PAST WEEK'S NEWS (July 14 – July 18)

The U.S. Senate narrowly passed President Trump’s $9 billion rescissions bill, 51-48, early Thursday, sending it back to the House ahead of Friday’s deadline. The bill cuts $8 billion from foreign aid and $1.1 billion from public broadcasting, though Republicans restored $400 million for PEPFAR after GOP pushback. Only Senators Susan Collins and Lisa Murkowski opposed it, citing vague implementation details and risks to rural communities reliant on public media. Supporters, like Majority Leader Thune, call it necessary fiscal discipline, while critics warn it threatens bipartisan budget norms and expands executive power. If passed, it would mark Trump’s second win this month and the first rescissions package approved by Congress in decades, though far short of DOGE’s $1 trillion savings target.

The cryptocurrency market crashed just in time for Crypto Week 2025 to begin, with Bitcoin retracing nearly 5% from its all-time high of $123,000, a total of $681 million in liquidations, mostly from long positions. A Satoshi-era Bitcoin whale moved 18,643 BTC, valued at $2 billion, to Galaxy Digital, presumably for profit-taking, with portions deposited to exchanges like Bybit and Binance, while the whale still holds 80,009 BTC worth $9.46 billion. Altcoins, namely Ethereum, Solana, XRP, and Dogecoin, saw losses ranging from 3% to 8%, with ETH and XRP falling below key resistance levels of $3,000 and $3.0, respectively, as investors await US CPI and PPI data for June that could sway the market further. Bitcoin’s price corrected to a low of $116,290 after peaking at $123,236, dragged by whale activity and profit-taking, evidenced by a spike in the "Coin Days Destroyed" metric and large transactions on Binance exceeding 35% of inflows. Market sentiment remains in focus, with the Fear and Greed Index at 70, reflecting "greed", though unresolved tariff issues could shift this outlook and affect Bitcoin’s trajectory.

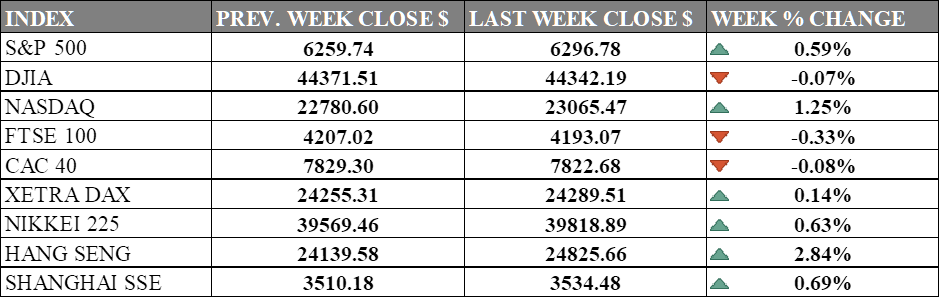

INDICES PERFORMANCE

Wall Street experienced mixed performance last week, with major indices posting modest gains as market sentiment improved. The S&P 500 rose by 0.59%, closing at 6296.78, reflecting cautious optimism in the broader market. The Dow Jones Industrial Average (DJIA) delivered a nearly flat performance with a marginal decline of 0.07%, finishing at 44342.19. The Nasdaq showed the strongest performance among major US indices with a 1.25% increase, closing at 23065.47, as tech stocks led the recovery. Beside rate uncertainty, the institution that set rate have also been under scrutiny, as the President tries to topple its old head over rate disagreement.

European markets showed mixed results during the period, with modest declines across major indices. The UK's FTSE 100 fell by 0.33%, closing at 4193.07. France's CAC 40 posted a slight decline of 0.08%, ending at 7822.68, while Germany's XETRA DAX managed a small gain of 0.14%, closing at 24289.51. European markets continue to navigate uncertainty around trade policies while monitoring domestic economic indicators, with Germany maintaining focus on its inflation targets.

Asian markets displayed strong performance with notable gains across the region. Japan's Nikkei 225 posted a solid gain of 0.63%, closing at 39818.89, reflecting renewed investor confidence over new government. Hong Kong's Hang Seng Index delivered the strongest regional performance with a 2.84% surge, finishing at 24825.66, while mainland China's Shanghai Composite Index showed modest strength with a 0.69% gain, ending at 3534.48, as both markets benefited from improved sentiment and supportive economic data.

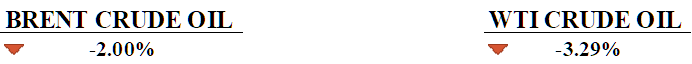

CRUDE OIL PERFORMANCE

WTI crude fell 3% for the week to low of $65.5 per barrel, snapping a two-week winning streak as supply concerns overshadowed new EU sanctions on Russia. The EU implemented its 18th sanctions package targeting Russian oil exports with a lower price cap and refined product bans, initially lifting prices before traders questioned enforcement effectiveness. OPEC+ plans to boost production by 548,000 barrels daily starting August 1, while Iraq approved resuming Kurdish region exports through the Turkey pipeline, adding 230,000 barrels per day to global supply. Strong US housing data and consumer sentiment supported demand expectations, though crude inventories declined by 3.9 million barrels. Markets worry about oversupply in the second half of 2025, with the International Energy Agency forecasting a surplus equivalent to 1.5% of global consumption by Q4. Trump's potential tariff policies and OPEC+ discussions about pausing October production increases remain key factors for oil prices ahead.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. consumer sentiment rose in July, but fears over Trump’s tariffs and inflation still weigh heavily on confidence.

Retail sales jumped in June, but rising prices from tariffs and slowing wage growth threaten to weaken consumer spending and delay Fed rate cuts.

What Can We Expect from The Market This Week

Fed Chair Powell Speech: In conjunction with pressure from the Trump administration, this speech will be closely monitored for any falter or signs of weakness, though he firmed that leaving is not an option. Fed Chair Powell had also emphasized the Federal Reserve's commitment to maintaining its cautious approach on interest rates, stating that the central bank is "well positioned to wait" highlighting tariff policies contributing to inflation.

ECB Interest Rate Decision: The European Central Bank is expected to pause next meeting after cutting its key interest rates by 25 basis points in June, bringing the deposit facility rate to 2.00%, based on improved inflation forecasts showing headline inflation averaging 2.0% in 2025.

UK Retail Sales: Consumption volumes crashed by 2.7% in May, marking its biggest monthly decline since December 2023, with poor performance in food stores and supermarkets. Consumer spending remained weak in June with overall retail spending increasing only 0.2% annually, increasing pressure on household budgets and cautious consumer behaviour.

US Initial Jobless Claims: The Labour market saw fewer employees filing for claims, falling to 221,000 last week, marking the fifth consecutive weekly decline and coming in lower than the expected 233,000. The four-week moving average dropped to 229,500, its lowest level since early May, indicating strength in the US labour market.

US Durable Goods Orders: Trump's tariff threat had the industry scrambling to order durable goods, causing a 16.4% uptick in May, the largest monthly boost since July 2014 and significantly exceeding expectations of 8.5%. The dramatic rebound from April's 6.6% decline was primarily driven by an almost mandatory influx of commercial aircraft orders by countries negotiating for lesser tariffs.