PAST WEEK'S NEWS (May 05 – May 09)

Focus are all on trade talks to be held in Switzerland, with China making a move by rolling out extensive stimulus measures, including interest rate cuts and a significant liquidity injection, to soften the blow on its economy from the effects of U.S. tariffs, which are leading to a decline in factory activity and fears of job losses and deflation. Meanwhile, the U.S., led by Treasury Secretary Scott Bessent and chief trade negotiator Jamieson Greer, is preparing to discuss tariff reductions and address specific trade barriers, a possibility of easing tensions between the two economic titans. The prolonged trade war has strained everyone, with China’s stimulus hopefully tipping the scales in its favour during the talks. At the centre of this effort is He Lifeng, China’s top economic official and a trusted ally of President Xi Jinping, whose pivotal role in economic diplomacy will shape the negotiations. The outcome of these talks could prove decisive for global economic stability, as both nations seek to resolve the fallout of their tariff standoff.

The Bank of England has recently cut interest rates to 4.25% as projected and in stronger conviction due to U.S. President Donald Trump's tariffs, which could reduce economic growth and lower inflation, though a surprising 5-4 split among policymakers could stop a June cut. The BoE's updated forecasts project inflation peaking at 3.5% this year and returning to the 2% target by Q1 2027, with a raised growth forecast of 1% for this year, though the 2026 outlook was trimmed. Since mid-2024, the BoE's rate cuts match those of the U.S. Federal Reserve but are less aggressive than the European Central Bank's. A U.S.-UK trade deal reducing tariffs on British goods offers some relief, yet the BoE warns that broader trade conditions are still uncertain. Meanwhile, the Federal Reserve held its key rate steady at 4.25%-4.5%, highlighting economic uncertainty from trade policies, despite Trump's criticism of Fed Chair Jerome Powell for not cutting rates as inflation nears the 2% target.

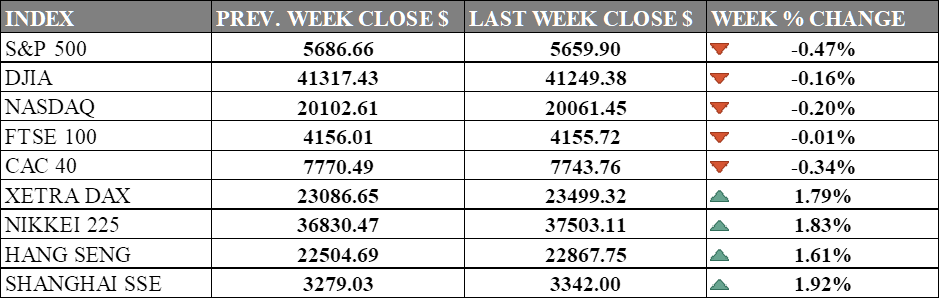

INDICES PERFORMANCE

Wall Street is seeing a slight pullback last week, pointing toward market consolidation. The S&P 500 declined by 0.47%, closing at 5659.90, with widespread pessimism surrounding tariffs. The Dow Jones Industrial Average (DJIA) also edged lower by 0.16%, finishing at 41249.38, showing resilience despite the overall negative sentiment. Similarly, the Nasdaq posted a modest loss of 0.20%, closing at 20061.45, as tech stocks faced mild selling pressure. The market is expected to rally further after a positive development evidenced by a done deal with the United Kingdom.

European markets showed mixed performance for the week. The UK's FTSE 100 remained essentially flat with a minimal decline of 0.01%, closing at 4155.72. France's CAC 40 experienced a decrease of 0.34%, ending at 7743.76, while Germany's XETRA DAX bucked the trend with a robust gain of 1.79%, closing at 23499.32. European markets appear to be responding differently to regional economic factors, with German equities showing strength.

Asian markets are strong with a boost from India-Pakistan conflict escalation, with consistent gains across the region. Japan's Nikkei 225 posted a solid gain of 1.83%, closing at 37503.11. Hong Kong's Hang Seng Index showed significant positive momentum, rising by 1.61%, finishing at 22867.75. In mainland China, the Shanghai Composite Index advanced impressively by 1.92%, ending at 3342.00, with weapon counter gaining more than other industry.

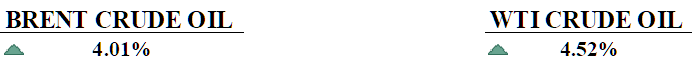

CRUDE OIL PERFORMANCE

Oil prices sees upside momentum, marking their first weekly gains since mid-April, with optimism surrounding U.S.-UK trade deal and U.S.-China talks. Brent settled at $63.88 and WTI at $61, with both gaining over 4% for the week. President Trump’s tariff reduction deal with the UK and tough stance on China raised hopes for improved U.S.-China trade relations. Rising Middle East tensions, including a missile intercepted by Israel from Yemen, also supported oil prices. However, risk remains due to U.S. volatile economic policy, sanctions on Iran and Russia, and OPEC+ output decisions. Even with planned output incrementals, OPEC output slightly declined in April, adding to market optimism.

OTHER IMPORTANT MACRO DATA AND EVENTS

India has offered to significantly reduce its average tariff gap with the U.S. from nearly 13% to under 4%, cutting duties to zero on 60% of tariff lines, and granting preferential access to 90% of U.S. goods in exchange for exemption from current and potential U.S. tariffs, as both nations push to finalize a sweeping trade deal.

Taiwan’s exports surged 29.9% in April, driven by strong demand for high-tech products and AI-related components amid U.S. tariff concerns, setting a record for first-half exports.

What Can We Expect from The Market This Week

US CPI April: Headline inflation rose 2.4% in March, significantly lower than the previous figure and consensus, as risk-off sentiment devalued equity assets. The monthly figure showed a 0.1% decrease, with economists monitoring early effects of the Trump administration's tariffs on consumer prices.

UK GDP Q1: The UK economy expanded by 1.1% in the full year of 2024, continuing its sluggish recovery from the mild recession in late 2023. Economic growth for the first quarter is expected to be pushed by the services sector, which grew by 0.4%, while production contracted by 0.9%, prepared to report its preliminary data at an overall of 0.6%.

German CPI April: Germany preliminary inflation data eased to 2.1% in April 2025, down from 2.2% in March, marking the lowest level since October 2024. The monthly inflation figure showed a 0.4% increase, with food and energy prices continuing to moderate while service-sector inflation remained persistent.

US Retail Sales April: Retail sales data for March was overinflated, while April data is expected to see a pullback with flat growth, following pre-tariff buying and improving sentiment. The moderation reflects consumer panic buying and eventual calm in uncertain economic conditions, with particular weakness in discretionary spending categories.

Philly Fed Manufacturing Index: The Index recorded a -26.4 in April 2025, down from +12.5 in March and far below market expectations of +2.2. The enormous decline represents the lowest reading since April 2023, with both shipments and new orders contracting, pointing toward deteriorating conditions in the regional manufacturing sector.