Stocks Performance (U.S. Stocks)

Stocks around the world fell last week, largely driven by news that daily coronavirus cases have hit new record highs in the U.S. and major European countries, coupled with the uncertainty around another round of fiscal stimulus that is yet to be approved, and the U.S. presidential elections predictions.

Meanwhile, Q3 corporate earnings reports were looking much stronger than expected, highlighted by robust growth at Amazon.com Inc., Microsoft Corp., Apple Inc. and Alphabet Inc. However, these stocks retreated nonetheless, after several of the companies issued cautious forecasts.

By sectors, every sector fell, with the less decline were led by Utilities sector at -3.20%, followed by Non-Energy Minerals at -3.99%, Communications -4.09%, and Consumer Durables at -4.34%. Meanwhile, the weakest sectors were from the Health Services at -8.01%, Distribution Services at -7.19%, Transportation (-6.65%), and Commercial Services sector (-6.49%).

Indices Performance

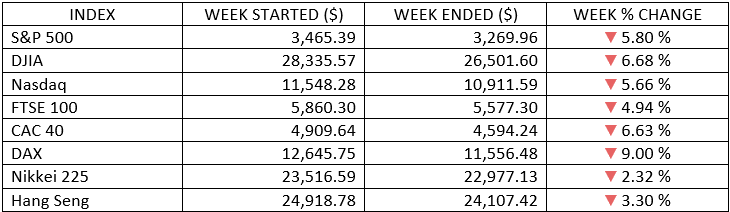

The major U.S.’s indices dropped more than 5% this week, as the market was overcome with growth concerns, uncertainty, and negative price momentum.

Every major market in Europe and Asia also down. As lockdowns were put in place in Germany, Italy, France and Spain, ECB President Lagarde said the economy was losing momentum faster than expected and that more monetary stimulus would be coming by December. Germany’s DAX index was especially weak.

Asian equities fared better than those in Europe and North America. Japan was the best-performing developed market, as employment and industrial production figures were better than expected.

Oil Sector Performance

Crude oil prices tumbled more than 10% for the week, falling to their lowest level in five months. U.S. crude dropped below $36 per barrel as the economic impact from rising coronavirus cases and new restrictions in the U.S. and Europe weighed on demand.

Market-Moving News

Tough Week

U.S. stocks sustained some of their steepest daily declines in months, with the major indexes tumbling 3% to 4% on Wednesday and around 2% on Monday. On Thursday, a measure of stock market volatility rose to its highest level since June.

Accelerating Decline

The major U.S. stock indexes fell for the second week, and at a much faster rate than they had previously. The S&P 500, the Dow, and the NASDAQ posted declines of around 6% as investors weighed rising coronavirus cases, election uncertainty, and stalled congressional efforts for an economic relief package.

Exceeding Expectations

With quarterly earnings in from nearly two-thirds of the companies in the S&P 500, the number of firms that had beaten expectations was at or near a record level as of Friday. According to FactSet, 86% of the companies that had reported third-quarter results exceeded analysts’ earnings-per-share forecasts, compared with an average of 73% over the previous five-year period.

GDP Comeback

The U.S. economy grew at an annualized rate of 33.1% in the Q3, compared with a 31.4% steep decline from the Q2, when the coronavirus outbreak grew into a pandemic.

Stalled Stimulus Negotiations

Talks between congressional leaders and the White House toward further coronavirus-related economic relief collapsed, although the effort could be renewed after Tuesday’s U.S. election.

Oil Slick

Crude oil prices tumbled more than 10% for the week, falling to their lowest level in five months. U.S. crude dropped below $36 per barrel as the economic impact from rising coronavirus cases in the United States and Europe weighed on prices.

Other Important Macro Data and Events

The first reading of Q3 GDP showed the biggest gain on record, topping economists’ expectations. Home prices, personal income and durable goods orders rose more than expected, and weekly jobless claims continued to gradually improve.

Stocks around the world fell this week as COVID-19 case growth hit record highs in the U.S. and major European countries. Several large European economies had reinstated lockdown measures that will likely dampen economic activity in the coming weeks.

The ECB left its monetary policy unchanged, keeping its deposit rate at -0.5% and its emergency bond-buying program at EUR 1.35 trillion. At the same time, a flight-to-safety in capital markets pushed the U.S. dollar higher. Stock market volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), rose to its highest level since June.

What We Can Expect from the Market this Week

With one day left before the U.S. presidential election, a trifecta of worries around the political outcome, the path of the virus, and the lack of progress on another fiscal package will be expected to weigh on stocks movement.

Crowded calendar on economic news to track in the week, starting with construction spending today, presidential election and factory order on Tuesday, Fed’s rate decision, employment report and trade balance on Wednesday, unemployment claims on Thursday, and Friday will bring a closely watched monthly report on jobs and unemployment, apart from wholesale inventories and consumer credit on Friday.