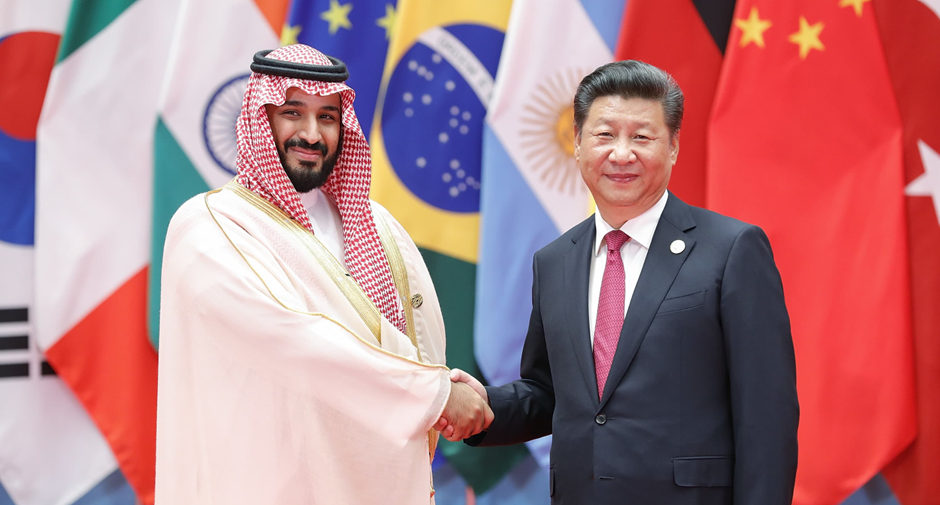

BRICS(audi Arabia). Next week, Chinese entrepreneurs and investors will be attending the 10th Arab-China Business Conference in Riyadh, Saudi Arabia. The event comes after Chinese President Xi Jinping's visit to the country and is seen as a sign of warming diplomatic relations and growing economic ties between the two countries. The conference will feature high-level speakers and provide a platform for business matchmaking and networking. It is a chance for both countries to benefit from each other's strengths and build a stronger relationship for the future. China's interest in the BRICS could be a bargaining chip to secure some power in the region, as Middle Eastern countries expressed their interest in joining the economic coalition.

EQUITY

U.S. stocks closed higher as technology stocks rebounded, and the VIX dropped to a record low. Investors were cautious ahead of upcoming inflation data, the Fed meeting with bets on a pause, and Treasury General Account (TGA) refill all happening next week. The liquidity drain narrative does not hold as investors expect the Treasury to sell T-bills that will be bought by money market funds using returned money from unwinding reverse repos (RRP) agreements, creating zero-sum changes in the M2 money supply.

GOLD

Gold gained on Thursday as the dollar weakened amid expectations of a rate pause as weekly US jobless claims surged. The drop in the dollar and easing Treasury yields benefited metal markets priced in the greenback. However, gold's medium- to long-term outlook remains uncertain due to the anticipation of higher US interest rates throughout the year.

OIL

Oil prices in Asian trade extended their decline as a result of weakening demand, further exacerbated by disappointing inflation data and a string of lacklustre economic indicators from China. Despite a production cut by Saudi Arabia, fears of slowing demand overshadowed signs of tighter supply. Soft economic indicators in the United States, including rising gasoline stockpiles and signs of an economic slowdown, further dampened crude markets.

CURRENCY

The U.S. dollar weakened after jobless claims exceeded consensus while investors awaited key inflation data and the Fed's interest rate decision. The surge in Americans filing for unemployment benefits to the highest level in over a year and a half may limit the ability of the Federal Reserve to continue raising rates despite high inflation pressures. Asian currencies are also declining due to China's weaker inflation.