INTRADAY TECHNICAL ANALYSIS APRIL 18th (observation as of 07:00 UTC)

[EURUSD]

Important Levels to Watch for:

- Resistance line of 1.10003

- Support line of 1.09363

Commentary/ Reason:

1. The price slides after a hawkish fed boosting the greenback although retail data were reported lower than expected showing slowing economy.

2. The Euro losing ground on Monday after higher bond yields and higher probability of fed bets for quarter point hike in May.

3. Building permits from the US will come in focus today as main driver of volatility and price changes.

4. The price is expected to trade in wide range on the upside until US macro data either push it further or increase the price to resistance at 1.10003 or higher.

5. If the price break below 1.09363, expect the price to go lower at 1.09102 where a retest on those level will show weakness that will drag the price lower but has low probability.

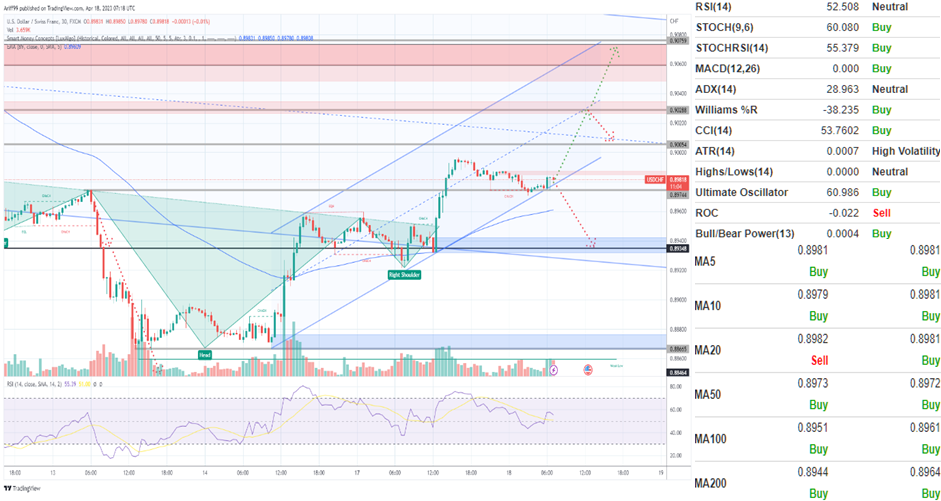

[USDCHF]

Important Levels to Watch for:

- Resistance line of 0.9005

- Support line of 0.8974

Commentary/ Reason:

1. The pair have been in strong move to the upside after rebounded at support 0.8866.

2. The price formed a reverse head and shoulder, breaking the limit in a strong move that saw a higher low and higher high.

3. There will not be any significant macro data from the Swiss, but US Building permits is expected to be the catalyst.

4. The price is expected to move higher to resistance 0.9005 and higher.

5. If the price break below support at 0.89744, the parallel range becomes invalid and the price could move lower to 0.8934.

[USDJPY]

Important Levels to Watch for:

- Resistance line of 134.605

- Support line of 134.071

Commentary/ Reason:

1. The pair were previously appreciated to a strong uptrend but retraced. Now it is back on its initial pace.

2. The price is now retreating from its high to possibly testing its support to see where the seller would take profit.

3. The pair is also dependant on US macro data to determine its next direction in the short term as Yen has no significant macro data to be expected this week.

4. The price is expected to retraced back to support 134.071 and either break below or continue its uptrend to Fibonacci level 168% with low chance of success.

5. The price could break below support and go lower if the macro data from USD shows sign that will make market expect dovish fed.

[GBPUSD]

Important Levels to Watch for:

- Resistance line of 1.2493

- Support line of 1.2465

Commentary/ Reason:

1. The pair have been on strong rise after a major downtrend possibly by worsening macro data in the UK.

2. The price now is moving upward after the UK reported higher income.

3. The building permit from US is the only catalyst that can stop its growth.

4. The price is expected to continue going up until market participants start taking profit from their positions or if the US building permits data report unexpected figures.

5. The price is expected to test resistance 1.24419 but the momentum suggest that it can go beyond and re-enter its long-term suggested price channel range.