PAST WEEK'S NEWS (November 04 – November 08, 2024)

The Federal Reserve's unanimous vote to cut rates by 0.25% to 4.50-4.75% shows the central bank is staying on track with its plan to ease monetary policy, but the Trump presidency may shake things up. Donald Trump's victory has created new questions about where rates might go next year, with his proposed policies on tariffs and immigration being more inflationary. Fed Chair Jerome Powell made it clear he's not letting politics influence current decisions, though he'll need to watch how Trump's policies affect prices and jobs once they roll out. Wall Street is now betting on just two more quarter-point cuts through mid-2025, down from earlier predictions of deeper cuts, as Trump's planned moves could heat up inflation. Powell reiterated that he would not step down even if Trump asks him before his term ends in 2026, reassuring legal protections for his position. The Fed chief seems confident about where things stand, saying both the economy and Fed policies are "in a very good place," though he'll likely have his hands full managing rate decisions if Trump's economic agenda takes shape.

Congratulations to the 47th United States of America President-elect, Donald J. Trump, voted to become the 22nd president in its history to ever serve two terms and the 6th president to serve those terms inconsecutively. World leaders, including those from Israel, Ukraine, the U.K., France, and Italy, congratulated President-elect Donald Trump on his election victory, hailing it as a significant moment for international alliances. Leaders expressed hopes for strengthened partnerships, with Ukraine’s Zelenskyy, Israel’s Netanyahu, and others highlighting Trump’s prospective on global peace, democracy, and economic ties. His opponent, Kamala Harris, who showed grace in defeat, called to congratulate, insisting on the "importance of a peaceful transfer of power and being a president for all Americans," according to CNN. Vice President-elect JD Vance expressed his gratitude to Trump for believing in him to serve the country at that level. President-elect Trump will be sworn in January 25th next year and inaugurated as President.

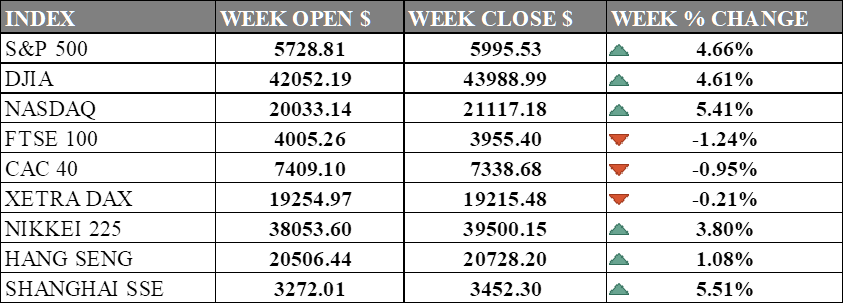

INDICES PERFORMANCE

Wall Street experienced a strongly positive week across major indices. The S&P 500 surged 4.66% to close at 5,995.53. The Dow Jones Industrial Average saw a substantial gain of 4.61%, finishing at 43,988.99, while the tech-heavy Nasdaq led the gains with a 5.41% increase to close at 21,117.18. The newfound euphoria which propel stocks valuation into a new horizon came directly from the victory of president-elect Donald Trump whom promised to make America great again, possibly through its inflationary and trade protectionist policies.

European markets faced downward pressure across the board. The UK's FTSE 100 declined 1.24%, closing at 3,955.40. France's CAC 40 fell 0.95%, closing at 7,338.68. Germany's XETRA DAX showed a modest decline, dropping 0.21% to end at 19,215.48. While the American market is happy, European market is expected to suffer after Trump’s promise to reduce or outright refuse to contribute to NATO funding, which the U.S. government already paying for majority of it. This will directly cost the European for higher defence spending.

Asian markets showed predominantly positive performance. Japan's Nikkei 225 posted a strong gain of 3.80% to 39,500.15. Chinese markets also showed significant strength, with Hong Kong's Hang Seng Index rising 1.08% to close at 20,728.20. The Shanghai Composite in mainland China posted the strongest gain among all indices, surging 5.51% to 3,452.30. This is opposite of what Asian market should expect in the face of Trump victory whom started the U.S.-China Trade war, but it is undergoing a massive stimulus injection by the Chinese government to support its stagnated economy.

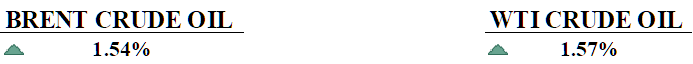

CRUDE OIL PERFORMANCE

Oil prices wrapped up a choppy week with Brent and WTI crude managing a modest 1.5% gain, even after Friday's sharp drop to around $74 per barrel. Crude markets rode a roller coaster as Hurricane Rafael initially spooked traders by shutting down over 22% of Gulf of Mexico production, though those fears quickly faded as the storm's path shifted. China grabbed the spotlight late in the week when its $1.4 trillion stimulus package fell flat with investors who wanted to see more direct support for the struggling property sector and consumer spending. The market got even more anxious from news that Chinese oil imports fell for the sixth straight month in October. Trump's upcoming presidency added another layer to the mix, with traders betting his promised tough stance on Iran and Venezuela could squeeze global oil supply. U.S. refineries emerged as a bright spot, running at over 90% capacity and showing healthy appetite for gasoline and diesel, which helped keep prices from falling further.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. consumer sentiment rose to a seven-month high in early November, with the University of Michigan's Consumer Sentiment Index reaching 73.0. The expectations index climbed nearly 6% to 78.5, while year-ahead inflation expectations dipped to 2.6%, the lowest since December 2020.

Unemployment claims ticked slightly higher last week, with strikes and hurricanes impacting October job growth, yet November is expected to rebound. Meanwhile, unit labour costs increased in Q3, keeping inflation concerns alive.

What Can We Expect from The Market This Week

US CPI October: headline inflation slowed to 2.4% in September, while core inflation rose unexpectedly to 3.3%, both higher than projection. Month-on-month, both headline and core inflation grew steadily, each increasing by 0.2% and 0.3%, respectively.

German CPI October: Germany’s harmonised inflation rose to 2.4% in October, exceeding the ECB's 2% target, with core inflation also increasing to 2.9%. Analysts predict that inflation will stay high because of growing wages and waning positive energy effects, even though the economy barely avoided a technical recession.

Japan GDP Q3: Japan's economy is likely to slow sharply in Q3, with GDP forecast to rise just 0.7% as consumption and capital spending lagged given high living costs. Economists expect minimal growth in private consumption and a slight dip in capital expenditure, which, along with global economic pressures, may complicate the BoJ's plans for rate hikes.

UK GDP Q3: The UK’s GDP grew by 0.7% in Q1 and 0.5% in Q2 after being in technical recession at the end of 2023. The IMF recently raised its UK growth forecast for 2024 to only 1.1%, which it already has surpassed, while consensus for Q3 stands at 0.2%.

US Retail Sales: consumer spending is expected to have a healthy growth rate in October at 0.3%, slightly below the 0.4% printed in September. Strong sales, along with this week's inflation data, might influence the dollar's direction, as they could lead the Fed to delay any rate cuts.