PAST WEEK'S NEWS (Jan 31 – Feb 6, 2022)

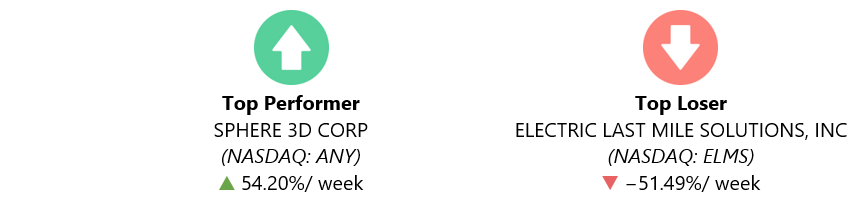

Sphere 3D Corp shares leads the weekly gains as investors are responding positively after the company announced it buying 60,000 units of new NM440 bitcoin miners from NuMiner Global Inc. Sphere 3D Corp is a company dedicated to becoming the leading carbon-neutral bitcoin mining company operating at an enterprise scale

Shares of EV start-up Electric Last Mile plummet by more than 50%, majorly slumped on Wednesday, after the CEO and Chair both unexpectedly resigned, following an internal probe into share purchases made by the co-founders, before it went public through a SPAC in June.

Stocks Performance

Equity markets remained volatile but recorded overall gains for the second consecutive week. The market continued to stabilize from an oversold condition despite increased rate-hike expectations.

The market had plenty going for it this week, including month-end rebalancing activity, first-of-the-month inflows, an improved technical posture, a fear of missing out on further rebound gains, the huge rush of earnings reports, and the increasingly likely near-term prospect of rising interest rates.

Alphabet and Amazon.com saw big gains following their earnings reports but not as big as Snap's, which provided investors a huge sigh of relief after Meta Platforms plunged over 25% following its disappointing earnings news. A decline in Facebook’s average daily users and guidance for slower revenue growth wiped a record $232 billion off its market cap on Thursday. SNAP popped off with a 60% gain after falling 24% prior to its report.

Expectations for the U.S. Fed to raise the fed funds rate by 50 basis points in March increased noticeably after the January employment report displayed surprisingly strong jobs growth and higher-than-expected wage gains. On a related note, the ECB and the BoE also acknowledged the inflation risks in the economy. The BoE responded accordingly with a 25-basis-point rate hike for the second meeting in a row, and the ECB said it couldn't rule out a rate hike this year after previously indicating that was an unlikely possibility.

In sectors perspective, gains were paced by the energy, consumer discretionary, and financials sectors with impressive gains. The materials, real estate, and communication services sectors ended the week with modest losses.

Indices Performance

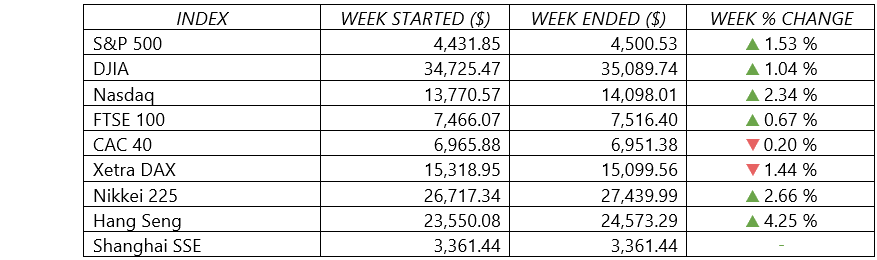

After starting 2022 with three straight weekly declines, the major U.S. stock indexes posted their second positive week in a row, eclipsing the previous week’s modest gains.

Equities in Europe weakened after ECB President Christine Lagarde made comments that appeared to leave the door open for a possible rate increase this year.

Stock markets in Asia generated a positive return for the week, while mainland China’s financial markets were closed for the Lunar New Year.

Crude Oil Performance

Oil benchmarks marks their seventh straight weekly gain, surged on Thursday and Friday with the price of U.S. crude climbed above $92 per barrel—the highest level in nearly eight years, after OPEC+ producers agreed to stick to only a modest production increase in the face of high demand. The group already struggling to meet existing targets and despite pressure from top consumers to raise production more quickly.

Geopolitical tensions in Eastern Europe and the Middle East have also fuelled oil's gains, which have pushed Brent futures up by 17% and WTI by 20% so far this year, building on 2021′s gain of more than 50%.

Other Important Macro Data and Events

U.S. treasury yields pushed higher amid the inflation pressures and hawkish Fed expectations. The 2-yr yield rose 15 basis points to 1.32%, and the 10-yr yield rose 15 basis points to 1.93%, the highest level since December 2019. Yields also climbed in other countries amid growing expectations of monetary policy tightening.

The U.S. dollar index fell 1.9% to 95.44, its biggest weekly drop since March 2020.

Gold recorded weekly gain, lifted on the weaker dollar, concerns over stubborn inflation and tensions surrounding Ukraine.

The week’s heavy calendar of economic releases included data showing that manufacturing prices rose more than expected in January, reflecting modest upside surprises in gauges of factory activity. Measures of services sector activity fell back, probably reflecting the imprint of the omicron variant of the coronavirus, but not as much as expected.

Labour market data appeared to puzzle investors. On Wednesday, private payrolls firm ADP reported that its tally of private sector employment fell by 301,000 in January—the biggest drop since the start of the pandemic. Friday morning’s official Labor Department jobs report showed a surprising jobs comeback of 467,000 jobs in January, exceeded expectations by a wide margin. Upward revisions to job totals in late 2021 provided a further indication of the labour market’s strength.

Earnings performance continued to improve, as the Q4 profits at companies in the S&P 500 were expected to increase more than 29%, based on companies that have reported so far and forecasts for firms that haven’t yet released earnings, according to FactSet. About 56% of companies had reported results as of Friday.

Core eurozone bond yields rose on concerns about inflationary pressures and the possibility of a shift in the ECB’s accommodative policies. Peripheral eurozone bond yields moved in tandem. A Bank of England (BoE) interest rate increase—the second one since December—pushed gilt yields higher.

Eurozone GDP growth slows in Q4, grew 0.3% in the final three months of 2021—a slowdown from the 2.3% expansion recorded in the Q3.

Geopolitical tensions in eastern Europe remains, with Russia accused the U.S. of ramping up tensions and ignoring Moscow's calls to ease a standoff over Ukraine, a day after Washington announced it would send nearly 3,000 extra troops to Poland and Romania. Russia has denied plans of an invasion though has amassed thousands of troops on its border with Ukraine.

What Can We Expect from the Market this Week

Bond markets will continue to focus on inflation and how central banks respond to it. Following this week is a read on consumer price inflation that has the potential to rattle the markets if it is believed to reset the FOMC rate hike plan.

A U.S. economic report scheduled to be released on Thursday will show whether January marked the fourth month in a row in which the annual inflation rate topped 6.0%. The CPI released last month showed that prices surged 7.0% for the 12-month period that ended in December—the highest level since 1982.

Other agenda in U.S. economic calendar in the week ahead also features updates on consumer credit, trade balance, wholesale inventories, and unemployment claims.

In oil sector, investors will focus on Thursday and Friday, awaited the market reports from the OPEC and IEA.

On the earnings front, blue chips Pfizer, Coca-Cola and Disney are some of the big names to report.