PAST WEEK'S NEWS (October 07 – October 11, 2024)

US employment data released last week showed strong growth with 254,000 jobs added compared to the weak forecast of 147,000, possibly triggering a selloff in the bond market. The Treasury yields reached above 4% as a result, levels not seen since August. The 10-year Treasury yield is sitting at 4.03%, while the 2-year yield reached 4.02%, a rather dramatic shift in market sentiment as traders now see less than 50 basis points of rate reductions through year-end. The latest CPI report, on the other hand, shows headline inflation dropped to 2.4% while core inflation rose to 3.3%, leading markets to expect two 0.25% Fed rate cuts by year-end with 88% odds for the November cut. Investors are rapidly scaling back their expectations for aggressive Federal Reserve rate cuts in fear of reinflation.

Goldman Sachs has raised its forecast for China's economic growth, projecting 4.9% GDP expansion in 2024 and 4.7% in 2025. This revision follows China's recent pro-growth measures, including a pledge to use 2.3 trillion yuan of local government special bond funds in Q4 2023. The National Development and Reform Commission announced plans to preapprove 200 billion yuan of next year's projects by October's end, aiming to boost near-term construction. Despite the upgraded forecast, Goldman Sachs analysts warn of ongoing structural challenges, including demographics, debt deleveraging, and global supply chain de-risking. China's stimulus is expected to positively impact emerging market equities due to the country's significant weight in benchmark indices. Veteran investor Mark Mobius suggests this could lead to increased foreign capital inflows to Chinese markets, consequently accelerating emerging markets' outperformance against U.S. stocks.

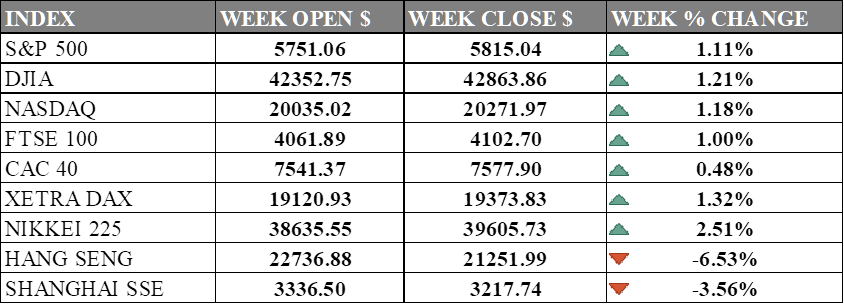

INDICES PERFORMANCE

Wall Street recorded solid gains this week, with all major US indices showing notable upticks. The S&P 500 rose 1.11% to close at 5,815.04. The Dow Jones Industrial Average saw a healthy increase of 1.21%, finishing at 42,863.86, while the tech-heavy Nasdaq climbed 1.18% to close at 20,271.97. These significant market gains suggest improved investor sentiment across various sectors, possibly reflecting optimism about future economic conditions and potential rate cuts.

European markets also experienced positive movements, albeit to varying degrees. The UK's FTSE 100 gained 1.00%, closing at 4,102.70. France's CAC 40 saw a modest 0.48% increase, closing at 7,577.90. Germany's DAX outperformed its European counterparts, rising 1.32% to end at 19,373.83. These gains indicate a generally positive week for European markets, aligning more closely with the performance of US indices.

Asian markets presented a mixed picture, with stark divergences between different regions. Japan's Nikkei 225 saw a considerable increase, rising 2.51% to 39,605.73. However, Chinese markets showed significant weakness, with Hong Kong's Hang Seng Index posting a substantial loss of 6.53%, closing at 21,251.99. The Shanghai Composite in mainland China also experienced a notable decline, falling 3.56% to close at 3,217.74. These contrasting movements suggest diverging economic outlooks and investor sentiments across Asian markets, with Japanese markets showing strength while Chinese markets faced significant headwinds.

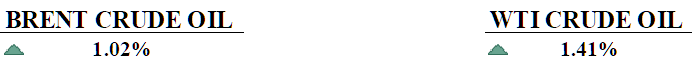

CRUDE OIL PERFORMANCE

Crude oil prices started the week with a decline, driven by bearish news from China regarding oil demand. September's consumer price inflation in China rose by only 0.4%, missing the 0.6% forecast, signaling weak demand. While lower inflation usually supports consumption, traders interpreted the slow price growth as a sign of weakening demand. Despite China's announcement of new economic stimulus measures, the lack of details left markets unimpressed. Oil traders remained skeptical, focusing on China's demand outlook instead of Middle Eastern developments. Additionally, the U.S. expanded sanctions against Iran, targeting its oil tanker fleet.

OTHER IMPORTANT MACRO DATA AND EVENTS

China consumer inflation slowed to 0.4% in September, falling short of expectations, while producer prices dropped by 2.8%, signalling weak domestic demand and economic strain. Despite recent monetary stimulus, calls for more targeted fiscal measures continue as inflation trends highlight the need for further economic support.

U.S. producer prices remained flat in September as rising service costs were balanced by lower goods prices, supporting a positive inflation outlook and the possibility of another interest rate cut by the Federal Reserve next month. While consumer prices slightly exceeded expectations, underlying inflation trends appear to be moderating, with core PCE inflation expected to slow further.

What Can We Expect from The Market This Week

ECB Interest Rate Decision: The European Central Bank is expected to cut interest rates on Thursday due to worsening economic conditions and a sharp drop in inflation, with markets pricing in a quarter-point rate cut in October and another in December. Contracting activity in the eurozone was cited, although some policymakers advocate for a gradual approach to easing.

US Retail Sales: The retail industry is seeing trouble ahead, with Halloween spending expected to drop by 5% to $11.6 billion, adding to the struggles of heavily indebted retailers battling high operational costs and changing consumer behaviour. This economic environment has led to several high-profile bankruptcies and a trend of retailers turning to bankruptcy.

UK CPI September: Inflation is expected to fall below the Bank of England’s 2 percent target for September, with forecasts ranging from 1.7 to 1.9 percent, primarily due to falling fuel prices. However, economists predict inflation will rise again later in the year, mainly from factors like increasing fuel costs and potential tax hikes.

China GDP Q3: After its market took a break last week from a 50% rally from its low, this data will come into focus as Goldman Sachs has raised China's GDP forecast for 2024 to 4.9% from 4.7%, citing the government's latest stimulus measures. While China's economy faced challenges in the third quarter of 2023, economists expect it to pick up pace in the fourth quarter, potentially achieving its annual growth target of around 5% for 2023.

Eurozone CPI September: Eurozone inflation expected to slide to 1.8% in September according to Eurostat's flash estimate, dropping below 2% for the first time since June 2021, while core inflation eased to a two-year low of 2.7%. This combination of weakening economy and lower inflation has increased the likelihood of a more rapid rate-cutting cycle by the ECB, though rising energy prices could present upside risks to inflation.