PAST WEEK'S NEWS (December 30,2024 – January 03, 2024)

Big food companies are facing fresh pressure as Governor Newsom takes aim at ultra-processed foods and synthetic dyes through a new executive order. The move comes at a time when over 70% of American adults are overweight or obese, making health-focused food policies increasingly likely across other states too. Food manufacturers will need to pour money into reformulating their products, with many already scrambling to meet growing consumer demand for healthier options – research shows 71% of people want to improve their health through better food choices. The timing is particularly interesting since companies that get ahead of these changes could win big, especially as initiatives like the Access to Nutrition Index push for half of all food and beverage sales to come from healthy products by 2030. Smart investors might want to look at companies that are already working on healthier alternatives, as they'll likely have a head start in this shifting market where both regulations and consumer preferences are moving away from ultra-processed foods.

The Federal Reserve looks set to keep interest rates high for now, as Richmond Fed President Thomas Barkin sees more reasons for inflation to rise than fall. Barkin told Maryland bankers he wants rates to stay restrictive longer, pointing to the economy's strength and potential wage pressures as key concerns. The Fed's cut rates by a full percentage point in late 2024, but inflation hasn't budged much, sitting stubbornly between 2.6% and 2.8% since last May. President-elect Trump's upcoming return to the White House adds another layer to watch, with his planned trade and immigration policies potentially pushing prices higher. The Fed seems to be taking a careful approach, with officials predicting just a half-point rate cut for this year and likely keeping rates at their current 4.25%-4.50% range at their January meeting. For rates to come down more, Barkin says two things need to happen: inflation needs to clearly hit the Fed's 2% target, or the economy needs to show significant signs of slowing down.

INDICES PERFORMANCE

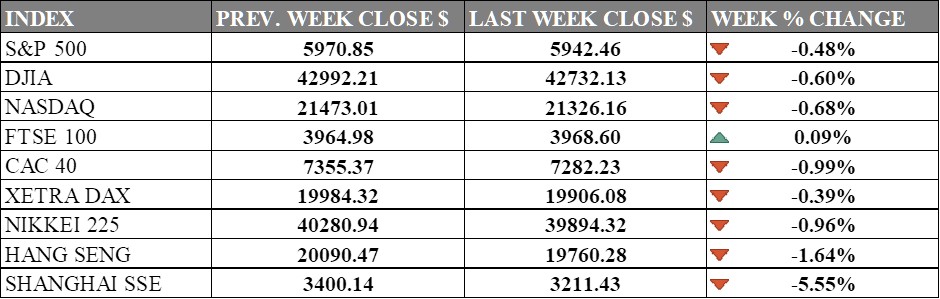

Wall Street ended mixed in a broadly negative week across major indices. The S&P 500 declined 0.48% to close at 5,942.46. The Dow Jones Industrial Average (DJIA) fell 0.60%, finishing at 42,732.13, while the Nasdaq also saw a decline, dropping 0.68% to close at 21,326.16. Concerns over inflation and potential Fed rate cuts have made investors cautious. Despite strong fundamentals like low unemployment and cooling inflation, markets remain sensitive to policy shifts under the Trump administration, especially on tariffs and immigration, which could add volatility.

European markets experienced modest pullbacks after a mixed week. The UK's FTSE 100 edged up slightly by 0.09%, closing at 3,968.60. France's CAC 40 saw a sharper decline, dropping 0.99% to close at 7,282.23. Germany's XETRA DAX also fell, declining 0.39% to end at 19,906.08. The subdued performance reflects economic challenges, including weak manufacturing and political uncertainties in France and Germany. Concerns over Trump’s trade policies affecting European exports persist, but anticipated ECB rate cuts in 2025 offer optimism, especially for rate-sensitive sectors like real estate and consumer industries.

Asian markets had a mixed performance. Japan's Nikkei 225 declined 0.96% to close at 39,894.32, reflecting moderate market weakness despite recent tech gains in the U.S. market. Chinese markets were also down, with Hong Kong's Hang Seng Index dropping 1.64% to close at 19,760.28. The Shanghai Composite in mainland China saw a significant decline, falling 5.55% to 3,211.43. Trump's proposed tariff hikes weighed on export-dependent economies, but South Korea's Kospi rose 1.91%, driven by tech stock gains, reflecting regional divergence.

CRUDE OIL PERFORMANCE

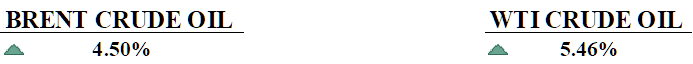

Oil prices hit their highest point in over two months as China shows signs of stronger demand, though a strong dollar kept gains modest with Brent crude reaching $76.6 and WTI touching $74. A brutal winter storm sweeping across the US and Europe is driving up demand for heating oil, while traders are betting on new stimulus measures from China to boost its economy. The oil market got an extra lift from the Biden administration's recent approval of new LNG export projects, signaling continued support for American energy development. US oil companies are playing it smart with their money - instead of rushing to drill more wells, they're focusing on better technology and mergers to grow production, with output already near record levels at 13.2 million barrels per day. Looking ahead, even with President-elect Trump's push for more drilling, oil executives seem likely to stick to their careful spending plans, suggesting steady but controlled production growth in the coming years.

OTHER IMPORTANT MACRO DATA AND EVENTS

US manufacturing activity contracted for the ninth consecutive month in December but showed signs of improvement, with the ISM purchasing managers' index rising to 49.3 from 48.4 in November. New orders expanded for a second month, and production and input prices edged higher, signalling potential stabilization and improving demand.

Germany's unemployment rose by 10,000 to 2.87 million in December, less than the expected 15,000 increase, with the seasonally adjusted rate stable at 6.1%. However, subdued economic conditions in 2024 have weakened labour demand, and unemployment is projected to exceed 3 million in early 2025, marking the first such rise in a decade.

What Can We Expect from The Market This Week

Nonfarm Payrolls: November data shows 227,000 jobs added, surpassing expectations with additional revision in October data, reflecting a strong labour market recovery, with significant growth in healthcare, leisure, hospitality, and manufacturing sectors. The unemployment rate held steady at 4.2%, while wage growth remained strong at 4.0% annually.

German CPI: Germany's inflation rate has risen to 2.2%, with core inflation reaching 3%, indicating underlying price pressures that are complicating the economic recovery and contributing to the country's economic slowdown. The rising inflation is adversely affecting consumer purchasing power and business investment, thereby hindering economic growth and prolonging the stagnation observed in 2024.

FOMC Meeting Minutes: The upcoming minutes are expected to offer additional clarity on the Fed's monetary policy direction, taking into account economic projections and the potential effects of political shifts.

ISM Non-Manufacturing PMI: The last data of 53.2 indicates continued expansion in the services sector, though at a slower rate than previous months. This suggests ongoing growth in the non-manufacturing economy, which is positive but may warrant caution due to recent fluctuations.

China CPI: China's inflation remains low at 0.2% year-on-year in November 2024, with recent deflationary trends, but forecasts point to a gradual rise with hopeful support by continued stimulus.