PAST WEEK'S NEWS (December 09 – December 13, 2024)

The consumer inflation came in as expected, but the future seems to be getting more complicated. The latest CPI stands higher at 2.7%, raising alarm for reinflation. Wall Street seems certain—with a 98% probability—that the Federal Reserve will cut interest rates at their upcoming December 18th meeting. What's fascinating is that even with these economic stresses, American households are showing unsettling optimism, reporting the most positive financial outlook in nearly five years, according to the New York Fed's recent survey. The Fed aims to support employment while trying to cool down inflation without triggering a recession. This could be the last rate cut we see until there is a clearer reason to adjust, with markets now expecting a pause in January.

The U.S. security market has experienced a mix of recession fears and periods of euphoric relief. Many predicted a market crash after the yield curve inversion began in April 2022. In a sense, they were right because the main equity index corrected 23% since then but ended in October 2022 and climbed 74% right after. A key factor supporting the market has been the Federal Reserve’s reverse repurchase agreement (RRP), which acts as a liquidity reserve. The RRP balance peaked in December 2022 and has since been gradually declining, with some attributing the market’s strength to this liquidity tool. Projections suggest the RRP will be exhausted early next year, pressuring the Fed to tread carefully when reducing its balance sheet in its easing phase.

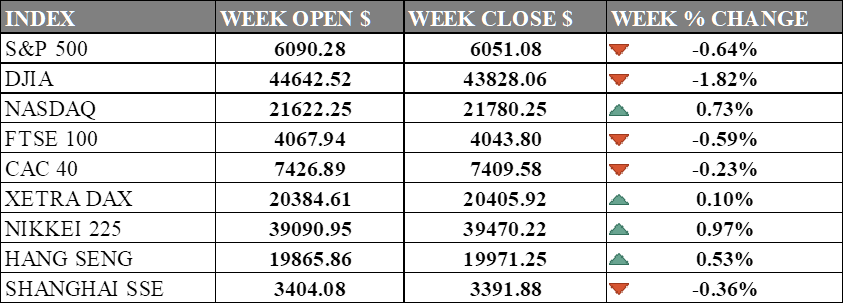

INDICES PERFORMANCE

Wall Street ended mixed in a broadly negative week across major indices. The S&P 500 declined 0.64% to close at 6,051.08. The Dow Jones Industrial Average fell significantly, dropping 1.82% to finish at 43,828.06, while the Nasdaq showed resilience with a 0.73% increase to close at 21,780.25. The market performance reflects certain confidence pertaining to interest rates cut that favour big tech compared to another sector.

European markets see modest pullback after a strong week. The UK's FTSE 100 down 0.59%, closing at 4,043.80. France's CAC 40 saw a slight drop of 0.23%, closing at 7,409.58. Germany's XETRA DAX showed a marginal gain, rising 0.10% to end at 20,405.92. The performance in European markets suggests cautious investor approach and mixed economic signals as interest rate path in the region continues to be in question.

Asian markets had a mixed performance. Japan's Nikkei 225 rose 0.97% to close at 39,470.22, showing moderate market strength after a strong tech gain in U.S. market. Chinese markets were mixed, with Hong Kong's Hang Seng Index rising 0.53% to close at 19,971.25. The Shanghai Composite in mainland China ended in a slight decline, dropping 0.36% to 3,391.88. The performance in Asian markets reflects the challenges in navigating its trade dynamics with the west, especially with the incoming trump administration.

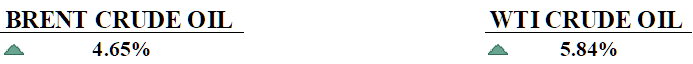

CRUDE OIL PERFORMANCE

Oil markets ended higher for the week with geopolitics tension becoming more blatant. The U.S. is considering new sanctions against Russia and Iran, which could further aggravated both oil producer to ramp up supply. Treasury Secretary Janet Yellen recently highlighted that the current oil market looks well-supplied, with relatively low prices and weakened global demand—potentially creating a strategic window for policy manoeuvres. China's oil consumption has officially peaked in 2023 in a report by CNPC, with refined oil consumption expected to decline by 1.3% in 2024 due to the rapid rise of electric vehicles and alternative fuel technologies. The International Energy Agency predicts a market surplus next year, with production growth in countries like Guyana, Brazil, and the United States, adding an approximately 1.5 million barrels per day to global supply, expecting OPEC+ cuts that is still in place to not be enough.

OTHER IMPORTANT MACRO DATA AND EVENTS

Britain's economy contracted for the second consecutive month in October, with GDP shrinking by 0.1% following weak manufacturing, construction, and services sectors, marking the first back-to-back declines since the COVID-19 lockdowns in 2020. The downturn, driven partly by anticipation of the Labour government's tax-heavy budget, though growth is expected to rebound in 2025.

U.S. consumer prices read 0.3% growth in November, the largest gain in seven months, with core inflation stuck at 0.3% for the fourth consecutive month, flinting concern toward the breakaway from Federal Reserve's 2% target. Slower rent increases offered some relief, but reinflation and labour market concerns keep future rate cuts uncertain.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: The FOMC is likely to cut interest rates to 4.25%-4.5% this week in what could be the last rate cut for a while with a target of 3.25% at the end of 2025, though the decision will depend on upcoming economic data.

BoE Interest Rate Decision: The Bank of England is estimated to pause its rate at 4.75%, diverging from other major central banks like the ECB and the Fed, which are continuously cutting rates. Investors anticipate only gradual rate cuts by the BoE through 2025.

BoJ Interest Rate Decision: The Bank of Japan is likely to keep the status quo, granting more time to assess overseas risks and next year’s wage outlook, though this increases the likelihood of a rate hike in January or March.

PBoC Loan Prime Rate: The People's Bank of China reported weaker credit growth in November, with new yuan loans totalling 580 billion yuan, significantly below the forecast of 990 billion yuan. Weak private sector demand despite aggressive monetary easing measures may push for further cuts in the PBOC’s key policy rates to stimulate lending and support economic recovery.

US PCE Price Index: Personal consumption excluding food and energy remained within expectation at 0.3%, suggesting stability in U.S. inflation trends and consumer purchasing power. While Wall Street sees a lower growth in the core PCE rate, it does not affect the projection for the Federal Reserve to cut interest rates in December.