PAST WEEK'S NEWS (June 16 – June 20)

The Federal Open Market Committee decided to once more pause its rate-cutting activity. The meeting highlighted a revision in GDP growth projections for 2025, now at 1.4%, including higher unemployment (rising to 4.5%) and greater inflation (core PCE projected at 3.1%). The Fed maintains its forecast of two rate cuts at year end and quantitative tightening at $5 billion per month, opting for a wait-and-see approach. Fed Chair Jerome Powell reiterates insecurity around tariff impacts as a key reason for delaying cuts, going by the logic of tariffs pushing inflation higher. Although job markets appear stable with low unemployment, the weakening job creation trend came into question. The current market projection is hopeful for a September rate cut, contingent on clarity regarding tariffs, particularly following Trump’s temporary pause set to expire in early July.

The Trump administration is moving in a precarious manner, voicing intentions of diplomacy while quietly repositioning military assets across the Middle East. Trump issues stern warnings that sound like orders to Iranians, urging civilians to evacuate Tehran and demanding an end to its secretive uranium enrichment programme, yet denies any role in Israel’s strikes on Iranian nuclear sites. Meanwhile, the USS Nimitz sails west, and over 30 U.S. refuelling tankers are deployed, provoking suspicions of provocation or a pretext for escalation. Officials describe the movements as routine, but their precision and timing suggest a deeper strategic play. Iran accuses Washington of complicity, casting doubt on U.S. claims of neutrality.

INDICES PERFORMANCE

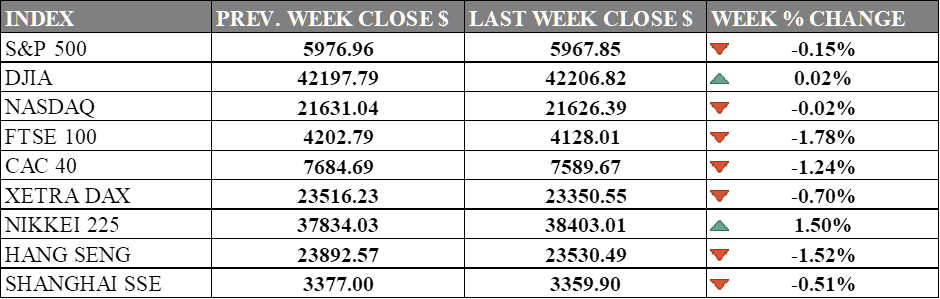

Wall Street showed mixed but largely flat performance last week, with major indices posting minimal changes with variety of opposing force though volatility index stay subdued. The S&P 500 declined modestly by 0.15%, closing at 5967.85, as broad market lag behind small-cap. The Dow Jones Industrial Average (DJIA) managed a slight gain of 0.02%, finishing at 42206.82. The Nasdaq also showed minimal movement with a 0.02% decrease, closing at 21626.39, as tech stocks traded in a narrow range with no rate cut in sight. The muted trading activity reflected investor uncertainty following the Fed's signal of just two rate cuts in 2025, down from four even with a 25-point cut, disappointing those hoping for more aggressive easing.

European markets faced more significant headwinds during the period, posting notable declines across the region. The UK's FTSE 100 fell by 1.78%, closing at 4128.01. France's CAC 40 decreased by 1.24%, ending at 7589.67, while Germany's XETRA DAX declined by 0.70%, closing at 23350.55. European markets continued to struggle with Middle East escalation as a main market for Iranian oil other than China.

Asian markets were mixed, with notable regional variations in performance. Japan's Nikkei 225 posted solid gains of 1.50%, closing at 38403.01, bucking the negative global trend as the country maintains its easy monetary policy stance and high inflation. Hong Kong's Hang Seng Index declined by 1.52%, finishing at 23530.49, while mainland China's Shanghai Composite Index showed slight weakness with a 0.51% decline, ending at 3359.90, with lower inflation in the region reducing growth.

CRUDE OIL PERFORMANCE

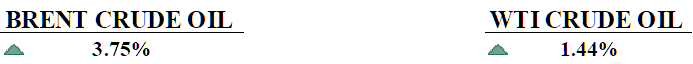

The week after Israel decided to strike Iran few hours after IAEA declaring Iran non-compliance toward its Non-proliferation Treaty, Crude benchmark only manage to close at most 3.75% higher while another strike had market on toes. Against all odd, Oil prices had only gain 3% after the U.S. sent seven B2 bomber to target Iran’s nuclear sites, with market shrugging off geopolitical factor thanks to OPEC+ reserves, ample stocks, and weak macro trends. This is a stark contrast to past shocks like the 2019 Abqaiq attack. Traders are betting Tehran’s retaliation won’t disrupt the Strait of Hormuz, a key oil artery, keeping the dream of $100 oil at bay for now. Morgan Stanley dismissed inflation fears, calling the rally a fleeting supply blip adding just 3 basis points to core inflation, far less than demand-driven spikes. Sanctions and diplomatic signals later cooled prices, though Israel-Iran hostilities linger, with Hormuz’s became centrestage for negotiation. Analysts warn that any attack around the strait or oil infrastructure, and crude could vault to triple digits overnight.

OTHER IMPORTANT MACRO DATA AND EVENTS

US Secretary of State Marco Rubio urge China to rein in Iran’s threat to close the Strait of Hormuz, warning of economic suicide for Tehran and global fallout.

European officials reluctantly ready for a 10% baseline on “reciprocal” tariffs in U.S.-EU trade talks, as Trump’s hardline stance and rising U.S. tariff revenues harden American resolve.

What Can We Expect from The Market This Week

US PCE Price Index: the Fed's preferred inflation measure, showed core prices declining to 2.5% annually in April from 2.7% in March, while headline numbers are at 2.1%, meeting expectations and proving progress toward the Fed's 2% inflation target.

US GDP Q1: The second preliminary economic growth data in the states printed negative 0.2% in Q1 2025, on track to mark the first quarterly decline following 2.4% growth in Q4 2024, primarily due to higher import volumes and lower domestic demand.

CB Consumer Confidence: The index was up 12.3 points to 98.0 in May 2025 from 85.7 in April, marking a turnaround in consumer sentiment as the American public turns optimistic about current economic conditions.

Canada GDP: Canada's economy grew 0.5% quarter-over-quarter in Q1 2025, maintaining the same pace as Q4 2024, with exports serving as the primary driver of economic growth. The economy performed better than expected, with some sources reporting an annualised growth rate of 2.2% for the quarter, although upcoming data is only confirming preliminary data of 0.1% growth in April.

US Durable Goods: Consumer durables orders fell 6.3% month-over-month in April 2025 to $296.3 billion, representing the sharpest decline since January 2024 and ending four consecutive months of growth, a halt to what could be panic orders in March before tariffs were implemented.