PAST WEEK'S NEWS (October 06 – October 10)

In a surprising development, Israel and Hamas have both agreed to the first phase of President Donald Trump’s 20-point peace framework in Sharm el-Sheikh, Egypt, marking the most significant breakthrough in the two-year war that has massacred over 67,000 Palestinians and displaced more than two million Gaza residents. The ceasefire requires Hamas to release 20 Israeli hostages within days in exchange for over 1,000 Palestinian captives, while Israeli troops begin withdrawing from Gaza within 24 hours. The landmark deal followed three days of intense negotiations involving Qatar’s Prime Minister Sheikh Mohammed bin Abdulrahman Al Thani, Trump’s envoy Steve Witkoff, and Jared Kushner. It marks the third ceasefire attempt since Hamas’s October 7, 2023 escalation that resulted in 1,200 Israelis dead and 251 hostages captured. Questions still remain with regard to Hamas’s disarmament, Gaza’s post-war governance, and the Palestinian statehood opposed by Netanyahu. Trump’s broader vision calls for a U.S.-led reconstruction plan, an Arab-Muslim security force, and a governing body cautiously welcomed by global leaders who continue to stress the need for a lasting two-state solution.

Sanae Takaichi’s meteoric rise to Japan’s premiership has sent markets into a frenzy, with investors betting on a revival of "Abenomics" policies since Shinzo Abe is considered a mentor to her. Japanese stocks shot up to record highs, while the yen fell below the 150-per-dollar threshold, showing growing optimism over fiscal stimulus and tax cuts, though analysts warn the currency remains vulnerable given the tightening circumstances of Bank of Japan. Unlike Abe’s deflationary era, Takaichi faces today’s inflationary pressures, a staggering 216% debt-to-GDP ratio, and a central bank shifting from easing to rate hikes, narrowing room for bold moves. The Nikkei’s recent 5% surge hints at market enthusiasm, but bond yields hit 17-year highs as investors fret over Japan’s fiscal health and the BOJ’s decision. While some see Takaichi as a fresh departure from recent "business-as-usual" leadership, others fear that her dovish stance clashes with inflationary realities, risking a repeat of past monetary policy missteps.

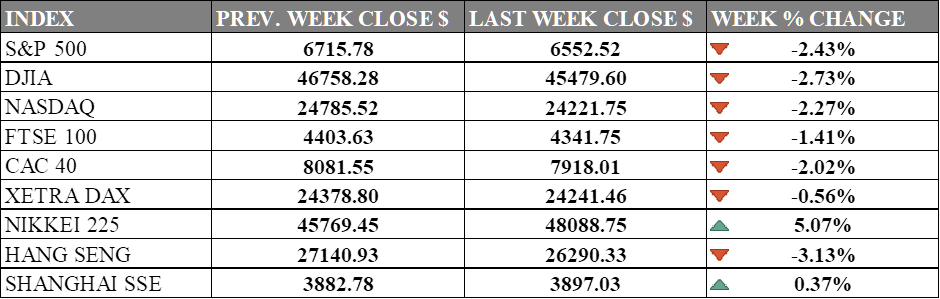

INDICES PERFORMANCE

Wall Street's major indices were exposed to high volatility last Friday, marking a notable decline this week as markets pulled back higher highs. The S&P 500 fell 2.43% to 6,552.52, while the Dow Jones Industrial Average dropped 2.73% to 45,479.60. The Nasdaq declined 2.27% to 24,221.75, with technology stocks retreating as investors reduced risk exposure following China new export tariff on its rare earth mineral with strong response from its American counterpart.

European markets also posted losses, though declines were more moderate than in the US. The UK's FTSE 100 fell 1.41% to 4,341.75, while France's CAC 40 declined 2.02% to 7,918.01. Germany's XETRA DAX showed relative resilience, edging down just 0.56% to 24,241.46, outperforming its regional peers as investors assessed economic conditions across the continent.

Asian markets especially Japan paint a different picture. Japan's Nikkei 225 jumped 5.07% to 48,088.75, posting strong gains supported by expected easing policy due to political shift. Hong Kong's Hang Seng Index fell 3.13% to 26,290.33, extending losses amid ongoing concerns over the regional economic outlook and risk sentiment. China's Shanghai Composite bucked the negative trend with a modest gain of 0.37% to 3,897.03, showing stability despite broader regional weakness.

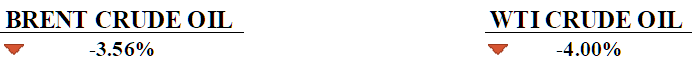

CRUDE OIL PERFORMANCE

Crude oil benchmark fall on the week with most of the losses happen on Friday, hitting a five-month low after President Trump’s threat of a “massive increase” in tariffs on Chinese goods reignited fears of a trade war that could worsen global economic growth and oil demand, though easing Middle East tensions reduced the risk premium on prices. Market bears were further empowered by rising output from OPEC+ and non-OPEC producers, including Saudi Arabia’s decision to hold November crude prices steady, signaling weak demand. Despite a modest decline in US oil rigs to 418, US crude production hit record highs, and Iraq is set to resume Kurdish oil exports, potentially adding 500,000 barrels per day to global supply. Meanwhile, Ukrainian drone attacks on Russian refineries have limited Russia’s export capacity, and crude stored on tankers fell by 7%. without a clear bullish catalyst, crude remains vulnerable to volatility near the $60 level..

OTHER IMPORTANT MACRO DATA AND EVENTS

Germany’s industrial output down 4.3% month-on-month, the sharpest drop since 2022 as car production nosedived and U.S. tariff frontloading fizzled, plunging the economy into deeper recession fears.

The World Bank's rosy 2025 growth forecast for MENAAP region, boosted by Gulf oil rebound and non-oil sectors gets a reality check with Iran's economy tanking under sanctions and war, while regional chaos from Syria to Gaza drags everyone down.

What Can We Expect from The Market This Week

US CPI September: Headline inflation accelerated to 2.9% annually in August 2025, up from 2.7% in July, the highest rate of increase since January and slightly above expectations. The monthly increase of 0.4% was driven primarily by higher energy and housing costs.

Eurozone CPI: Eurozone preliminary annual inflation increased to 2.2% in September, rising from 2.0% in August. The uptick reflects broad-based price pressures across the 20-nation currency bloc, moving slightly above the European Central Bank's target and reinforcing sentiment for cautious monetary policy.

US Retail Sales: Consumer spending grew 0.6% month-over-month in August, matching July's revised gain in a 3-month rally streak, with annual growth reaching 4.8%. This strong performance was likely supported by back-to-school shopping and steady consumer spending, even with valid concerns lingering.

Philadelphia Fed Manufacturing Index: Philly Fed Manufacturing Index shot up to 23.2 from August's -0.3 reading, marking the highest level since January, though not unusual. The dramatic boost exceeded forecasts of 1.7 and suggests a recovery in regional manufacturing activity, with both new orders and employment components showing healthy growth.

German CPI: German inflation grew to 2.4% annually in September preliminary data, up from 2.2% in August. The increase was backed by higher energy and services costs, with core inflation also rising.