Stocks Performance (U.S. Stocks)

Equity markets around the world added to the previous week’s sharp gains, bolstered after Pfizer Inc. released a large-scale study that showed that its COVID-19 vaccine prevented more than 90% of infections. Stock market also further buoyed by the declaration on the weekend of Joe Biden as President-elect, overweighted the surge in COVID-19 cases in the U.S. and Europe.

All the major indexes touched all-time intraday highs in early trading Monday but surrendered much of their gains at midweek, before rebounding again on Friday. Almost every major index moved higher for the week. One notable exception was the Nasdaq Composite, which sank under the weight of retreating “stay-at-home stocks”, such as Amazon.com Inc. and Netflix Inc.

Vaccine and U.S. presidential news give strength in the energy and financials sectors and weakness in the giant technology and Internet companies. Rising optimism for better economic growth led to pronounced outperformance of value stocks over growth stocks and of small-capitalization companies over large caps. Value stocks and small caps, which have been hard hit by the COVID-19 lockdowns, have significantly underperformed year-to-date.

By sectors, the most outperformed weekly stocks were led by Energy Minerals sector at 16.97%, followed by Finance at 8.46%, Industrial Services 7.73%, and Distribution Services at 6.33%. Meanwhile, the weakest sectors were from the Retail Trade at -2.84%, Technology Services at -1.43%, Non-Energy Minerals (-0.49%), and Consumer Durables sector (0.48%).

Indices Performance

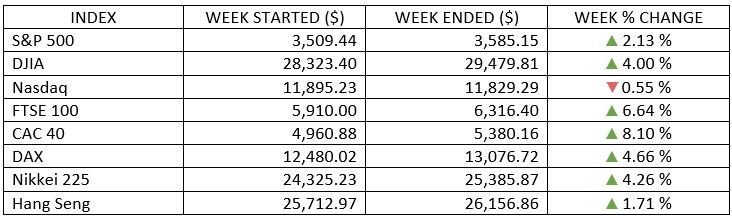

Stocks followed an uneven path to mostly positive returns for the week, although the S&P 500’s overall gain paled in comparison with the prior week’s 7% surge, up more than 2% after posting strong gains on Monday and Friday but a steep decline on Thursday. The Dow outpaced the other U.S. major stock indexes by a wide margin, gaining more than 4% in a week when the NASDAQ fell almost 1%.

All major equity markets in Europe and Asia advanced. Stocks in Europe were generally much stronger than those elsewhere, though Europe appears to be headed for a double-dip recession because of its renewed lockdowns in response to a spike in COVID-19 cases. However, the effect of the news of vaccine progress was expected as the catalyst to the advancement in the indexes. The rally in Japanese stocks lifted the Nikkei 225 Index to its highest level since early 1991.

Oil Sector Performance

Confidence that a coronavirus vaccine will lift economic activity increase the demand for oil, pushed the price of crude to a 2-month high.

Market-Moving News

Shifting Momentum

Stocks mostly positive returns for the week, although the S&P 500’s overall gain less in comparison with the prior week’s 7% surge. The index finished the latest week at a record high, up more than 2% after posting strong gains on Monday and Friday but a steep decline on Thursday. The Dow outpaced the other major stock indexes by a wide margin, gaining more than 4% in a week when the NASDAQ fell almost 1%.

Small-Cap Surge

U.S. small-cap stocks outperformed the broader market by a wide margin, as the Russell 2000 Index, a small-cap benchmark, climbed around 6%. At Friday’s close, the index was up 20% from a recent low on September 23.

Bad News/Good News

The coronavirus pandemic continued to be a big force driving financial markets, with a spike in new cases in the U.S. and many other countries offset by optimism about vaccine development. On Monday, the release of positive test data for one vaccine candidate was a key catalyst in a rally that sent the Dow 3% higher.

Yield Volatility

The market for government bonds was choppy for the second week in a row, as the yield of the 10-year note closed on Tuesday at 0.98%, the highest in nearly eight months. By the end of the week, the yield slipped to around 0.89%; as recently as late September, it was just 0.66%.

Oil Recovery

The price of U.S. crude oil moving back above $40 per barrel. The price was up about 16% from a recent low on November 1. However, the price weakened on Friday amid concern that the recent spike in coronavirus cases could trigger further travel restrictions, depressing demand for fuel.

Improved Outlook

More than a month into the fourth quarter, Wall Street analysts have lifted their earnings expectations for the period. During October, analysts raised their earnings forecasts for companies in the S&P 500 by 1.8%, on average, according to FactSet. It’s just the third time since 2011 that forecasts have increased over the first month of a quarter.

Other Important Macro Data and Events

Stocks surged on Monday after Pfizer and BioNTech announced that their vaccine had 90% effectiveness in their large study, triggering a wave of hope and optimism that a medical solution will address the health crisis and accelerate the economic recovery.

Stock market also soared by the declaration on the weekend of Joe Biden as President-elect, overweighting the surge in COVID-19 cases in the U.S. and Europe, as optimistic investors pulled money out of safe haven assets, such as gold and government bonds, sending bond yields higher. The selling of safe haven US treasury bonds lifted US 10-year yields to their highest since March. The 10-yr yield increased seven basis points to 0.89%.

The upbeat mood was also bolstered by a bigger-than-expected drop in claims for unemployment benefits, to their lowest level since March. Initial jobless claims last week fell to 709,000, the fourth consecutive weekly decline and the lowest reading since the pandemic began.

Q3 earnings announcements are wrapping up, and corporate profits broadly came in ahead of expectations, with more than 80% of companies beating estimates. The technology, health care and communications services sectors reported earnings above the same period a year ago, reflecting the ability for many companies and industries to effectively navigate, or even thrive in, the difficult pandemic environment.

What We Can Expect from the Market this Week

The market took the vaccine news as well as one could have hoped. Development on vaccine will help the pace of the economic rebound. In addition, Joe Biden being projected as the winner of the presidential election washed out some political uncertainty, although there will be two election runoffs in Georgia on Jan. 5 that will determine if Republicans retain their majority in the Senate, keeping the negotiations around an awaited additional fiscal-aid stimulus.

Important economic news released this week including retail sales and industrial production on Tuesday, housing starts on Wednesday, unemployment claims and existing home sales on Thursday, and the leading index on Friday.