PAST WEEK'S NEWS (February 03 – February 07)

A slurry of macroeconomic data was released, but the main focus was the services sector PMI, which saw slower growth in January, partly due to bad weather and uncertainty regarding trade policies. At the same time, hiring remained strong, with private employers adding more jobs than expected, suspecting a gap left by increasing deportation of illegal immigrants. However, the widening trade deficit tells a different story, as companies rushed to import goods before potential tariffs kicked in, driving imports to record highs. This rush highlights the fear created by trade tensions, especially with China, Mexico, and Canada, which could weigh on the economy if businesses start scaling back or overload inventory that will increase overhead. For now, the labour market remains a bright spot, but all eyes will be on Friday’s jobs report to see if this momentum holds or if cracks are starting to form.

President Trump had successfully weaponised tariffs on Canada and Mexico, where both countries agreed to reinforce border security. While Trump hails these outcomes as victories, it raises questions over its efficacy long-term. Europe and other nations are already forging new trade alliances to reduce their reliance on the U.S., with the European Union recently finalising major trade deals with South American countries, Switzerland, and Malaysia. China's 10% tariff, which is not delayed, may send tech manufacturers like Apple to continue manufacturing outside China as tariffs on Chinese-made electronics could raise costs for iPhones and laptops. Looking ahead, while some industries might secure exemptions, the emerging risk should awaken the need for businesses and investors to prepare for volatility and adopt diversified strategies.

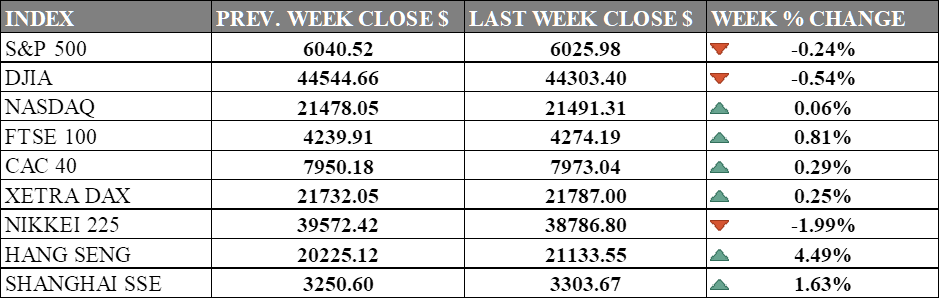

INDICES PERFORMANCE

Wall Street ended the week with mixed performances across major indices. The S&P 500 was in a decline of 0.24%, closing at 6,025.98, despite forward earnings growth being a key factor in previous rallies. The Dow Jones Industrial Average (DJIA) showed a decrease of 0.54%, finishing at 44,303.40, influenced by broader market uncertainties and a fall of −0.99% on Friday. Meanwhile, the Nasdaq posted a marginal increase of 0.06%, closing at 21,491.31, as it managed to stay afloat amidst ongoing volatility in the tech-heavy index.

European markets fared better than its American counterpart. The UK's FTSE 100 gained 0.81%, closing at 4,274.19, driven by corporate developments and broader economic conditions. France's CAC 40 saw a modest rise of 0.29%, ending at 7,973.04, while Germany's XETRA DAX advanced by 0.25%, closing at 21,787.00. These gains were underpinned by projections of a potentially lower interest rate environment that could support future growth.

Asian markets also showed mixed results. Japan's Nikkei 225 declined by 1.99%, closing at 38,786.80, reflecting heightened sensitivity to global economic shifts and domestic factors, notably BoJ future cuts planned. Hong Kong's Hang Seng Index surged by 4.49%, finishing at 21,133.55, buoyed by strong gains in technology and financial sectors. In mainland China, the Shanghai Composite Index rose by 1.63%, ending at 3,303.67, supported by policy measures aimed at stabilizing the market amid ongoing trade tensions with the United States.

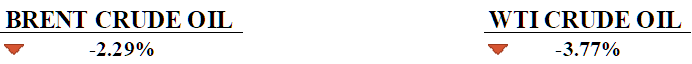

CRUDE OIL PERFORMANCE

Oil prices edged higher on Friday following new U.S. sanctions on Iranian crude exports but posted weekly losses of over 2% with escalating trade tensions between the U.S. and China. The Trump administration's announcement of tariffs on Chinese imports and threats of additional duties on other countries weighed heavily on market sentiment with already weaker global oil demand even with supply disruptions by sanctions stands to limit losses. Analysts noted that while sanctions on Iran added some upward pressure, risk surrounding trade policies and their potential to curb economic growth overshadowed these gains. Meanwhile, U.S. shale producers signaled a shift away from aggressive production growth, emphasizing financial discipline over output expansion, which could further constrain supply in the coming years. In China, independent refiners reduced crude processing rates to multi-year lows due to soaring costs triggered by U.S. sanctions on Russian oil shipments

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. nonfarm payrolls in January added only 143,000 jobs—well below expectations—with significant revisions. Meanwhile, a dip in the unemployment rate to 4.0% and stronger wage gains support the Fed’s hold on rates.

UK retail stores rose by 6.6% in January compared to last year, even though December saw a 2.2% drop. Retail parks, shopping centers, and main-street stores all had more visitors, with increases of 7.9%, 7.4%, and 4.5% respectively.

What Can We Expect from The Market This Week

US CPI January: annual inflation rate risen to 2.9% in December, mainly in energy, food, and shelter prices. Excluding food and energy, inflation came in at 3.2% annually. The Fed is likely to maintain its current stance. Long-term projections estimate the CPI to reach around 2.40% in 2026 and 2.30% in 2027.

UK GDP Q4: Economic growth in the kingdom only saw a slight increase of 0.1% in November 2024, after a period of stagnation, mainly in the construction and services sectors, though it's actively being offset by a decline in production. Goldman Sachs Research forecasts a 1.2% GDP increase for 2025, while the Bank of England projects 1.5%.

Fed Chair Powell Testify: In front of Congress, Fed Chair Jerome Powell is expected to present economic highlights, appearing before the Senate Banking Committee on Tuesday and the House Financial Services panel on Wednesday.

IEA Monthly Report: The IEA's January 2025 Oil Market Report highlights a strong close to 2024 with global oil demand up 1.5 mb/d in 4Q24, with lower fuel prices and colder weather. World oil supply edged up to 103.5 mb/d in December. Russian oil exports slightly lower, but revenues increased due to higher prices. Refinery activity hit a five-year high, and global oil inventories rose in November. Early January saw oil prices climb past $80/bbl after reinforced sanctions and cold weather.

US Industrial Production: the latest figures beat the forecast, printing 0.9% in December 2024, the strongest monthly gain since June. The manufacturing sector saw a slight dip, and future projections suggest a more modest 0.3% monthly increase and 1.5% annual growth by 2026.