK’s FTSE 100 Index lost 1.64%.

Despite rallying late in the week, Japanese equities finished the period lower than they began, as investors braced for hawkish message from U.S. Federal Reserve Chair Jerome Powell at the annual Jackson Hole economic symposium.

China’s stock markets declined as extreme temperatures and power shortages in some provinces raised concerns about the growth outlook.

Crude Oil Performance

Oil prices recovered some ground after slipped in the week before. Renewed concerns over tight supply dominated market sentiment after Saudi Arabia warned that OPEC+ producer alliance could cut output to correct a recent oil price decline and offset production increases from Iran.

Further gains were capped as investors braced for the possible return to global markets of sanctioned Iranian oil exports and on worries that rising U.S. interest rates would weaken fuel demand.

Tehran is reviewing Washington's response to EU-drafted final offer to revive a nuclear deal, with the EU expecting a response soon. It is unclear, though, how quickly Iranian oil exports would resume if a deal were reached. If sanctions are lifted against Iran, it could take around a year and a half for it to reach its full capacity of 4 million bpd, up 1.4 million bpd from its current output.

Other Important Macro Data and Events

The Treasury market, which had already been under pressure at the thought of a more hawkish-minded Fed, held its ground better in the wake of Mr. Powell's speech. The 2-yr note yield rose just one basis point to 3.40% and the 10-yr note also rose just one basis point to 3.04%. They were up 15 basis points and five basis points for the week, respectively. When the month started, the 2-yr note yield stood at 2.90% and the 10-yr note yield stood at 2.64%.

Euro-dollar parity - The year-to-date strengthening of the U.S. dollar lifted its value slightly above that of the euro on Tuesday, and the dollar remained above the parity level for nearly all of the rest of the week. On Friday afternoon, a euro was trading around $0.997. The last time the two currencies reached parity for a sustained period was in late 2002.

Much of the week’s economic data surprised on the downside and arguably offered evidence that growth had slowed considerably in recent weeks in response to tightening financial conditions.

Global announced that its composite gauge of service and manufacturing activity had fallen further into contraction territory and hit its lowest level since early 2020.

Sales of new homes in July fell for the sixth month so far this year to the slowest pace since early 2016, and both personal income and spending rose much less than consensus expectations (0.2% versus roughly 0.6% and 0.1% versus 0.4%).

On the positive side, weekly jobless claims fell back to their lowest level in a month. The University of Michigan’s index of consumer sentiment also rose more than expected, hitting 58.2 in August after bottoming at a record low of 50 in June.

Friday's session started with some welcome inflation news, though was not enough to make the market feel comfortable. The PCE Price Index and core-PCE Price Index, which excludes food and energy, both moderated in July. They were up 6.3% and 4.6% year-over-year, respectively, versus 6.8% and 4.8% in June. The monthly inflation metric that the U.S. Federal Reserve uses as its preferred gauge of price trends confirmed that inflation has recently decelerated.

Although U.S. GDP has contracted for two quarters in a row, an updated estimate shows that the rate of decline was more modest than initially estimated. Thursday’s government revision put the contraction at an annual 0.6% rate in the Q2, compared with an initial estimate of 0.9% that was released in late July.

In the Europe, minutes from ECB’s July policy meeting suggested that more interest rate hikes could be forthcoming to subdue persistently high inflation that “posed an increasing risk of longer-term inflation expectations becoming unanchored.” At that meeting, policymakers sanctioned a larger-than-expected 0.5 percentage point increase in key rates and “cautioned that a continued anchoring of inflation expectations was dependent on the Governing Council acting decisively on the worsening inflation outlook.

Also weighing on investor sentiment, natural gas prices surged to record levels after Russia’s state-owned natural gas producer Gazprom announced further maintenance-related closures of the Nord Stream 1 pipeline to Europe at the end of August. Pipeline flows are currently at 20% of the agreed volume.

Meanwhile in China, the People’s Bank of China (PBOC) cut two key interest rates as the central bank stepped up efforts to revive the economy. The central bank cut the 5-year loan prime rate (LPR), a reference for mortgages, by 15-bps to 4.30% and trimmed the 1-year LPR by a smaller-than-expected 5-bps to 3.65%. Last month, China reported its economy narrowly avoided contracting in the Q2 amid repeated coronavirus lockdowns and a nationwide property crisis.

What Can We Expect from the Market this Week

The calendar turns to September this week with the stock market reeling from a more hawkish Federal Reserve than some anticipated. Will the selling pressure continue as higher interest rates are priced in?

Economic reports due in during the week include updates on consumer confidence, construction spending, and vehicle sales, which all arrive before the big August jobs report drops at the very end of the week.

A monthly U.S. labor market update due out on Friday will show whether July’s upward momentum in jobs growth extended into August, despite high inflation. The U.S. jobs report for August is expected to show 300,000 jobs adds for the month and an unemployment rate that holds steady at 3.5%. In July, the economy generated 528,000 new jobs - the biggest monthly gain in five months - while the unemployment rate slipped to 3.5%.

On the corporate calendar, earnings reports from Lululemon, HP Inc., and Broadcom are the headliners, while a strategy update from Bed Bath & Beyond also has a good chance to be a share price mover.

Another wildcard to watch is the developments in the European energy markets when Russia's Gazprom stops gas flows through the Nord Stream pipeline for three days of maintenance. European nations have accused Russia of using gas as a weapon to fight back against Western sanctions over Ukraine.