PAST WEEK'S NEWS (Oct 11 – Oct 17, 2021)

Jasper Therapeutics, a clinical-stage biotech company that went public on September, have jumped last week, mostly on Wednesday, thanks to coverage from the investment bank Oppenheimer. Investors took note of the bank's coverage after it suggested the stock with an Outperform rating and announced a price target of $21 within the next 12 months. Before Oppenheimer's coverage, Jasper's shares were trading at around $7.21, an almost 42% drop since their debut on the Nasdaq last month.

Stocks Performance

The stock market regained its footing for the second half of the week, bolstered by some encouraging economic signals, better-than-expected earnings reports, and improving technical factors, as well as China’s trade and inflation data.

A strong start to quarterly earnings season provided a key catalyst, with most companies (predominately banks) exceeding expectations. Investors also digested minutes from the FOMC’s meeting in September, which showed central bank officials broadly agreeing to begin tapering assets as soon as November, scaling back pandemic-era support for the economy.

The good news helped the market overlook persistent inflation pressures indicated in the softer CPI and PPI reports for September, higher energy prices, and continued pressures from supply chain disruptions.

The consumer discretionary, energy, real estate, and materials each gained around 3.5%, while the communication services sector lagged, weighed down by declines in traditional media providers.

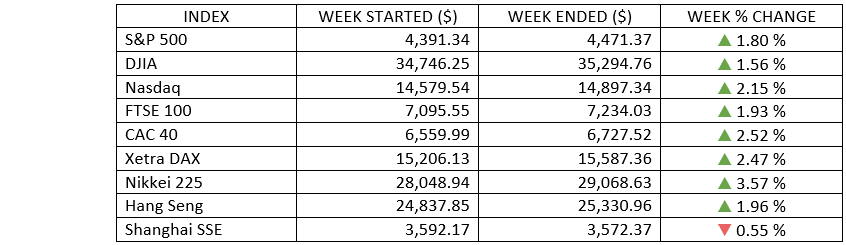

Indices Performance

The major U.S. stock indexes rebounded late in the week, to record their second positive week in a row, led by the Nasdaq Composite with a 2.2% gain. Strong earnings reports and a decline in weekly unemployment claims helped to fuel a stock market rally on Thursday. On Thursday, the S&P 500’s surge 1.7%, the index’s biggest daily gain in more than seven months, while the NASDAQ also added 1.7% and the Dow up 1.5%.

Shares in Europe also rallied on optimism about the continuing economic recovery and strong corporate earnings.

Japan’s stock market returns also were positive, ahead of the October 31 general election. Investors gained reassurances that new Prime Minister Fumio Kishida is not planning to veer too far away from the policies of his predecessors and does not intend to raise the country’s capital gains tax, a subject that previously spooked markets.

Chinese mainland Shanghai Composite Index ended lower, as investors have been spooked by a deepening energy crisis.

Oil Sector Performance

Oil prices holds on to its rally, pushed higher on increasing signs of tight supply over the next few months as rocketing gas and coal prices stoke a switch to oil products.

The International Energy Agency said surging natural gas prices could boost demand for oil among power generators. A global energy crunch is expected to boost oil demand by 500,000 bpd and could stoke inflation and slow the world's recovery from the COVID-19 pandemic, the IEA said, in its October market report released Thursday, added that the elevated demand could last through the first quarter of 2022.

Prices also supported after top oil producer Saudi Arabia dismissed calls for additional OPEC+ supply, saying the group's unwinding of production cuts was protecting the oil market from wild price swings seen in natural gas and coal markets.

The U.S. oil prices hit a seven-year high, and the Brent crude oil reached a three-year high on Friday.

Market-Moving News

On The Rebound

The major U.S. stock indexes slipped on Monday and Tuesday but came back in a big way late in the week, rising around 2% overall to record their second positive week in a row. Strong earnings reports and a decline in weekly unemployment claims helped to fuel a stock market rally on Thursday. The S&P 500’s 1.7% surge was that index’s biggest daily gain in more than seven months; the NASDAQ also added 1.7% and the Dow was up 1.5%.

Earnings Surprises

As of Friday, 80% of the S&P 500 companies that had reported Q3 results exceeded analysts’ earnings estimates, according to FactSet. Results were in from 8% of S&P 500 companies as of Friday, with many of the early reports coming in from major banks.

