Stocks Performance (U.S. Stocks)

Stocks climbed higher for the third week in a row. Stocks recorded their best weekly gain in two months as investors celebrated signs of the beginning of an economic recovery.

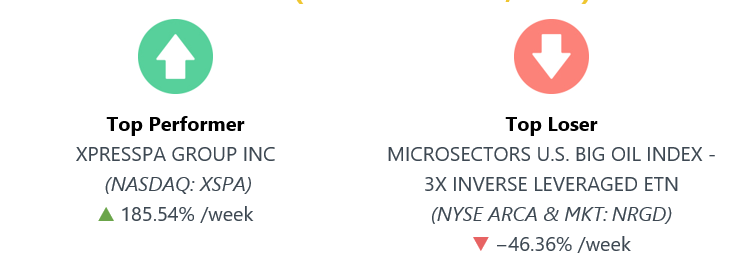

By sectors, the most outperformed weekly stocks were led by Energy Minerals at 17.67%, followed by Finance at 11.50%, and Transportations (10.47%). Meanwhile, the weakest sectors were from the Health Technology sector (-0.27%), Health Services (1.47%), Technology Services (2.17%) and Utilities sector (2.21%).

Energy shares outperformed, helped by news on OPEC and other oil major exporters’ agreement to scale back production. Financials shares were helped by a rise in longer-term interest rates, which boosts banks’ lending margins. Industrials shares were also exceptionally strong, lifted by a sharp rebound in Boeing, American Airlines and Lyft.

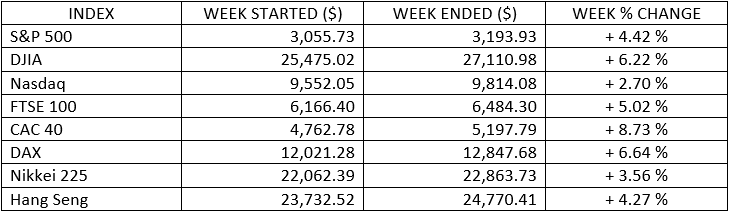

Indices Performance

Global equities extended their remarkable rally as manufacturing indices showed signs of improvement across Europe, North America and China, and employment data suggested the economy was picking up faster than expected.

Oil Sector Performance

Oil climbs over as the major oil producers agreed to extend oil production cuts. OPEC+ agreed to a one-month extension of its record oil-production cuts and adopted a stricter approach to ensuring members do not pump more than they pledged. Under the original agreement reached on April 12, production was set to be increased after June.

Market-Moving News

Index Rally Time

Stocks surged, climbing for the third week in a row. NASDAQ on Friday set an intraday record, eclipsing its prior peak set less than four months earlier, and the major indexes’ weekly gains ranged from around 3% to 7%.

Small-Cap Surge

Small-cap stocks outperformed the broader U.S. stock market by a wide margin, as a small-cap benchmark, the Russell 2000 Index, added more than 8% for the week.

Oil Recovery

Crude oil prices rose to their highest levels since early March amid expectations that the OPEC consortium of oil-producing countries would finalize an extension of production curbs through July. WTI climbed above $39 per barrel, up from a recent low of $18 in late April.

Yields Rebound

Government bond prices fell, sending the yield of the 10-year U.S. Treasury bond above 0.90% on Friday—the highest level since mid-March. The bond sell-off came amid better-than-expected data on the U.S. labour market.

Euro Stimulus

ECB ramped up its economic stimulus program, pledging to expand the value of government bonds that it purchases and to extend the program into mid-2021. The moves followed similar steps taken in recent days by central banks in the U.S., Japan, and the UK.

Climbing Back

Friday’s unexpectedly strong jobs report fuelled a rally that left the S&P 500 up 43% from a recent low on March 23 and down just 0.3% year to date. The index was less than 6% below its record high, which was reached less than four months ago.

Other Important Macro Data and Events

Stocks climbed higher for the third week in a row, oil jumped, and Treasury yields rose to an 11-week high following a surprising gain in payrolls last month.

The U.S. economy added 2.5 million jobs in May, while the unemployment rate declined to 13.3% from April's record level, suggesting that an economic recovery is under way faster than previously thought. Even though economic activity will likely take a while to return to pre-crisis levels, last week's employment data may be laying the foundation for a long-term recovery

The European Central Bank (ECB) boosted its emergency bond purchases by another $600 billion euro, to a total of EUR1.350 trillion, while Germany, the EU's largest economy, added another 130 billion euro in new spending and economic stimulus.

What We Can Expect from the Market this Week

Important economic data being released including Federal Reserve interest rate decision (on Wednesday), April’s Wholesale inventories, May’s Consumer and Producer Price Indices, May’s Import and Export Price Indices, and Consumer Sentiment Index on Friday.

U.S.’s actions on George Floyd’s protest, deemed as the worst civil unrest seen in the country in decades. Worries also grew that recent mass gatherings at protests would spark a resurgence in coronavirus infections.

U.S.-China trade tensions appeared to fade a bit from the headlines, though still not showing any end.

AstraZeneca (NYSE:AZN) last month informally got in touch with Gilead (NASDAQ:GILD) about a possible merger, according to the report. Terms weren't discussed, but Gilead has since reached out to advisers

News AstraZeneca was planning to manufacture billions of doses of a possible vaccine by the end of the year may supported the day’s rally.