PAST WEEK'S NEWS (April 5 – April 11, 2021)

Stocks Performance (U.S. Stocks)

Global stock markets advanced, with several equity benchmarks climbed to record highs last week, buoyed by optimism about the pace of economic growth and stronger economic data, as well as the assurance of continued accommodative monetary conditions and growing hopes of injections of fiscal stimulus would spur a global economic rebound.

Equities strengthened on Wednesday after minutes from the last U.S. Federal Reserve meeting underscored its commitment to low interest rates for “some time”. Economic data around the world was mostly positive, reflecting accelerating vaccination programs and massive fiscal stimulus. The IMF raised its forecast for global growth this year from 5.5% to 6%.

Big gains in mega-capitalization Internet and technology companies dominated action in the S&P 500, rallied strongly with the improving market sentiment. Tech shares regained the lead during the week, helped by solid gains in Apple and Microsoft. Energy stocks lagged as oil prices pulled back early in the week.

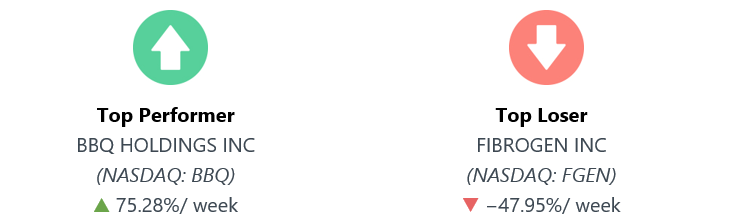

BBQ Holdings, Inc. surged to lead among the stocks after the company reported better-than-expected Q4 sales results. Meanwhile, FibroGen stock crashed to a 4-year low Wednesday after the company allegedly manipulating drug data, by backtracking some of the safety data for its experimental anemia treatment in chronic kidney disease patients.

Advancing sectors were led by Technology Services sector at 4.42%, followed by Electronic Technology at 3.83%, Retail Trade (3.38%), and Non-Energy Minerals at 2.76%. Meanwhile, the weakest sectors were from the Energy Minerals at -3.51%, Communications at -0.14%, Industrial Services (0.45%), and Consumer Services sector (0.50%).

Indices Performance

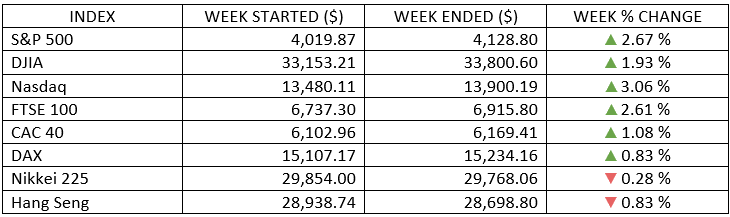

The S&P 500 and Dow Jones Industrial Average climbed for the third week in a row, kicked off the week on Monday with a data-driven rally to new heights. The Nasdaq Composite outperformed with a 3% gain but stayed below its February peak.

Europe and much of Asia got off to a slow start after being closed for Easter Monday.

Stocks in the UK, one of the countries at the forefront of vaccinating its population, were especially strong after the IMF forecast the country would lead European growth this year and PM Boris Johnson laid out details of a plan to ease COVID-19 restrictions in the coming weeks.

Japan’s stocks started the week positively, with the Nikkei 225 breaking through the 30,000 mark early in the period. The rest of the week made for a more mixed picture before the index finished slightly lower than it began.

Oil Sector Performance

Oil prices lagged for most of the week. Early in the week, oil dipped as OPEC+ agreed to gradually ease some of its production cuts between May and July. The oil also pulled back by concerns over a big jump in U.S. gasoline stocks. The EIA figures reported U.S. crude stocks fell 3.5 million barrels last week, and gasoline inventories jumped 4 million barrels, more than expectations.

Market-Moving News

Third Week Advance

The Dow and the S&P 500 climbed for the third week in a row, rising around 2% to 3% and pushing their record levels higher in a mostly quiet week of trading. The biggest moves came on Monday, when stocks rose on the heels of a strong monthly jobs report released on April 2, a day of a holiday market closure.

