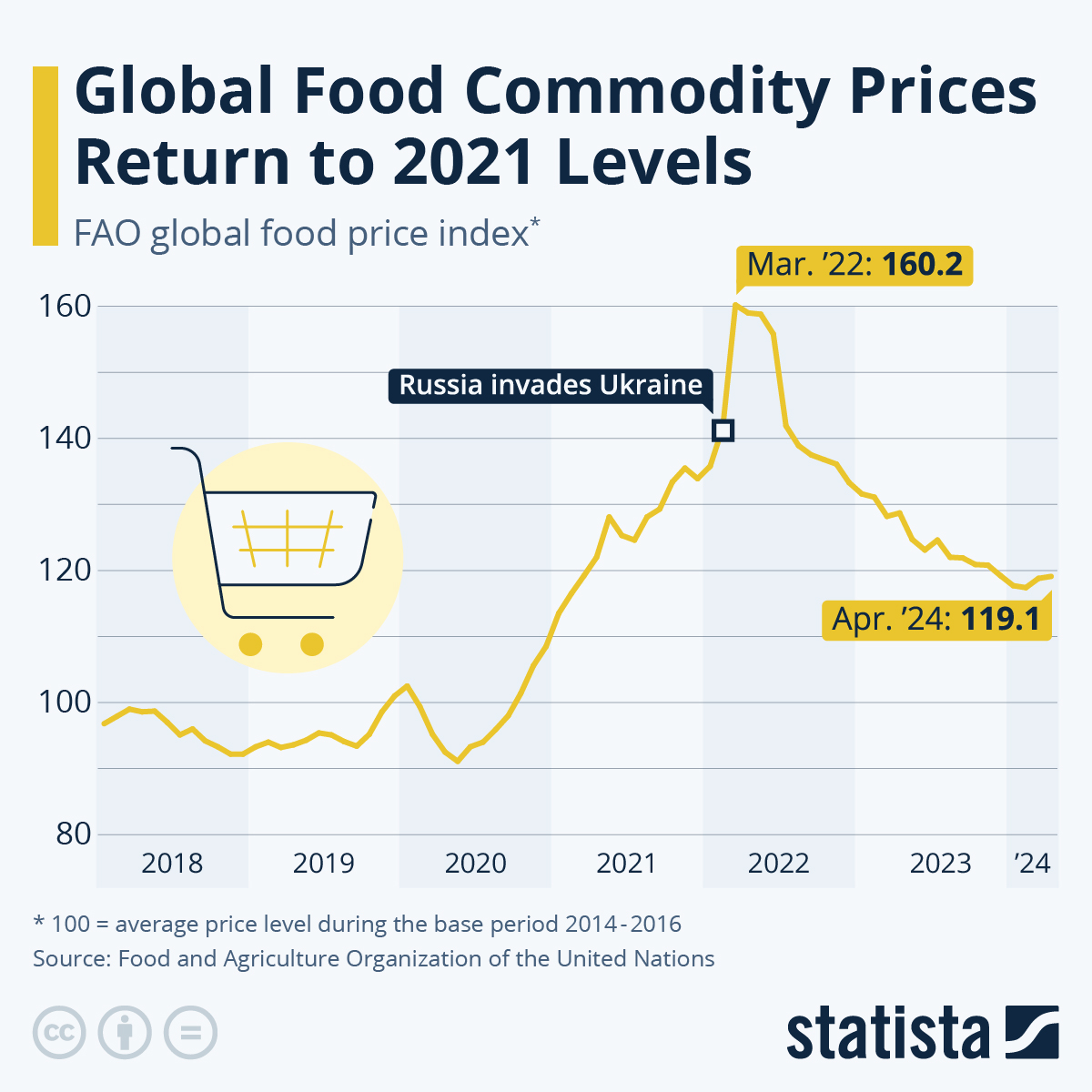

With global demand fully recovered, it's time to get back into the food commodities game. Every day, vast quantities of various foods, from wheat and coffee to cocoa and seafood, are harvested and consumed. Climate change and phenomena like El Niño further increase the potential for trading these commodities.

Global Outlook

Between August 2023 and February 2024, the IMF’s food and beverages price index rose by 6.0 %. However, commodity prices varied significantly: while cereals and vegetable oils dropped by 7.2% and 10.9%, tropical crops like cocoa and coffee surged by 64.2% and 18.2%, respectively.

Climate Change

The increasing global temperatures and extreme weather conditions have made food commodity prices more volatile. Events like storms that destroy crops and heatwaves that render farming areas unproductive create opportunities for traders to speculate on these price fluctuations. On the other hand, new technologies represent potential for short sellers.

One of the best-known effect is El Niño that alters Pacific jet streams, causing floods in East Africa, droughts in Southern Africa, and high temperatures in Southeast Asia, complicating farming and daily life.

