Stocks Performance (U.S. Stocks)

The tense political situation seemed to remain a major driver of sentiment during the week. Stocks drifted lower as optimism about additional U.S. fiscal stimulus was tempered by concerns that the impeachment of President Donald Trump might slow the process of steering Joe Biden’s larger-than-expected COVID-19 relief proposals through Congress.

The social media companies that dominate the communication sector, such as Twitter Inc., Facebook Inc. and Alphabet Inc. (Google/YouTube) fell sharply in reaction to the backlash they faced after banning or limiting posts from President Trump and some of his supporters.

The CPS Technologies Corporation (NASDAQ: CPSH) stock rallied last week as investors piled on to it, extending the manufacturing company's staggering gains since last three years. The company, last week, was granted EU patent titled 'Scalable modular design of 48-volt li-ion battery management system.'

The energy sector was strong, as oil prices neared $54 per barrel for the first time in a year, helped by a surprisingly large drawdown in domestic oil inventories. While the non-energy minerals slipped lower as the price of gold slumped.

By sectors, the most outperformed weekly stocks were led by Industrial Services sector at 2.97%, followed by Energy Minerals at 1.58%, Health Technology (1.40%), and Utilities at 0.13%. Meanwhile, the weakest sectors were from the Non-Energy Minerals at -4.41%, Technology Services at -2.34%, Consumer Non-Durables (-2.31%), and Health Services sector (-2.26%).

Indices Performance

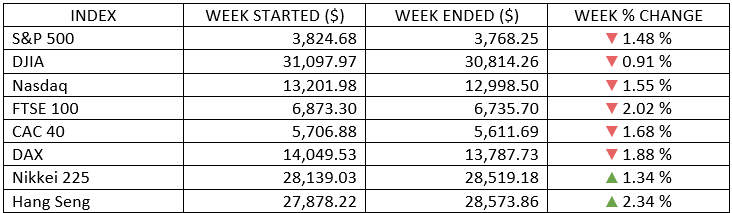

After posting gains of around 2% in the first week of the new year, the major U.S. stock indexes all lost ground on the second week, slipped about 1.0% to 1.5% in a mostly quiet week of trading.

Most major European equity markets also were lower, as the resurgence in coronavirus infections dented optimism, due to the imposition of a stricter lockdown, despite a better-than-expected economic data and a reassurance from ECB President Christine Lagarde that economic activity will rebound as the pandemic recedes. Stocks in Italy fell as political uncertainty erupted on political turmoil in that country. The government led by PM Conte is close to collapse after losing the majority.

In Japan, stocks climbed after reports that the government is considering a new pandemic relief package. Meanwhile, the COVID-19-related state of emergency was expanded from Tokyo to seven more prefectures, and officials are debating whether to once again cancel or delay the Tokyo Olympics.

Oil Sector Performance

The oil prices hardly changed for the week. The U.S. oil prices neared $54 per barrel for the first time in a year earlier in the week, before retreating to end the week virtually unchanged, around $52 on Friday.

Market-Moving News

A Declining Week

After posting gains of around 2% in the first week of the new year, the major U.S. stock indexes slipped about 1.0% to 1.5% in a mostly quiet week of trading. The decline pushed indexes off the record highs they had achieved entering the new year.

Small-Cap Momentum

For the third week in a row, small caps outperformed as the Russell 2000 Index posted a modest gain while large-cap indexes declined. Since the end of September 2020, the Russell 2000 has surged 41%.

Stimulus Proposal

In advance of Wednesday’s scheduled inauguration in Washington, President-elect Joe Biden announced a proposed $1.9 trillion coronavirus relief and economic stimulus package. In addition to more money for COVID-19 testing and vaccine distribution, the proposal calls for $1,400-per-person direct payments to most U.S. households.

Inflation Gauge

Although inflation has generally remained subdued amid the pandemic, U.S. CPI increased solidly in December. However, the 0.4% increase in the consumer price index was largely attributed to the rising cost of gasoline. In November, the index rose just 0.2%.

Unemployment Line

New unemployment claims continue to grow. Total claims jumped to 965,000 in the latest weekly report—the most since last summer, and a sign that the rising numbers of coronavirus cases have triggered additional layoffs.

Retail Slump

U.S. retail sales dropped in December, marking the third monthly decline in a row. Sales fell 0.7% from November’s level, and the government also revised November’s data downward from a 1.1% decline to a 1.4% drop.

Earnings Launch

With quarterly earnings season just starting, Wall Street analysts expect companies in the S&P 500 to report a 6.8% decline in net income compared with the prior year’s Q4, according to FactSet. Of the 26 companies that had reported as of Friday, all but one exceeded expectation.

Bitcoin's Stumble

The $40,000 Bitcoin price threshold was short-lived. After eclipsing that record level at the end of the previous week, the cryptocurrency plunged below $32,000 at one point on Monday. By Friday, bitcoin was trading for around $35,000.

Other Important Macro Data and Events

The new U.S. administration unveiled last Thursday a $1.9 trillion economic relief plan that it will bring to Congress for approval. The proposed bill's size represents about 9% of GDP, is more than double the bipartisan bill approved last month.

U.S. bond yields jumped on stimulus hopes and dovish comments from Federal Reserve Chair Jerome Powell. However, yields reversed course to finish lower.

Fed Chairman Powell reiterated on Thursday that the fed funds rate will not be raised for a long time.

U.S. economic data was mixed, with much higher-than-expected initial unemployment claims and a disappointing drop in retail sales, but a solid gain in industrial production.

The banking giants JPMorgan Chase, Citigroup, and Wells Fargo reporting Q4 earnings results before the start of trading on Friday. Despite upside earnings surprises, shares in all three fell as trading began, with Wells Fargo leading the declines on a revenue miss.

European lockdowns extended again - Italy will prolong its state of emergency to the end of April, Health Minister Roberto Speranza said. Switzerland, which announced tighter measures, and the Netherlands both said they would extend lockdowns into February. German Health Minister Jens Spahn said Germany was likely to do the same. France said it would tighten entry restrictions for travelers and impose an evening curfew nationwide. The UK toughened entry restrictions for travelers from Brazil, where a new variant that appears to be resistant to vaccines has been detected.

Japan’s state of emergency was expanded from Tokyo to seven more prefectures.

What We Can Expect from the Market this Week

With quarterly earnings season just starting, Wall Street analysts expect companies in the S&P 500 to report a 6.8% decline in net income compared with the prior year’s Q4, according to FactSet. Of the 26 companies that had reported as of Friday, all but one exceeded expectation.

Economic data being released this week including housing market index, weekly unemployment claims, PMI breakdowns, housing starts, existing home sales, and inflation rates. U.S. financial markets will be closed on Monday in recognition of Martin Luther King Day, while the inauguration of Biden administration will be on Wednesday.