Inflation Spike Persists

Amid rising energy costs and disruptions in global supply chains, the recent spike in U.S. consumer prices extended into September, picking up slightly from August’s level. The CPI rose 5.4% compared with the same month a year earlier. The latest increase is roughly in line with the elevated levels seen in June and July.

Retail Resilience

Despite inflation concerns and the Delta variant’s spread, U.S. shoppers continued to spend at a steady clip in September. The government reported on Friday that sales at retail stores, restaurants, and online sellers rose a seasonally adjusted 0.7% compared with the previous month. Relative to September 2020, sales jumped 13.9%.

Bright Labour Market

Although recent monthly jobs reports have been disappointing, the number of Americans making initial claims for unemployment benefits has declined to the lowest level since March 2020. New claims dropped below 300,000 in the latest weekly count, marking the second consecutive weekly decline.

Slimmer Growth Outlook

The IMF trimmed its global economic growth forecast for 2021. Its current 5.9% global GDP growth estimate is down one-tenth of a percentage point from an earlier forecast; the fund kept its 2022 growth forecast unchanged at 4.9%. This year’s revised outlook comes as the global trade is challenged by supply chain issues and many countries confront increasing COVID-19 cases.

Bitcoin Rally

The price of Bitcoin rose above $60,000 on Friday, close to the record high that the cryptocurrency set six months earlier. As of Friday, Bitcoin’s price had jumped about 40% since the end of September, when it was around $44,000 as of Friday.

Other Important Macro Data and Events

The U.S. Treasury yield curve flattened through most of the week, as investors assessed the latest inflation data and the minutes from the Fed’s September policy meeting. Concerns over the economic outlook caused longer-term yields to retreat, although the yield on the benchmark 10-year U.S. Treasury note retraced part of its decline following Friday’s retail sales report.

The dollar recorded its first weekly decline versus major peers since the start of last month, falling back from a one-year high. The dollar index, which measures the greenback against six rivals, declined 0.1% lower for the week, despite hitting the highest since Sept. 25 of last year at 94.563 on Tuesday.

Supply pressures and peaking inflation might be seemed to be a major factor in stocks regaining momentum to end the week. On Wednesday, the Labor Department reported that core CPI had risen 4.0% for the year ended in September, in line with consensus expectations. PPI reported Thursday, rose 0.5% for the month (8.6% for the year), down from the 0.7% rise in August and less than consensus forecasts. Investors also digested minutes from the FOMC’s meeting in September, which showed central bank officials broadly agreeing to begin tapering assets as soon as November, scaling back pandemic-era support for the economy.

On Thursday, the weekly jobless claims reported a fall to 293,000, a new pandemic-era low. Airline and cruise ship stocks rose after the White House announced an easing in border controls following the recent decline in coronavirus cases.

Momentum carried into Friday after the Commerce Department reported that retail sales had defied expectations for a decline and jumped 0.7% in September. The University of Michigan’s preliminary gauge of consumer sentiment in October fell back toward multiyear lows, against a slight gain expectation.

Meanwhile, the U.S. has overtaken China to account for the world's biggest bitcoin miner, accounting for a third of the global hash rate after Beijing banned all cryptocurrency transactions, data published on Wednesday by Britain's Cambridge Centre for Alternative Finance showed.

Industrial production in the Eurozone fell in August due to supply chain bottlenecks and slowing global trade. Output from factories, mines, and utilities fell 1.6% from July, when output increased by 1.4% sequentially.

UK GDP in August grew 0.4% month over month as the hospitality industry benefited from the first full month of reopening.

Concerns are still mounting about contagion among indebted developers in China. Evergrande, which is shouldering more than $300 billion in liabilities, failed to pay nearly $150 million worth of coupons on three bonds due Monday after missing two other bond payments in September. Sinic Holdings Group Co. has become the latest real-estate firm to warn of imminent default.

What Can We Expect from the Market this Week

The corporate earnings will be kept under watch, with big reports pouring in from every sector, setting the pace for upcoming performance. The bar of expectations remains high, while the combination of rising labour costs, supply disruptions, less monetary stimulus, and the prospects of corporate tax hikes could temporarily dent the profit-growth picture.

On the economic calendar, several important economic data being released this week include the PMI index, industrial production, housing market index, leading indicators, and the unemployment claims. Federal Reserve's Beige Book report will give economists another check on the central bank's thinking.