INTRADAY TECHNICAL ANALYSIS AUGUST 08th (observation as of 07:00 UTC)

High-Impact News:

Thursday August 08

- (US) 08:30 ET: US Initial Jobless Claims

- (US) 13:01 ET: US 30-year Bond Auction

- (CN) 21:30 ET: China CPI July

[EURUSD]

Commentary/ Reason:

1. Price on the weekly timeframe painted a consolidating price pattern with lower highs and higher lows before price break above those trendlines, indicating growing interest in Euro and lower dollar valuation.

2. Although moving averages are in buy zone, oscillators remain neutral as price pulling back to equilibrium before deciding on its next direction.

3. Price has established a clear price imbalance level although unlikely to retest as price rejects far from the zone although it is not impossible for price to test it if lose bullish momentum to supply zone that formed before re-enter consolidation zone.

[USDCHF]

Commentary/ Reason:

1. Price was trending down before making a drastic move to the downside, breaking even long-term demand zone and breaking a significant support. Price has also formed price imbalance in which price rejected off which could be the first sign of bearish continuation.

2. Technical indicators are staying neutral for Oscillators and moving averages, signifying price is at equilibrium level.

3. Price is expected to continue bearish although it may retest price imbalance, but may turn into a long-term uptrend if price close above imbalance.

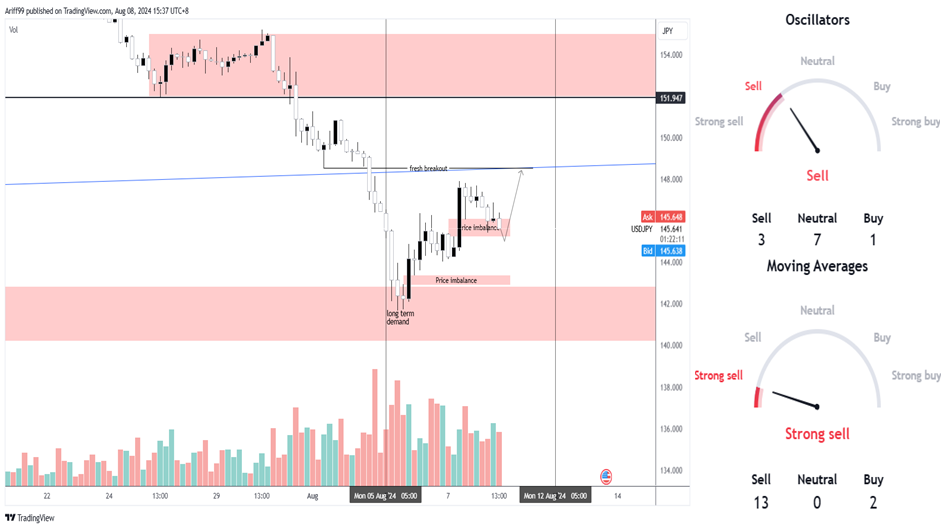

[USDJPY]

Commentary/ Reason:

1. The price broke below a long-term higher low but rebounded off a demand zone, confirmed by small price imbalance that has not been filled, indicating strong buying pressure off the zone.

2. Technical indicators are confidence with sell, on track with strong selling pressure since its last consolidative move.

3. The price is expected to rebound to equilibrium at fresh breakout level before continuing downtrend and will continue to consolidative level above if price close above the same level.

[GBPUSD]

Commentary/ Reason:

1. The price is rangebound after experiencing significant downward pressure as it enter into oversold territory with demand area tested and bounce higher, indicating higher chance of upward pressure rather than downward.

2. The technical are mixed with oscillators on neutral while moving averages are on buy.

3. The price broke tested above short term resistance before moving back down, indicating that price will have higher chance of breaking above to significant resistance level.