PAST WEEK'S NEWS (April 15 – April 20, 2024)

Remarks from key Federal Reserve policymakers, including Raphael Bostic and John Williams, hint at a willingness to explore rate hikes if inflation fails to reach the 2% target. Paired with reports of an Israeli attack on Iran, the turmoil in the currency market grew wider, with South Korean authorities declaring decisive measures to combat excessive foreign exchange volatility, including access to a $68 billion stabilisation fund. Vietnam's central bank voiced similar preparedness for currency market intervention, citing currency weakness against the dollar and import-driven pressures.

Federal Reserve officials, including Chair Jerome Powell, have pushed back on expectations for interest rate cuts this year, stating that monetary policy needs to remain restrictive for longer, citing "lack of further progress." The central bank's preferred measure of underlying inflation is expected to have remained elevated in March, leading the Fed to maintain its current high-interest rate policy until it gains greater confidence that price pressures are subsiding. Analysts believe the Fed has adopted a more neutral communication stance, showing a less immediate bias towards cutting rates.

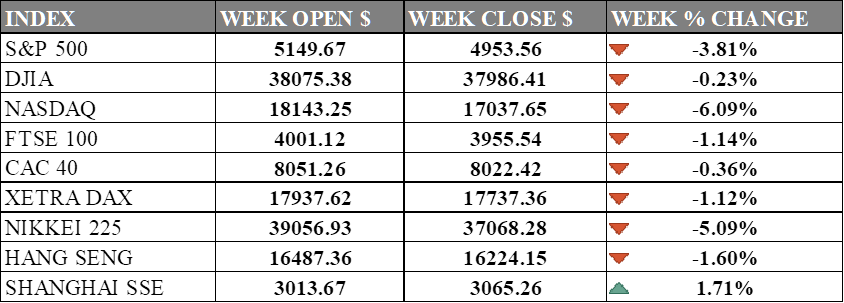

INDICES PERFORMANCE

The major U.S. stock indexes experienced a decline last week. The S&P 500 fell 3.81% to close at 4953.56, down from its open of 5149.67. The Dow Jones Industrial Average dropped 0.23% to finish at 37986.41 compared to its opening level of 38075.38. The tech-heavy Nasdaq declined 6.09% to 17037.65 after opening the week at 18143.25. There's apprehension among investors as long-term Treasury rates may need to climb higher to address inflation, creating rate uncertainty that affect rate-sensitive stocks like tech which is the reason Nasdaq fell the most.

In Europe, the major indexes also saw declines. The UK's FTSE 100 fell 1.14% to close at 3955.54 compared to its open of 4001.12. Germany's XETRA DAX lost 1.12% to settle at 17737.36 from its starting point of 17937.62. France's CAC 40 edged down 0.36% to end the week at 8022.42 after opening at 8051.26. European index sees a modest recovery from its earlier declines but still hovers near a six-week low, with concerns over Middle East tensions easing. Federal Reserve officials' cautious remarks on interest rates contribute to market sentiment, while reports of a decline in German producer prices add to economic considerations.

Asian markets had a mixed performance. Japan's Nikkei 225 fell 5.09%, closing at 37068.28 versus its open of 39056.93 as market track chip-related stocks that sank due to TSMC's earnings report. Hong Kong's Hang Seng declined 1.60% to finish at 16224.15 from its starting level of 16487.36. China's Shanghai Composite gained 1.71%, closing at 3065.26 compared to its open of 3013.67. China's index saw declines as analysts noted diminishing effectiveness of fiscal stimulus, although the Shanghai Composite Index closed higher. Xiamen Tungsten's shares fell nearly 6% after announcing plans to boost production capacity through a new energy materials plant.

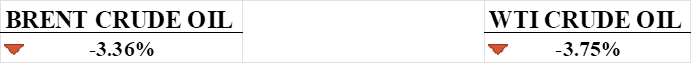

CRUDE OIL PERFORMANCE

Oil prices settled slightly higher on Friday but posted a weekly decline. Iran played down a reported Israeli attack, easing concerns over potential supply disruptions. OPEC+ is expected to increase output from July, which could ease supply tightness. However, geopolitical tensions, healthy demand, and OPEC+ production cuts continue supporting prices. Goldman Sachs and Commerzbank raised their Brent crude forecasts, citing these factors.

OTHER IMPORTANT MACRO DATA AND EVENTS

Unemployment filings in the U.S. held steady, indicating a strong job market and potentially delaying Federal Reserve interest rate cuts until September amidst inflation worries. While some industries face a shortage of skilled workers, overall employment prospects remain favourable, with hints of manufacturing sector recovery alongside concerns over escalating goods prices.

Japan's exports rose 7.3% in March, driven by U.S. car shipments, but export volume fell 2.1%, raising doubts about economic recovery. Business confidence also dipped in April due to cost-of-living pressures and a weakening yen, prompting cautious monetary policy from the Bank of Japan.

What Can We Expect from The Market This Week

US New Home Sales: New home sales recorded a moderate decline, not meeting market expectations and reflecting the impact of rising mortgage rates on buyer’s appetites. The sales dipped to a seasonally adjusted annual rate of 662,000, with notable regional variations and a median sales price of $400,500.

US Durable Goods Orders: The manufacturing sector’s health indicators showed resilience as they rose by 1.3% in February, surpassing expectations and rebounding from a previous decline. This increase, led by significant boosts in transportation equipment orders, indicates sustained business confidence and investment.

BoJ Interest Rate Decision: Yen was hit hard after BoJ abandoned its negative interest rate policy, marking the first rate hike in 17 years, and set the short-term interest rate at between 0% and 0.1%. Despite the rate hike, the BoJ pledged to continue buying long-term government bonds and maintain an easy stance until inflation expectations fully reach 2%.

PCE Price Index: a key indicator of inflation, rose slightly to 2.5% in February 2024, a cause of concern for the increase in the cost of goods and services. This uptick has driven investor pessimism towards an early rate cut, as it is one of the most prominent measures used by the Fed.

German ifo Business Climate Index: a key indicator of economic trends, reflected varying sentiments among German firms in early 2024. After a dip to 85.2 points in January due to more pessimistic views on the current and future business situation, the index saw a gradual recovery, reaching 87.8 points in March.