PAST WEEK'S NEWS (June 7 – June 13, 2021)

Novan, Inc. led gains as the shares jumped after the company reported the B-SIMPLE4 pivotal Phase 3 trial of SB206, its topical antiviral gel achieved statistical significance and no serious adverse events were reported. Recon Technology ltd shares plummeted on Friday after the company’s subsidiary Beijing BHD Petroleum Technology Limited signed two contracts with North China E&P Company.

Stocks Performance (U.S. Stocks)

Global equities muddled through the week before ending mostly flat. Drive of Interest rates and inflation seemed to continue to dominate the market sentiment. A sharp decrease in longer-term U.S. bond yields seemingly pushed lower by recent assurances from Federal Reserve policymakers that they would keep monetary policy highly accommodative for “some time” and that the recent spike in inflation would prove temporary.

Broader risk markets also weighed the inflation versus growth debate, monitored infrastructure spending talks in Washington, and awaited inflation data. Policy developments supported sentiment as a bipartisan group in the Senate reached a deal on an infrastructure plan that would not raise corporate taxes, as the Biden administration had proposed. According to reports, Republican leaders indicated they were open to the proposal, though remained unclear if the president and Democratic leaders in Congress would agree to the scaled-back plan.

The underperformance of the cyclical stocks also was partially due to profit-taking interest and an underlying belief that the economy is running into peak growth rates. The latter viewpoint was indirectly corroborated by the Treasury market, which appeared to be sticking with the peak inflation thesis. Speculative stocks did well, too, presumably on the understanding that the Fed isn't in a rush to tighten or communicate it will tighten policy.

Advancing sectors were led by Health Technology sector at 3.84%, boosted by gains in Biogen, followed by Technology Services at 2.62%, Commercial Services (1.36%), and Utilities at 1.20%. Meanwhile, the weakest sectors were from the Process Industries sector at -1.53%, followed by Transportations at -1.23%, Producer Manufacturing (-1.20%), and Non-Energy Minerals sector (-0.84%).

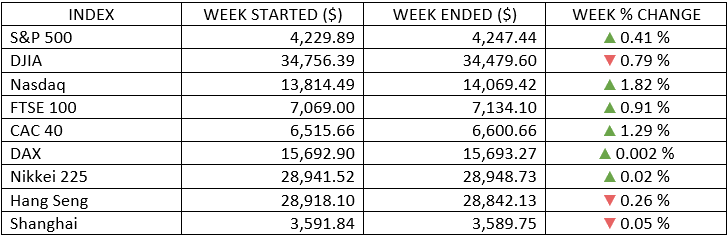

Indices Performance

A lower yield help push the S&P 500 Index to a record high on Thursday, while the technology-heavy Nasdaq Composite outperformed and marked its fourth consecutive weekly gain. The narrowly focused Dow Jones Industrial Average recorded a modest loss.

Shares in Europe gained ground for a fourth consecutive week, lifted in part by the ECB pledge to continue its high rate of bond purchases into the coming quarter.

Japan’s stock market returns were broadly unchanged for the week. While the domestic economic recovery remains fragile, sentiment was boosted by the government lifting the coronavirus states of emergency in three prefectures in the face of steadily declining infection rates and easing pressure on hospitals. Chinese stocks fell for a second week.

Oil Sector Performance

Oil recorded its third weekly rise as investors grow more confident that the recovery from the pandemic will help demand and lead to an easing of pandemic curbs. The prospect of a near-term return of Iranian oil supply meanwhile faded as the U.S. secretary of state said sanctions against Tehran were unlikely to be lifted.

The positive sentiments pushed prices above $70 per barrel for the first time in more than 2-1/2-years. As recently as May 20, oil was trading as low as $62.

Market-Moving News

Index’s Mixed Results

The major U.S. stock indexes continued to hover near record highs set earlier in the spring, with the S&P 500 breaking its record on Thursday. That index posted a small gain for the third week in a row, as did the NASDAQ, which outperformed its peers. Dow retreated modestly.

Thursday Momentum

A significant move coming on Thursday. The S&P 500’s daily gain of 0.5% pushed that index to a record, eclipsing a previous high set five weeks earlier.

Bond Rally

Prices of U.S. government bonds surged, pushing yields down to the lowest levels in more than three months. The yield of the 10-year U.S. Treasury bond fell below 1.50% on Wednesday, before slipped as low as 1.45% on Friday.

Oil Tops $70

U.S. crude oil prices rose more than 1%, climbing for the third week in a row and pushing prices above $70 per barrel for the first time in more than two and a half years.

Price Pressures

An index of U.S. CPI rose at a 5.0% annual rate in May, the steepest increase since 2008. The latest monthly inflation spike extends a trend that accelerated earlier this spring, although the increases are being boosted in part by comparisons with relatively low inflation a year ago, when the pandemic depressed prices.

Recovery Indicators

A new claim for unemployment benefits fell to 376,000, the lowest level recorded since the pandemic hit. On Friday, an index of consumer sentiment rose more than expected as survey participants grew more optimistic about future economic growth and employment.

Other Important Macro Data and Events

Inflation as measured by the CPI rose 5.0% from a year ago, and the core index, which excludes food and energy, rose 3.8%, the largest 12-month increase since 19921. The University of Michigan’s survey of consumer sentiment, released Friday, showed that Americans expected prices to rise 4% in the current year, versus the previous month’s read of 4.6%. Consumers also grew more confident, with the survey’s overall sentiment gauge reversing much of May’s decline.

Despite the hotter-than-expected data, government bond yields fell to their lowest levels in three months. The yield on the benchmark 10-year U.S. Treasury note fell ten basis points this week to 1.46%. As recently as March 31, the yield had been at 1.74%.

Against a basket of major currencies, the dollar index edged higher, rose 0.42% to stay at 90.509. EUR/USD slipped 0.42%, USD/JPY added 0.12%, and GBP/USD retreated 0.35%.

In Europe, the Eurozone government bond yields also largely fell, reflecting the ECB’s commitment to continue its bond-buying program at the current pace for another quarter. The central bank forecast also called for inflation to subside and come in well below its target in 2023.

The ECB left its key policy measures unchanged and said that it would maintain emergency bond-buying at a higher pace for the next quarter, even though the central bank’s updated forecasts called for higher rates of inflation and economic growth. ECB President Christine Lagarde said at a press conference that inflation would accelerate this year and then slow in 2022.

UK gilt yields broadly tracked yield in core markets. The faster-spreading “Delta” variant of the COVID-19 likely to delay England’s full reopening of society for some weeks beyond the June 21 target date.

What Can We Expect from the Market this Week

Inflation concerns could be top of mind for many U.S. Fed officials as policymakers hold a 2-day meeting scheduled to end on Wednesday. While the Fed is expected to keep its benchmark interest rate unchanged—and at a near-zero level—the recent spike in consumer prices could spur discussion of other steps to tighten monetary policy.

A recalibration in interest rate and central-bank-policy expectations could trigger some volatility, though increased vaccination rates, rising consumer demand, and surging corporate profits rightfully outweigh inflation concerns.

Important economic data being released this week including PPI data, retail sales, housing market index, FOMC interest rate decision and the leading economic indicator index.