PAST WEEK'S NEWS (MAY 08 - MAY 12, 2023)

The U.S. stock market continued to trade in a tight range, with the S&P 500 and the Dow Jones Industrial Average posting small weekly declines while the Nasdaq Composite Index eked out a slight gain. U.S. inflation slowed for the tenth consecutive month, but prices still rose, with the latest reading of the Consumer Price Index showing a 4.9% annual rate in April. Crude oil prices declined for the fourth consecutive week, while the price of Bitcoin fell nearly 11%. The 10-year U.S. Treasury bond yield has traded in a narrow range, and the proportion of S&P 500 companies that have beaten analysts' earnings expectations has remained slightly higher than usual. While there is less volatile market data coming this week, it will be an indication of the direction consumers are taking.

Zimbabwe's central bank has gone ahead with the sale of gold-backed digital tokens worth approximately $39 million; against IMF advice. The tokens were sold for a minimum price of $10 and $5,000 for individuals and corporations, respectively, and must be held for a minimum period of 180 days. This move is part of an effort to stabilize Zimbabwe's economy, which has been experiencing currency volatility and inflation for over ten years. The tokens are backed by about 140kg of gold, and the second round of digital token sales is already underway.

US Treasury Secretary Janet Yellen has said that pressures on earnings of some regional banks in the US may lead to some concentration in the sector, and regulators will be open to such mergers. She also sought to reassure her G7 partners that the US financial system is stable. The KBW Regional Banking index has fallen 14% so far in May.

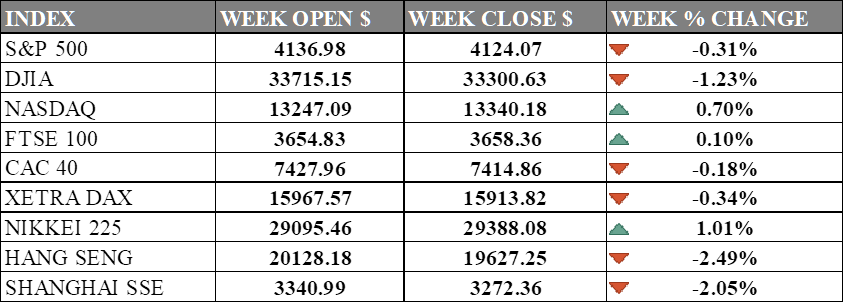

INDICES PERFORMANCE

The U.S. stock market posted mixed results as investors digested a slew of corporate earnings reports and economic data, including inflation and consumer spending. The technology-heavy Nasdaq Composite outperformed, helped by strong results from Google parent Alphabet and other mega-cap stocks. The Dow Jones Industrial Average lagged, weighed down by Disney, which reported a decline in subscribers to its streaming platform, Disney+. The S&P 500 Index also edged lower, as cyclical, and small-cap stocks underperformed amid concerns over rising interest rates and slowing global growth.

The European stock market also posted mixed results, as investors balanced optimism over the region's energy crisis as oil prices relaxed a bit. The FTSE 100 in the UK eked out a small gain, boosted by positive earnings reports and economic data. The CAC 40 in France and the XETRA DAX in Germany slipped slightly, as some sectors such as financials and energy faced selling pressure.

Asian stock markets fell on Monday, dragged down by weak Chinese trade data and ongoing regulatory crackdowns. The Hang Seng in Hong Kong and the Shanghai Composite Index both fell more than 2%, while the Nikkei 225 in Japan bucked the trend, rising 1.01%. Investors were also fretting over rising U.S.-China tensions over Taiwan and human rights issues.

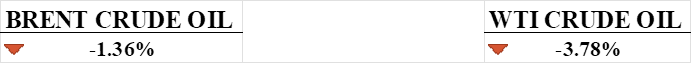

CRUDE OIL PERFORMANCE

OPEC expects China to buy more crude oil in H2 2023 than initially predicted, despite a slowdown in the economy. However, recent disappointing data on Chinese trade and inflation may contradict this expectation, plunging crude oil price. Meanwhile, the US added 253,000 jobs in April, exceeding expectations and making it harder for the Federal Reserve to stop raising interest rates and strengthening of USD. The US economy also faces other challenges, including an 1.1% growth in Q1 2023 and a potential debt default crisis. OPEC's forecast for China's crude oil demand in H2 2023 remains to be seen.

OTHER IMPORTANT MACRO DATA AND EVENTS

Although inflation in the US has decelerated for ten months in a row, the most recent reading of the Consumer Price Index did not indicate a significant reduction in prices. In April, inflation slowed to an annual rate of 4.9%, down from 5.0% in March. If energy and food are excluded, prices increased by 5.5% compared to 5.6% in the previous month.

The U.S. stock market has experienced small changes lately, and similarly, the government bond market has also witnessed reduced volatility compared to the significant fluctuations observed earlier in March. Over the past few weeks, the 10-year U.S. Treasury bond yield has remained within a limited range, fluctuating between 3.60% and 3.29%, with Friday's yield hovering around 3.46%. In contrast, it had reached a peak of 4.07% in early March.

The Bank of England raised interest rates to 4.5 percent, the highest level in 15 years, as part of its aggressive policy to combat inflation. The central bank forecast that Britain was likely to avoid a recession but warned that the economy would grow more slowly this year than previously thought.

China's trade growth slowed to its lowest level in two years in April. Exports grew by 3.9% in April from a year earlier, down from 14.7% growth in March, while imports remained flat. China's imports from Russia soared by 56.6% from a year earlier to a record US$8.8 billion in April, although exports fell by 25.9% to US$3.8 billion.

What Can We Expect from The Market This Week

US Retail Sales: This measures the change in the total value of sales at the retail level. The consensus is for a 0.7% increase in April after a 0.6% decline in March. Home Depot's earnings on Tuesday will also set expectations for the retailer.

Philadelphia Fed Manufacturing Index: This is a leading indicator of the health of the manufacturing sector and the overall economy. Analysts expect the index to report a decline of 19.2 points after its worst drop since COVID last month.

Eurozone CPI YoY: This measures the change in the prices of a basket of goods and services purchased by households in the region. Analysts expect a 0.7% increase, following a 0.9% rise in March.

Japan's GDP Q1: This measures the change in the inflation-adjusted value of all goods and services produced by the economy. Analysts expect a slowing growth rate of 0.1% due to worrying demand from China.

China Industrial Production: This measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities. Analysts expect a steep 10.9% increase from 3.9% last month.