PAST WEEK'S NEWS (November 11 – November 15, 2024)

Fed Chair Jerome Powell laid out his views on interest rates during a Federal Reserve event in Dallas on Thursday, making it clear that rate cuts won't come down as fast as some hoped. The Fed chief pointed to strong economic growth and declining inflation in its projection as key reasons to stay patient. The job market remains solid, with unemployment at 4.1%, while the economy keeps growing at a healthy 2.5% pace, ensuring Powell and his team have breathing room to take their time with any rate decisions. Recent data shows inflation staying stuck around 2.8% when looking at core prices, suggesting the Fed's work isn't done yet. Markets are now betting rates might stay higher for longer, with predictions showing them possibly landing around 3.9% by 2026 instead of the earlier 2.9% estimate. The incoming Trump presidency adds another layer to the cake, with proposed policies on tariffs and immigration that could affect both growth and inflation in ways the Fed will need to carefully consider.

The latest inflation numbers are hawkish, yet expectations are going the opposite way. Price inflation grew 2.6% compared to last year, up from 2.4% last month and marking the first expansion since March. Wall Street seems unfazed, but instead betting on the opposite, as evidenced by an 82% chance the Federal Reserve will cut rates at their December meeting, up from 60% before the inflation report came out. The Fed started to easing in September 2024 by lowering rates for the first time in four years, and the market expects this trend to continue into 2025. Looking at historical patterns, some analysts worry the Fed didn't keep rates high enough or long enough to fully tame inflation, although previous inflation struggles required pretty much the same rates. While the Fed aims for 2% inflation, their recent shift to rate cuts could reverse this, with the full effects of easier money likely showing up in late 2025 and really kicking in during 2026. Fed Chair Powell has made it clear that deflation isn't on the table, suggesting we're more likely to see continued price growth than any meaningful improvements in the cost of living.

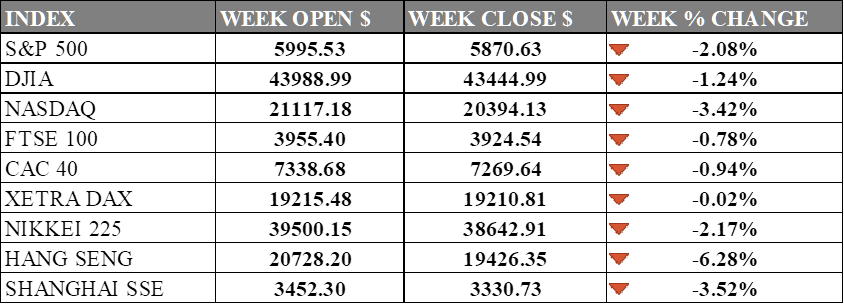

INDICES PERFORMANCE

Wall Street experienced a broadly negative week across major indices. The S&P 500 fell 2.08% to close at 5,870.63. The Dow Jones Industrial Average declined 1.24%, finishing at 43,444.99, while the tech-heavy Nasdaq led the losses with a sharp 3.42% decrease to close at 20,394.13. The market decline reflects growing concerns about persistent inflation and the possibility of delayed interest rate cuts by the Federal Reserve.

European markets also faced downward pressure across the board. The UK's FTSE 100 dropped 0.78%, closing at 3,924.54. France's CAC 40 fell 0.94%, closing at 7,269.64. Germany's XETRA DAX showed minimal change, dropping just 0.02% to end at 19,210.81. The European markets' decline aligns with global market sentiment and ongoing concerns about regional economic growth and monetary policy.

Asian markets showed particularly weak performance. Japan's Nikkei 225 posted a significant loss of 2.17% to close at 38,642.91, tracking weakness in American tech companies. Chinese markets showed even greater weakness, with Hong Kong's Hang Seng Index plunging 6.28% to close at 19,426.35. The Shanghai Composite in mainland China also posted substantial losses, falling 3.52% to 3,330.73. The sharp declines in Asian markets reflect ongoing concerns about China's property sector, deflationary pressures, and broader economic challenges in the region.

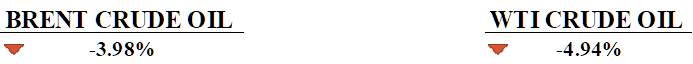

CRUDE OIL PERFORMANCE

Oil prices slumped again this week as China's refining sector posted its seventh consecutive month of declining demand, with October processing rates dropping 4.6% despite the International Energy Agency's optimistic revision of global demand growth forecasts. Brent crude dipped to $71 while WTI traded at $66.90, pressured further by a surprising 2.1-million-barrel build in U.S. crude inventories, even as gasoline stocks fell by 4.4 million barrels. Adding to the bearish sentiment, Russian refineries have begun reducing operations and some are considering shutdowns after mounting losses from export restrictions, sanctions, and Ukrainian drone attacks, with at least three facilities already suspending or cutting crude processing. The market's losses are only limited by OPEC's bullish 2024 demand projection of 1.82 million barrels per day growth, significantly higher than the IEA's conservative estimate of 920,000 barrels per day. Major U.S. oil companies, including Chevron and ExxonMobil, continue to prioritize capital discipline and shareholder returns over aggressive production growth, with Chevron's CEO noting that Permian Basin capital expenditure will likely peak this year. The strengthening U.S. dollar following Trump's election victory has further dampened crude oil demand in international markets by making dollar-denominated commodities more expensive for foreign buyers.

OTHER IMPORTANT MACRO DATA AND EVENTS

Japan’s GDP grew 0.9% year-on-year in Q3, beating estimates but slowed from 2.2% in Q2, with private consumption driving growth as weakness spotted in exports and external demand. Inflation cooled, and the data raised questions about the Bank of Japan's ability to hike rates further in midst of economic and political risk.

US producer prices rose 2.4% in October, higher than September’s 1.9% and above forecasts of 2.3%. Core prices, excluding food and energy, increased 3.1% year-over-year, aligning with estimates.

What Can We Expect from The Market This Week

G20 Summit: Brazil's Rio de Janeiro takes centre stage as G20 leaders gather for a high-stakes summit focused on fighting poverty and securing ambitious climate finance commitments, with the host nation championing a new "Global Alliance against Hunger and Poverty" initiative.

UK CPI October: UK inflation is expected to spike to 2.2% in October, driven by higher energy prices after the 10% increment of the Ofgem price cap on domestic energy prices, with the Bank of England focusing on rising services inflation, which may influence the pace of future rate cuts.

Canada CPI October: Canada's inflation rate fell to 1.6% in September, below the 2% target, prompting the Bank of Canada to cut rates by 50 basis points to 3.75%. The central bank aims to sustain low inflation while carefully balancing rate cuts to avoid throttling economic growth further, with consensus for October standing at 1.9%, a healthy growth rate.

Philadelphia Fed Manufacturing Index: The index shot up to 10.3 in October from mere 1.7 in September, possibly due to increased new orders, improved supply chain conditions, and a positive outlook among manufacturers. This growth reflects a broader economic recovery, with heightened demand leading to greater production and employment in the sector.

UK Retail Sales: Total sales as reported by BRC in the Kingdom slowed to 0.6% in October as shoppers delayed spending ahead of Black Friday and due to a later school half-term. Non-food sales fell slightly, with mild weather curbing winter clothing purchases, while essential spending saw its steepest drop since April 2020.