PAST WEEK'S NEWS (July 26 – Aug 1, 2021)

Flora Growth soared after the firm signed a non-binding letter of intent to create a joint venture, through which it will handle registration, sales and distribution of its products in Colombia, Mexico and other Latin American countries, while also signed a Letter of Intent with Evergreen Pharmaceuticals, an Australian importer and distributor of medical cannabis products, to supply its premium dried flower and derivative products. Hoegh LNG Partners nosedived after the company announced that it cut its quarterly distribution from $0.44 to $0.01 per unit.

Stocks Performance (U.S. Stocks)

The major indexes were mixed for the week. A slew of corporate earnings reports, economic data, a Fed latest policy decision, coronavirus headlines, and the regulatory-induced sell-off in Chinese equities markets made the last week of July the busiest one this summer. There was a lot of push and pull, with equities finishing slightly lower to where they started the week, although still near all-time highs.

While earnings reports drove moves in stocks—including several technology and internet-related giants—investors also appeared to keep a close eye on macroeconomic concerns. The fast spreading of the Delta variant of the coronavirus weighted sentiment after the CDC on Tuesday advised vaccinated individuals to wear masks indoors again in higher-transmission areas. China’s regulatory crackdown on mega-cap internet stocks over the last several months, and on the private education sector last week, also dragged the indices down.

From a sector perspective, advancing sectors were led by Non-Energy Minerals sector at 4.05%, followed by Consumer Durables at 2.62%, Energy Minerals (2.30%), and Process Industries at 1.82%. Meanwhile, Retail Trade fared worst to decline -4.34%, followed by Transportations at -2.13%, Health Services (-1.37%), and Technology Services sector (-1.22%).

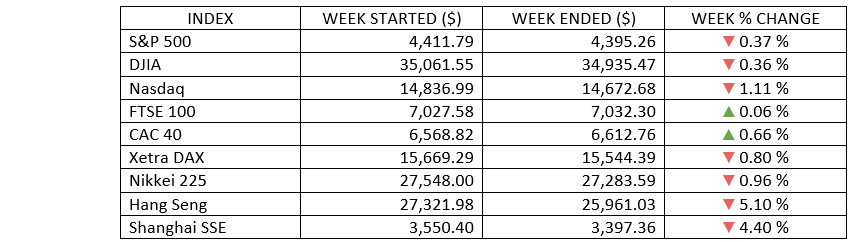

Indices Performance

Each of the major U.S. indexes ended the week in negative territory, after setting intraday and record highs at the start the week.

Shares in Europe were little changed. Optimism engendered by strong corporate earnings was offset by concerns about the spread of the Delta variant of the coronavirus and volatility spurred by sectors cracking down by the Chinese regulators.

Japan’s equity markets reopened Monday after a 4-day weekend to mark the start of the Tokyo Olympics. Its major stock benchmarks faced headwinds as COVID-19 cases in the country reached a record level and the government extended a state of emergency.

Chinese stocks slumped after a regulatory overhaul of the for-profit education sector unveiled July 24 proved to be much tougher than investors had expected, and fears of heightened government oversight spilled into Chinese technology, health care, and property stocks.

Oil Sector Performance

Oil prices posted solid gains for the week, buoyed by a decline in the U.S. fuel and crude stockpiles, adding to signs of a tightening market, outweighing worries about the consequences of surging COVID-19 cases.

The U.S. crude inventories fell by 4.1 million barrels in the week to July 23, lowest since January 2020, the U.S. EIA reported, helped by lower imports and a decline in weekly production. Gasoline stocks also dropped, bringing them largely in line with pre-pandemic levels.

Market-Moving News

Fluctuating Market

The major U.S. stock indexes modestly retreated from the previous week’s record highs. The S&P 500 and the Dow slipped less than half a percentage point and the NASDAQ slightly lagged its peers.

July's Modest Gains

Despite sustaining a midmonth decline, the S&P 500 recovered to record its sixth positive month in a row, rising more than 2% in July. The Dow and the NASDAQ were positive as well, but those two indexes lagged, as they added a little over 1%.

Small-Cap Reversal

After lagging large-cap peers by a wide margin through much of July, a U.S. small-cap benchmark posted a gain of nearly 1% in a week when large-cap indexes slipped. Despite the comeback, from June 11 through Friday’s close, the Russell 2000 Index has declined nearly 5%.

Worrying Factors

Although the latest quarterly earnings continued to provide some lift, U.S. stocks were held back by a myriad of factors. Among them: the continuing rise in Delta variant COVID-19 infections, a regulatory crackdown by Chinese authorities affecting some of that country’s fastest-growing technology companies, and expectations of more moderate growth ahead for big U.S. tech firms.

Upbeat Earnings

Earnings season continued to exceed expectations. Q2 profits at companies in the S&P 500 were expected to surge 85% as of Friday, based on companies that have reported so far and forecasts for upcoming reports, according to FactSet. That’s up from the 63% gain that had been forecast at the end of June. The 85% figure—if realized once earnings season concludes—would mark the highest year-over-year earnings growth since the fourth quarter of 2009.

Fed Rate Outlook

U.S. Federal Reserve Chairman Jerome Powell said that the central bank was nowhere near considering plans to raise interest rates. He said that an increase is not yet “on our radar screen” despite the economy’s continued progress toward the Fed’s goals of achieving low unemployment and stable inflation.

GDP Update

The government’s initial estimate showed that GDP expanded at a 6.5% annualized rate in the Q2, below most economists’ expectations for around 8.0% - although slightly better than the 6.3% in the Q1.

Other Important Macro Data and Events

New home sales for June, durable goods orders for June, and the advance estimate for Q2 GDP each missed expectations. On the plus side, Q2 GDP still increased at a robust annual rate of 6.5%, the consumer confidence report for July was better than expected, and the Personal Income and Spending report for June featured better-than-expected spending data and better-than-feared PCE price inflation data. Weekly jobless claims fell less than expected, and continuing claims rose a bit.

Reflecting the downward growth and inflation surprises, the yield on the benchmark 10-year U.S. Treasury note ended lower for the week, on hawkish FOMC meeting. The Fed made no changes to its extraordinarily accommodative policy stance. And during his post-meeting remarks, Fed Chair Jerome Powell underscored that the committee’s marker of “substantial further progress” has not yet been reached towards reaching the Fed's employment goal.

Eurozone bond yields declined on concerns about the spread of the coronavirus and doubts about reflation expectations and the wider economic recovery. Peripheral market yields generally followed core markets, falling after the ECB suggested inflation could temporarily overshoot its 2% target. UK gilt yields also tracked yields in other core markets.

The eurozone economy bounced back from recession in the Q2, growing by a faster-than-expected 2% relative to the first three months of 2021. The YoY growth rate of 13.7% also topped prominent estimates. Output expanded in Germany, France, Italy, and Spain, although the uptick in Germany came in below forecast because of supply bottlenecks that hindered its manufacturing sector. Eurozone inflation accelerated to 2.2% in July from 1.9% in June.

What Can We Expect from the Market this Week

Expectations that the mega-caps will provide strong earnings reports after a heavy slate of good earnings news last week. The increased spread of the Delta variant captured the spotlight, but we suspect inflation and the implications for Fed policy will take center stage over the balance of the year.

Important U.S. economic data being released this week including the construction spending, hourly wage growth, and consumer credit.