PAST WEEK'S NEWS (AUGUST 07 – AUGUST 11, 2023)

The headline inflation report showed some minor improvements for a few months, but inflation still remains stubbornly high. Headline CPI rose to 3.2%, and core ticked down slightly to 4.7%, but core inflation is still far above the Fed's 2% target. Categories like food, energy, shelter, and services are still seeing substantial price increases. The report slightly lowered the odds of a September rate hike, but the Fed stresses it has a long way to go to get inflation down and likely needs to keep rates elevated into 2024, only gradually lowering them over time until inflation is back to target, which history shows takes around 2 years from peak inflation.

Recent successful contract negotiations by major unions like the Teamsters demonstrate organised labour's continued leverage to secure improved compensation and benefits. For example, there is a 50% spike in UPS driver job searches following the Teamsters' negotiation of $30 billion in new compensation over 5 years, increasing average driver pay to $170,000 annually. Unions warn that stronger laws are needed to protect negotiated benefits, as current bankruptcy laws don't safeguard worker benefits. Teamsters say 22,000 members may lose bargained benefits despite providing wage and pension concessions after Yellow Corp.'s bankruptcy filings. Powerful unions pushing reforms to prioritise worker claims, benefits, and protection are healthy economic indicators but a worry to investors as rising costs would hurt corporate profits.

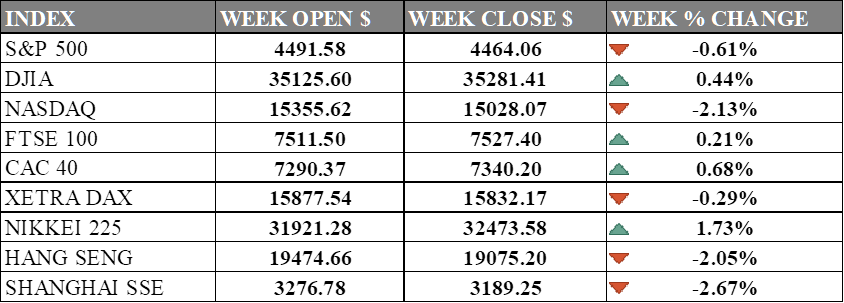

INDICES PERFORMANCE

The S&P 500 edged lower for the second week, declining 0.61% to close at 4464.06. The index continues to decline after falling dramatically the week prior, putting investors at risk. The pullback comes due to big tech losses and rising US Treasury yields, although it is supported by companies with positive earnings. The Dow Jones Industrial Average fared slightly better, eking out a 0.44% gain to finish at 35,281.41. The tech-heavy NASDAQ saw the largest declines, dropping 2.13% to 15,028.07. Continued selling in large-cap tech names like Apple and Alphabet weighed on the index.

Overseas, European equities were mixed. The UK's FTSE 100 rose a modest 0.21% to 7,527.40 after undoing gains from the week earlier on Friday to its lowest point as markets processed strong growth data and evaluated their impact on the BoE’s policy view. France's CAC 40 and Germany's DAX also grinded higher, climbing 0.68% and falling 0.29%, respectively. Geopolitics concerned investors as a Russian warship fired warning shots at a cargo ship in the Black Sea over the weekend.

In Asia, Japan's Nikkei 225 rallied 1.73% to 32,473.58, recovering some of last week's losses. But China's Shanghai Composite plunged 2.67% to 3,189.25 amid a gloomy property market outlook after Country Garden Holdings failed to repay its loan. Hong Kong's Hang Seng also tumbled 2.05% to 19,075.20 on growth concerns after President Biden this week prohibited certain US investments in sensitive technology in China.

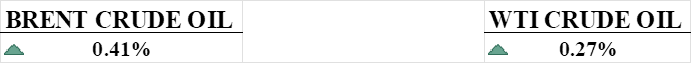

CRUDE OIL PERFORMANCE

Oil prices have rallied for nearly two months, gaining around 20% and reaching multi-month highs. However, last week the rally showed signs of slowing down, with both WTI and Brent seeing their smallest weekly gains since mid-June. While traders remain confident about tight oil market conditions, some see the market as overbought and due for a pullback. Key resistance levels are approaching around $86-87 per barrel, which could trigger profit-taking. Any break below $80 could signal an end to the rally, with support levels around $77-78 next in sight. The price action in the coming week will be crucial, as failing to break resistance could prompt a deeper correction. Overall, the oil market rally seems to be losing steam but still faces a critical test at key overhead resistance.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. producer prices rose slightly more than expected in July, indicating some lingering inflationary pressures, but the overall trend points to moderating inflation. Core producer prices, excluding food and energy, also rose moderately but goods prices were unchanged, suggesting goods disinflation is taking hold; this, along with moderating consumer prices, supports the view that the Federal Reserve may leave interest rates unchanged at its next meeting.

Hong Kong's economy grew 1.5% in the second quarter from a year ago, slowing from 2.9% growth in the first quarter, as exports weakened and investment spending fell amid a difficult global environment, though tourism and private consumption will remain drivers of growth for the rest of the year. The government has lowered its full-year growth forecast to 4-5% from 3.5-5.5% earlier, and also lowered its inflation forecasts on slower growth and weak demand.

The Bank of England is forecast to miss its 2% inflation target until at least 2028, with the British economy facing near-stagnant growth over the next few years according to the National Institute of Economic and Social Research. The think-tank predicts high inflation, weak productivity, labour shortages, and lack of investment will constrain the UK economy, which is unlikely to return to its pre-pandemic size before late 2024.

What Can We Expect from The Market This Week

US Retail Sales: It is a closely watched indicator of economic activity, and a strong reading could boost stock prices. However, a weak reading could weigh on stocks, as it could suggest that consumers are starting to pull back on spending on the upcoming student loan repayment next October.

Canada CPI July: This report measures the rate of inflation in Canada. A higher-than-expected reading could put pressure on the Bank of Canada to raise interest rates, which could weigh on stock prices. However, a lower-than-expected reading could give the Bank of Canada more room to keep rates low, which could be positive for stocks.

US Housing Starts: A strong reading could suggest that the housing market is still healthy, which could boost the stock prices of homebuilders and other related companies. However, high-interest rate environment discouraged transaction which in turn could lower asset productivity as less profit is on the table for developers.

FOMC Meeting Minutes: Investors will be looking for clues as to whether the Fed is planning to raise interest rates at its next meeting. If the minutes suggest that the Fed is leaning towards raising rates, it could weigh on stock prices. However, if the minutes suggest that the Fed is still undecided about raising rates, it could be positive for stocks.

Eurozone CPI July: This report measures the rate of inflation in the Eurozone. A higher-than-expected reading could put pressure on the European Central Bank (ECB) to raise interest rates, which could weigh on stock prices in Europe.