Key Commodities

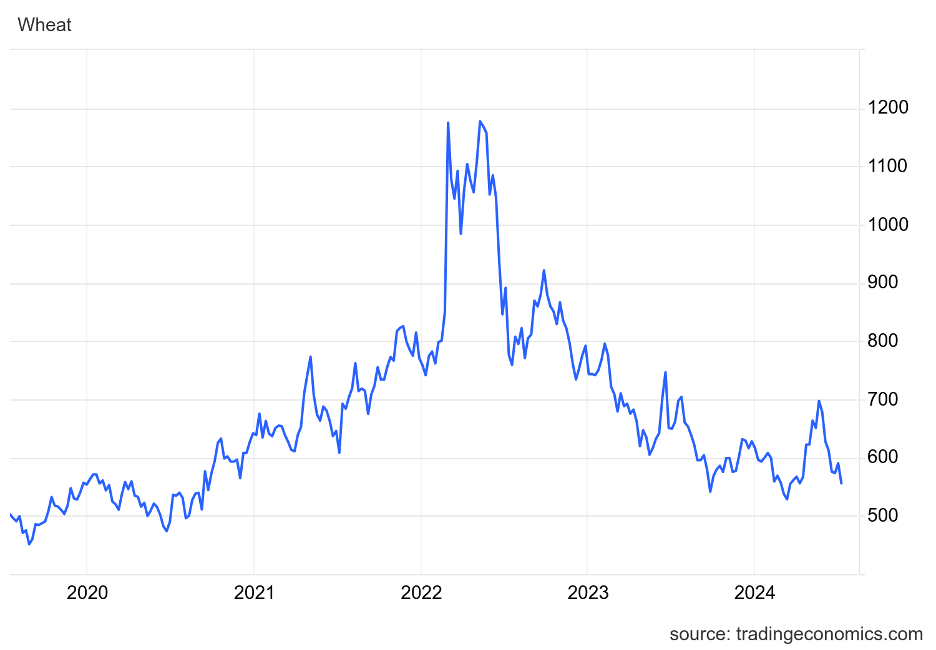

Wheat

Wheat is a highly traded agricultural commodity due to its essential role in global staple foods. Investors often take a long-term view, recognizing its critical importance in maintaining the global food supply and preventing famines. Demand for wheat has significantly increased in recent decades, further enhancing its market value. Considering the yearly price development, it is possible to see a bullish movement, but this was followed by an equally strong bearish movement. Although the price has not made a new low yet, but for the eventual continuation of the bullish trend, a short-term decline is likely to occur, which will create even more favorable buying conditions.

Coffee

Cultivated in over 50 countries with tropical and subtropical climates, coffee is greatly affected by climate change. The coffee trading market has a long history, with trade and consumption dating back to the 15th century in the Middle East. Global coffee consumption grew annually by about 2% before the pandemic, though prices have fluctuated significantly in recent decades. Looking at the development of the market price at the beginning of 2024, an impulsive upward trend is evident, namely up to 30%, and the price has the potential to head to the key price of $300, which it has already reached three times in its history.

Seafood

Seafood is a substantial but less well-known segment of the commodity market, comprising 43% of all food commodities by volume harvested. This category includes fish, crabs, octopuses, squids and many more. The largest seafood market is Europe also due to its high intra-traded volume, followed by the United States and Japan. Prices typically drop in summer and autumn when supply peaks.

Dried Fruit and Nuts

The dried fruit and nuts market has long been vital for producing biscuits, cakes, sweets, and … Nutella. However, demand is rising as consumer preferences shift toward healthier snacks and plant-based foods like alternative milks. This growing interest suggests increasing potential for these commodities in the future.

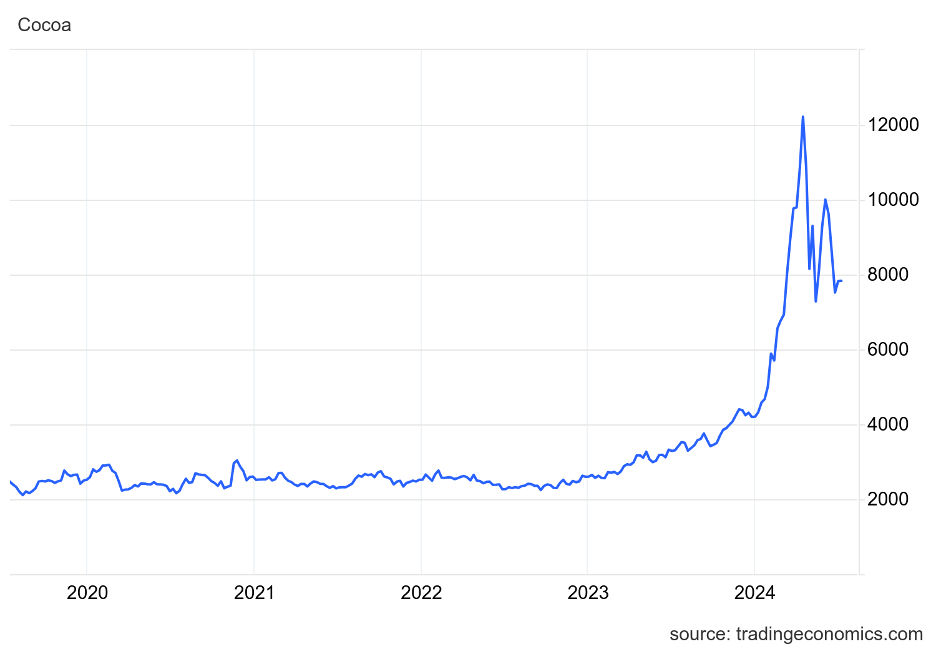

Cocoa

Cocoa is a volatile commodity influenced by various factors, primarily supply and demand dynamics. Cocoa beans are essential for chocolate production. Supply can be affected by weather conditions, pests, or plant diseases, while changes in consumer preferences for chocolate can influence demand. Of these key commodities, cocoa was the most successful. Since January 2024, the market price has increased by almost 200%. Since the top the price found at $12 000, a corrective movement has started to form, with cocoa currently trading at around $8 000.

Prepared by team of Golden Brokers analysts