Gold is a “safe heaven”

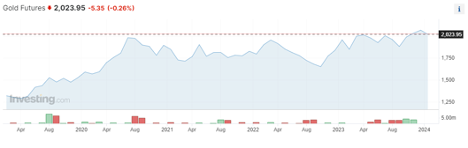

Gold has always experienced a stable upward trend. It has always been considered a “safe heaven” commodity by investors due to its value persistence through time. Gold prices are closely tied to the U.S. dollar. Federal Reserve activities and speeches are often the focal point with expectations of monetary policy changes. This asset thrives in times of economic and geopolitical uncertainty. A weaker U.S. dollar and lower interest rates enhance the appeal of this non-yielding bullion. Gold prices showed an uptrend since Q4 2023, breaking previous highs in December. However, a quick retracement below $2100/oz raised concerns, and the market is yet to retest this limit. While prices appear bullish, there's anticipation of potential downside reversals, especially if gold either breaks above current resistance or trades below $2000/oz, indicating a new trend.

Anticipations in 2024

Investors anticipate record high prices in 2024, driven by several factors. In 2023, spot gold rose by 15%. A record high of $2,146.79 was reached in December 2023, following expectations of U.S. monetary policy easing. Potential rate cuts in mid-2024 could lead to a "breakout rally," with J.P. Morgan targeting $2,300 and UBS forecasting $2,150. Geopolitical uncertainties, including conflicts in the Middle East and global elections, alongside central bank buying, are expected to enhance gold's appeal. However, there is a cautionary note regarding potential unwinding of gains if an inflation resurgence alters the Fed's policy plans in 2024.

Source: https://www.investing.com/commodities/gold

No bull runs for silver

Silver traded within the $20-$26 range throughout 2023, shaped by a triangle pattern. Unlike gold, silver has not established a clear uptrend and lacks strong momentum in either direction.

Indecisiveness in longer-term price direction persists due to the absence of substantial bullish or bearish momentum. The metal faced resistance around $26, leading to selloffs on multiple attempts to breach this level. Initial 2023 recession fears did not materialize, with most central banks aiming for a soft landing. Lower interest rates are considered bullish for silver. Rising international tensions lead non-Western countries to diversify reserves, indirectly supporting silver prices. Silver mine production has declined since 2016, attributed to inefficiencies and lack of financing for projects. Recycling has helped balance falling mine production, with increased demand in industrial sectors.

Outlook for 2024

TD Securities projects that silver will trend towards $26 an ounce in 2024, benefiting from improved industrial demand. IMF projects a slight global growth slowdown in 2024, with Fed expected to start cutting rates. Gold/silver ratio fluctuations significantly impact silver's performance. While the long-term trend favours the ratio, historical data suggests silver has room for upside. This precious metal is not overly volatile typically and it can exhibit strong momentum under certain catalysts. As the Fed is anticipated to cut rates in 2024, precious metals, including silver, may experience solid demand.

Source: https://www.investing.com/commodities/silver

Palladium

Palladium experienced a notable jump in late Q4 2023 but faced strong resistance from the overall long-term downtrend. Despite a spike in December 2023, the bullish momentum was insufficient to reverse the bearish sentiment. Palladium prices are currently holding a bearish outlook, trading near the lows observed in December '23.

Source: https://www.investing.com/commodities/palladium

Platinum

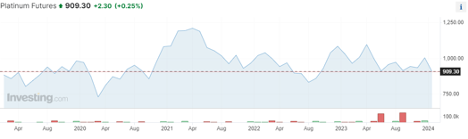

Platinum prices briefly formed a short-term uptrend in late Q4 2023 but faced rejection from the overall market. Despite reaching historic resistance zones, platinum retraced below the $1000/oz level, signalling bearish pressure. The current trend for platinum indicates a retracement towards the November '23 lows.

Source: https://www.investing.com/commodities/platinum

Platinum's slow advance against palladium in autocatalysts

The pace at which platinum is replacing palladium in autocatalysts is slowing down as both metals edge closer to price parity, a trend expected to persist throughout the year, according to analysts. The increased use of platinum in autocatalysts, designed to curb emissions from internal combustion engines, along with the growing sales of battery-powered electric vehicles, led to a 39% drop in palladium prices in 2023. Last year, around 620,000 ounces of palladium were substituted with platinum, compared to 385,000 ounces in 2022. The World Platinum Investment Council (WPIC) forecasts the substitution to reach 700,000 ounces in 2024. However, the WPIC anticipates palladium moving into surplus from 2025, prompting a shift where palladium might be replaced by platinum. The substitution process is gradual and mainly occurs with new vehicle models. There was a significant price difference between palladium and platinum at the start of 2023 but as of January 2024, this has reduced to less than 20%. The diminished price gap makes research and development for platinum substitution less attractive, easing pressure on palladium prices. Nevertheless, significant stockpiles and long-term factors, such as the rise of electric vehicles and recycling activities, continue to influence the market. Metals Focus estimates above-ground palladium stocks at 11.6 million ounces in 2023.

Platinum is expected to hold a range between $800 and $1,100 per ounce, while palladium faces surpluses as electric vehicles gain popularity, with Bank of America forecasting an average of $750 per ounce in 2024, subject to potential supply cuts.

Conclusion

The precious metals at the close of 2023 reflected a modest gain, yet caution prevailed as most metals lacked robust bullish action. The allure of precious metals endures, attracting investors with intrinsic value and unique market dynamics. The Global Precious Metals MMI shifted from a previous sideways trend, influenced by global battles against inflation, financial events, and geopolitical dynamics, setting the stage for 2024. While macroeconomic factors dominated, emerging supply-demand dynamics, including issues affecting mine and smelter output, and shifts in end-use consumption and operating costs, will play a crucial role in determining metal prices in 2024.

Sources:

https://www.americanbullion.com/what-is-highest-price-of-gold-in-history/

https://www.spglobal.com/marketintelligence/en/news-insights/research/metals-price-outlook-2024

https://finance.yahoo.com/news/precious-metal-prices-trade-sideways-160000965.html

https://www.jpmorgan.com/insights/global-research/commodities/gold-prices