Reversal of Fortune

For the second week in a row, an index of U.S. large-cap growth stocks outperformed its value-oriented counterpart by a wide margin, interrupting value’s recent run of relative gains versus the growth style. As in the previous week, some of the biggest technology stocks set record highs while stocks of companies more sensitive to cyclical economic changes lagged.

Mixed Signals

U.S. economic indicators were mixed for the week. On the positive side, a monthly gauge of services sector activity posted record growth. However, a higher-than-expected total of 744,000 workers filed initial claims for unemployment benefits, marking the second such weekly increase in a row.

Earnings Optimism

Q1 earnings for companies in the S&P 500 are forecasted to jump more than 24%, with the consumer discretionary and financials sectors expected to see the biggest gains, according to FactSet.

Yield Pullback

For the second week out of the past three, yields of U.S. government debt slipped as bond prices recovered, deflating some of 2021’s surge in yields. The yield of the 10-year U.S. Treasury bond fell to around 1.67%, down from a recent high of 1.74% on March 31. Nevertheless, the yield is still up sharply from 0.92% at the end of last year.

Dollar's Setback

The U.S. dollar had a strong start to 2021, rising about 4% versus other major currencies from early January to the end of March. But the dollar has reversed course in April, losing about 1% so far this month. The continuing expectations that the Fed won’t raise interest rates anytime soon despite the economy’s growth.

Fed Outlook

U.S. Federal Reserve Chair Jerome Powell said that the Fed is looking for "actual progress" rather than forecasts in reaching the central bank's employment and inflation goals. He also reinforced expectations that the Fed will maintain its accommodative policy stance by noting that the economy still has a way to go before reaching the Fed’s targets.

Other Important Macro Data and Events

The U.S. central bank's dovish monetary was reaffirmed in the FOMC Minutes from the March meeting. The Fed’s reiteration of its pledge to keep benchmark rates low and to make no changes to its bond-buying program any time soon prompted a drop in government bond yields and the U.S. dollar.

The dollar turned lower for the week. Against a basket of major currencies, the index slipped -0.76% to stay at 92.18. EUR/USD advanced 1.43%, USD/JPY declined -0.85%, GBP/USD slid -0.98%, and USD/CHF slipped -0.76%.

The lower dollar, in turn, boosted prices of most commodities, including gold and copper.

Oil prices falling due to concerns about global demand, as COVID-19 continued to spread rapidly in several large countries, including India and Brazil.

Economic data around the world was mostly positive, reflecting accelerating vaccination programs and massive fiscal stimulus.

On Monday, the U.S. market keyed off a strong employment report for March, which was released the prior Friday when the stock market was closed, and a record-setting ISM Non-Manufacturing Index for March. The ISM gauge of service sector activity jumped to its highest level on record, mirroring the ISM’s earlier report that factory activity had reached its highest level in four decades. Details in the ISM report were also strong, with broad-based strength in employment, new orders, and business activity easily offsetting weakness in inventories and export orders. At the end of the week, the PPI increased a better-than-expected 1.0% m/m in March.

PM Boris Johnson said that England would move to the second phase of its “road map” for lifting the lockdown on April 12, when outdoor pubs, nonessential shops, hairdressers, indoor gyms, and other facilities will be allowed to reopen. The UK government also announced a framework for the resumption of international travel, which could begin to take effect on May 17, at the earliest.

The IMF raised its forecast for global growth this year from 5.5% to 6%.

What Can We Expect from the Market this Week

Some investors remained worried about the possibility of rising inflation and proposals for higher taxes, as progress in President Biden's new infrastructure proposal is underway.

With recent market movements that seem to follow the near-term headlines, it is easy for investors to be swayed and discouraged when short term corrections happen. Investors then find themselves with two options, either to continue investing in a disciplined manner or to divest to cut losses. For those unable to digest short term pullbacks, it is perhaps better to reassess one’s risk tolerance and rebalance the investment portfolio accordingly.

Important economic data being released this week started with the Federal Budget, followed by CPI, imports/ exports, retail sales growth, weekly unemployment claims, manufacturing production and housing starts.