PAST WEEK'S NEWS (MAY 15 - MAY 19, 2023)

During the G7 summit in Hiroshima, Ukraine's President Volodymyr Zelenskyy met with G7 leaders to discuss the ongoing war in Ukraine. Despite Russia claiming a victory in the battle for the city of Bakhmut, Zelenskyy later cast doubt on this claim. The G7 nations, including the United States, announced new military aid worth $375 million for Ukraine, which includes ammunition and armored vehicles. The leaders of the G7 also addressed global concerns such as climate change, poverty, economic instability, and nuclear proliferation. In addition, efforts were made to improve relations between South Korea and Japan. The G7 leaders vowed to intensify pressure on Russia through sanctions and expressed their desire for constructive relations with China while urging China to pressure Russia to end the war in Ukraine. They also warned North Korea to abandon its nuclear weapon ambitions. The G7 leaders discussed strengthening the global economy and addressing rising prices, particularly in developing countries, and aimed to offer an alternative financing program to China's investments.

Target ($TGT) has reported a staggering increase in theft losses this year, amounting to an additional $500 million compared to 2022. With losses of $650 million last year, this year's theft is projected to exceed $1 billion. This surge in retail theft has not been limited to Target, as Walmart also suffered losses of nearly $3 billion in 2022, potentially leading to higher prices for consumers. These escalating thefts have contributed to a significant decline in retailers in San Francisco, with theft and a lack of foot traffic being the primary reasons. Home prices in the city have also plummeted by almost 35% over the past year. The challenges faced by San Francisco continue in the post-pandemic era, as even major stores like Whole Foods have been forced to close due to concerns about worker safety and theft.

Recent data reveals a concerning trend as auto loan and credit card interest rates have soared to record highs. Credit card interest rates have reached an average of 25%, while used car loans carry an average interest rate of 14%, and new car loans stand at 9%. Simultaneously, the nation faces staggering levels of debt, with total household debt surpassing a daunting $17.1 trillion. Auto loans alone account for $1.6 trillion of this figure, while credit card debt amounts to a staggering $986 billion. Adding to this mounting burden is the imminent resumption of student loan payments, with an unprecedented $1.6 trillion in student loan debt. As the numbers continue to rise, the severity of the debt crisis becomes increasingly apparent.

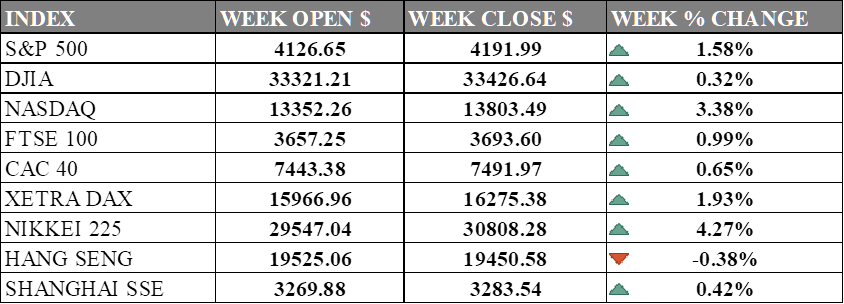

INDICES PERFORMANCE

The NIKKEI 225 had the highest percentage gain of 4.27%, followed by the NASDAQ with 3.38%. Both indices benefited from strong earnings reports from technology companies and optimism about the global economic recovery. The S&P 500 and the XETRA DAX also posted solid gains of 1.58% and 1.93%, respectively, as investors shrugged off inflation worries and focused on resilient market data.

The DJIA had a modest increase of 0.32%, as some blue-chip companies faced headwinds from rising costs and supply chain disruptions. The FTSE 100 and the CAC 40 rose by 0.99% and 0.65%, respectively, as European markets were boosted by progress in U.S. debt ceiling talks and upbeat economic forecasts from the EU commission.

The only index that declined was the HANG SENG, which fell by -0.38%, as investors were cautious about China's yuan reaching below key 7 level compared to USD and slowing industrial production. The SHANGHAI SSE had a slight increase of 0.42%, as some sectors such as consumer staples and health care outperformed.

Overall, the global stock market showed resilience and optimism in the face of easing pandemic restrictions, geopolitical tensions, and sticky inflation. However, some risks remain, such as the possibility of a U.S. debt default, a renewed banking crisis in Europe, or a further escalation of the Russia-Ukraine conflict.

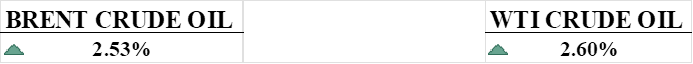

CRUDE OIL PERFORMANCE

Oil prices had a mixed week influenced by the U.S. debt crisis talks, with a slight decline on Friday but ending the week with a 2% gain, marking the first weekly increase in five weeks. Optimism surrounding the talks initially boosted prices, but the lack of progress dampened market sentiment. Weakening of the U.S. dollar provided some support, and traders remained cautious ahead of the weekend. Key levels to watch for WTI are around $71.55 as support and a potential push towards $73.80 for further upside momentum.

OTHER IMPORTANT MACRO DATA AND EVENTS

Last week, the major U.S. stock indexes experienced a breakout, with the NASDAQ outperforming the S&P 500 and the Dow for the fourth consecutive week. U.S. large-cap growth stocks continued to surpass their value counterparts, while the 10-year U.S. Treasury bond yield rebounded but remained below previous highs.

German stocks reached a record high, outperforming U.S. indexes, and concerns about inflation declined among corporate executives. Despite uncertainty, market volatility remained low, and U.S. retail sales showed a modest recovery. Investors are now focused on the release of the Federal Reserve's meeting minutes for insights into future rate hikes.

What Can We Expect from The Market This Week

German, UK, and US PMI: Across the board, each country's PMI, especially in manufacturing, has fallen below the 50-benchmark level except for the US, which is slowly declining. Supply chain disruptions are likely to intensify as geopolitical tensions arise from recent G7 meetings.

RBNZ Interest Rate: After a surprise 50 basis point hike in April, New Zealand is expected to see another quarter point hike as RBNZ faces a trade-off between high inflation and slowing growth.

IEA Crude Oil Inventories: The latest IEA report shows a build-up in global crude oil inventories. Demand is forecast to rise, but the recovery remains fragile with downside risks, even as both Brent and WTI recovered by 2%.

German and US GDP Q1: The market expects the German and US GDP for Q1 2023 to be weak, reflecting the slowdown in economic activity, although growth is still on the positive side.

US PCE Price Index: The market expects the PCE Price Index to rise by 4.2% year on year in April 2023, down from 5.1% in March 2023 which would ease expectations of another rise as inflation cools.