PAST WEEK'S NEWS (April 08 – April 11, 2024)

With growing narrative that there will be a shift towards a more dovish monetary policy, Federal Reserve President Mary Daly has emphasized the need for patience and caution in managing inflation. Despite stronger March inflation data, Daly asserted that the Fed will maintain its current stance "as long as necessary" to bring down inflation to the 2% target. Meanwhile, the European Central Bank (ECB) is growing increasingly confident in its fight against inflation, with policymaker Francois Villeroy de Galhau indicating a likely interest rate cut in June. However, the ECB cautioned against a return to "ultra-low, even negative rates," suggesting a more gradual and data-driven approach to monetary policy adjustments.

The German Finance Minister, Christian Lindner, is reportedly planning over 20 billion euros in tax relief to stimulate the economy, though a finance ministry spokesperson has stated these reports are speculative. The proposed measures include reducing the solidarity tax by 13 billion euros and allowing immediate write-offs for climate protection investments. Lindner had previously presented plans for 10 billion euros in tax relief to help families cope with inflation, but this faced controversy within the coalition government. The government is expected to follow up with additional relief packages to address rising energy costs, including increases to housing allowance and benefits.

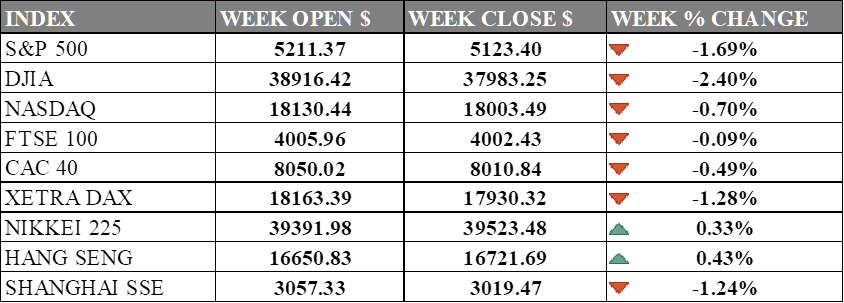

INDICES PERFORMANCE

The major U.S. stock indexes experienced a slight decline last week. The S&P 500 fell 1.69% to close at 5123.40, down from its open of 5211.37. The Dow Jones Industrial Average dropped 2.40% to finish at 37983.25 compared to its opening level of 38916.42. The tech-heavy Nasdaq declined 0.70% to 18003.49 after opening the week at 18130.44. indices fell primarily due to inflation concerns and disappointing corporate earnings. The market was also impacted by geopolitical tensions in middle east and uncertainty about the Federal Reserve’s policy direction.

In Europe, the major indexes also saw modest declines. The UK's FTSE 100 edged down 0.09% to close at 4002.43 compared to its open of 4005.96. Germany's XETRA DAX fell 1.28% to settle at 17930.32 from its starting point of 18163.39. France's CAC 40 lost 0.49% to end the week at 8010.84 after opening at 8050.02. Investors remained cautious on federal reserve rate path while weaker data dragged automakers like porsche.

Asian markets had a mixed performance. Japan's Nikkei 225 gained 0.33%, closing at 39523.48 versus its open of 39391.98 as tech stock track its U.S. counterpart. Hong Kong's Hang Seng saw a slight gain of 0.43% to finish at 16721.69 from its starting level of 16650.83. China's Shanghai Composite declined 1.24%, closing at 3019.47 compared to its open of 3057.33. Chinese stocks fell due to scaled-back bets on U.S. interest rate cuts amidst uncertain inflation outlook, alongside a stronger dollar and U.S. Treasury yields, impacting investor sentiment in broader Asian equities including China.

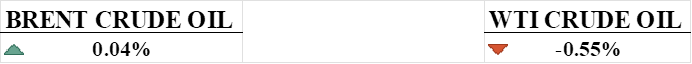

CRUDE OIL PERFORMANCE

The attack by Iran on Israel over the weekend has raised concerns of a wider regional conflict that could disrupt oil supply. However, the limited damage from the attack and Iran's indication that its retaliation is over have reduced the risk of a significant escalation, tempering the initial price rally. While the situation remains uncertain, ample spare production capacity from OPEC and the potential for further release of strategic reserves could help offset any supply disruptions, limiting further price gains. Analysts expect oil prices to trade in the $85-$90 per barrel range, with a potential for a sharper drop to the high $70s or low $80s if the conflict is contained. Only an extreme scenario of a prolonged direct conflict between Iran and Israel is seen as potentially pushing oil prices above $100 per barrel.

OTHER IMPORTANT MACRO DATA AND EVENTS

Britain's economy is showing signs of exiting a shallow recession, with GDP growing for a second month in February and January's data revised upwards, though the long-term outlook remains constrained by earlier interest rate hikes and supply-side issues.

China's inflation slowed unexpectedly in March, with producer prices continuing to decline, pressuring policymakers to provide more stimulus as weak demand and structural economic challenges take centre stage.

What Can We Expect from The Market This Week

US Retail Sales: The National Retail Federation forecasts a 2.5% to 3.5% increase in US retail sales for 2024, slightly slower than last year's growth of 3.6% and far from the current 1.5%. Despite challenges like rising credit costs and shifting consumer spending habits towards services, a strong job market and rising wages are expected to continue to lift household spending.

US Business Inventories: Inventory stagnated, contradicting predictions of a 0.2% increase, with retail stocks rising while those of wholesalers and manufacturers declined. The February report saw no change in business inventories, maintaining a 1.39 inventory-to-sales ratio.

UK Unemployment Rate: the figures unexpectedly increased to 3.9% in January 2024, up from 3.8% the previous month as the country entered a technical recession. This rise in unemployment was accompanied by a decline in annual average wage growth, dropping to 5.6% from 5.8%, as reported by the Office for National Statistics.

UK CPI March: report showed slight decreases in their annual rates compared to previous months, with downward contributions from food and restaurants, and upward contributions from housing and motor fuels. Core CPIH and core CPI, excluding energy, food, alcohol, and tobacco, also saw slight decreases.

US Initial Jobless Claims: A recent report suggests an increase in claims to a two-month high, although the overall job market remains fairly tight, with workers finding jobs even though layoffs have risen.