PAST WEEK'S NEWS (December 02 – December 06, 2024)

China’s export ban on rare earth minerals like gallium, germanium, and antimony to the U.S. is sending shockwaves through tech and defence industries, cutting off access to 51% of its antimony imports, 54% of germanium, and about 21% of gallium. The ban puts a spotlight on supply chain vulnerabilities for high-tech goods and military equipment. Stocks of rare earth companies are already climbing as fears of shortages grow, and U.S. lawmakers are calling for more domestic mining to cut reliance on imports. This move was a tit for tat after U.S. government added 140 Chinese firms, including chip equipment maker Naura Technology Group, to the "entity list," imposing strict export controls on them. Industries are now racing to secure alternative supplies, changing the global trade landscape and sparking a shift toward resource self-reliance.

The situation unfolding in Syria has been unprecedented following a surprise offensive by rebel forces that led to the capture of Damascus, effectively ending President Bashar al-Assad's long-standing rule. The rebels have declared the capital "free," asserting that Assad has fled the country to Russia, although the plane carrying the former dictator is rumoured to have been shot down after it disappeared from radar. The recent military gains by insurgents are among the most significant in years, resulting in a swift collapse of government defences and a withdrawal of Iranian military support. Fighting has escalated in other areas, including Daraa province and Homs, where insurgents have seized control of key military installations. Given this chaos, the humanitarian crisis continues to deepen, leaving millions displaced and in urgent need of assistance as the conflict evolves and international responses remain mixed.

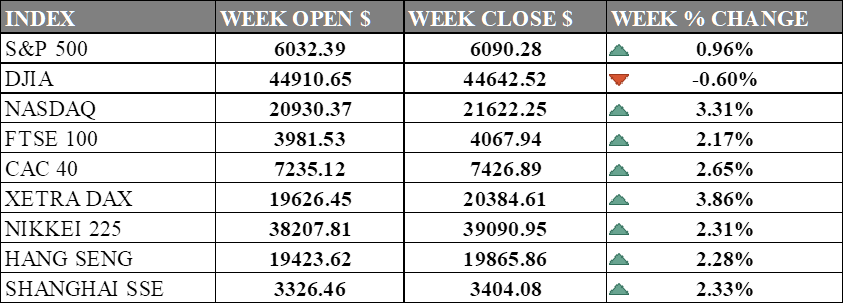

INDICES PERFORMANCE

Wall Street ended in a broadly positive week across major indices. The S&P 500 gained 0.96% to close at 6,090.28. The Dow Jones Industrial Average declined 0.60%, finishing at 44,642.52, while the Nasdaq showed strong performance with a 3.31% increase to close at 21,622.25. The market gains reflect growing investor optimism in the Tech instead of cyclical sector, with increasing bet on another interest rate cuts by the Federal Reserve.

European markets gain higher than U.S. market performance. The UK's FTSE 100 gained 2.17%, closing at 4,067.94. France's CAC 40 saw a significant rise of 2.65%, closing at 7,426.89. Germany's XETRA DAX showed impressive gains, rising 3.86% to end at 20,384.61. The strong performance in European markets suggests growing investor confidence and positive economic sentiment.

Asian markets had also been positive. Japan's Nikkei 225 rose 2.31% to close at 39,090.95, showing strong market performance. Chinese markets demonstrated resilience, with Hong Kong's Hang Seng Index rising 2.28% to close at 19,865.86. The Shanghai Composite in mainland China posted a notable gain, rising 2.33% to 3,404.08. The performance in Asian markets reflects improving economic conditions and investor optimism across the region.

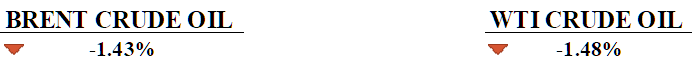

CRUDE OIL PERFORMANCE

Oil markets losses were limited after OPEC+ decides to delay its planned production increases, painting a gloomy demand landscape. The group has opted to extend its current production cuts until September 2026, with the restart of output increases now pushed to April 2025, showcasing a thoughtful reaction to weak market conditions. Even though current pessimism has driven oil prices down to around $72 per barrel for Brent crude, analysts from Barclays suggest that the market's concerns about oversupply may be premature. Saudi Energy Minister Prince Abdulaziz bin Salman remains hopeful, asserting that the market in 2025 will be more favorable than current forecasts and highlighting OPEC+'s adaptability in managing global oil dynamics. Interestingly, while the present outlook seems bleak, some analysts predict a potential tightening of supply-demand balances after 2025, with the possibility of price stability, particularly by 2026.

OTHER IMPORTANT MACRO DATA AND EVENTS

The U.S. economy saw an addition of 227,000 jobs in November, exceeding the anticipated 202,000. The unemployment rate remained stable at 4.2%, and hourly earnings increased by 0.4%.

Japan's base salary increased by 2.7% in October, marking the quickest growth since 1992. This boost led to a 2.6% rise in nominal wages and helped stabilize real wages after two months of decline.

What Can We Expect from The Market This Week

ECB Interest Rate Decision: The European Central Bank is expected to cut its deposit rate by 0.25% to 3% in its final 2024 policy meeting, marking the fourth reduction this year. It will also present updated forecasts, likely lowering growth projections and showing inflation sustainably reaching its 2% target earlier than previously expected.

US CPI November: Inflation rose to 2.6% year-on-year, the first annual uptick since March, yet markets anticipate an 82% chance of a December rate cut, up from 60% pre-report. Shelter price contributed the most to this increase, accounting for over half of the CPI figure.

BoC Interest Rate Decision: The Bank of Canada is polled by Reuters to cut its interest rate by 50 basis points in its next meeting after a sharp rise in unemployment to an eight-year high of 6.8%. While most economists agree, others argue for caution as consumer spending, real estate, and job growth are still within healthy ranges.

OPEC Meeting: This meeting will focus on discussions regarding oil production strategies and potential adjustments to current production cuts. The meeting was originally scheduled for the 1st of December, where most believe the group will avoid increasing production to prevent oversupplying the market, although there are some who believe there is a 25% chance of further cuts.

UK GDP October: Britain's economy shrank by 0.1% in September, with third-quarter growth slowing to 0.1% compared to 0.5% in the previous quarter. Finance minister Rachel Reeves pledged investment and reform to boost growth, but GDP per capita has remained stagnant since 2022, far from her ambitious targets for the G7.