PAST WEEK'S NEWS (SEPTEMBER 18 – SEPTEMBER 22, 2023)

The Fed is staying on course, and the market did not react too strongly. While they kept the interest rate steady for now, one more hike is expected this year. Core inflation slowed in August but remains well above the Fed's 2% target, so they're not declaring victory yet. The Fed expects rates to peak at 5.75% while projecting fewer rate cuts in 2024. Everyday Americans are struggling as inflation outpaces incomes, stimulus funds dry up, student loans repayment restart, and gas prices rise again. More people are falling behind on bills as living costs outpace wages growth. It's unclear if further rate hikes will tame inflation without tipping more people into hardship and triggering a recession.

The Bank of England unexpectedly halted its series of interest rate hikes after new data showed inflation slowing, sending sterling lower. In contrast, the Bank of Japan maintained its ultra-easy monetary policy, sending the yen lower versus the dollar and raising intervention risks. The BoE is concerned about recession risks, while the BoJ is still focused on boosting inflation. The divergence in central bank policies caused currency market fluctuations, with sterling falling and the yen weakening further. Going forward, the BoE will monitor the economy closely for signs of persistent inflation before hiking again, while the BoJ laid the groundwork for eventually exiting stimulus. However, both central banks remain data-dependent, balancing inflation risks with recession concerns.

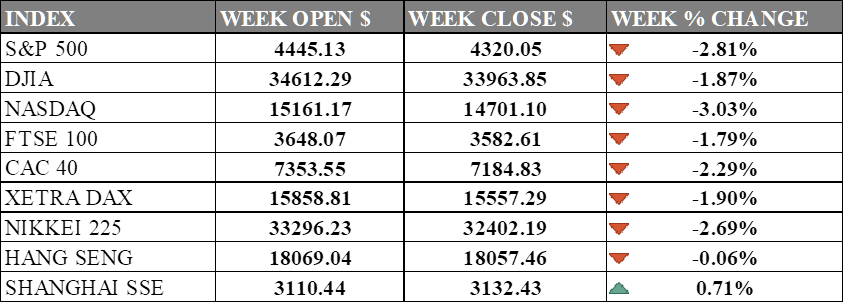

INDICES PERFORMANCE

In the week ending September 22, 2023, the U.S. stock market faced notable challenges. The S&P 500 index opened the week at 4445.13 but ultimately closed at 4320.05, marking a 2.81% decline. This huge decline was attributed to rising long-term treasury yields and anticipated government shutdown by 1st October. Similarly, the Dow Jones Industrial Average (DJIA) experienced a 1.87% decrease, closing at 33963.85. The DJIA's decline was driven by the same fears and UAW president expecting its strike to expand into 38 auto-parts distribution centres in 20 states. The tech-heavy NASDAQ composite struggled the most, falling 3.03% during the week to finish at 14701.10. The index extended its losses due to Nvidia shedding more than 5% and Tesla by 10.75% leading the market as rate-sensitive stock selloffs continued.

Meanwhile, European markets faced their own challenges. The UK's FTSE 100 index fell by 1.79% to close at 3582.61, down from its opening level of 3648.07. France's CAC 40 experienced a 2.29% decline, closing at 7184.83. Germany's XETRA DAX decreased by 1.90%, settling at 15557.29. These European indices were weighed down primarily due to prospect of The European Central Bank's commitment toward higher interest rate for an extended period. Concerns are growing as preliminary data suggests economic activity is contracting in France and Germany, indicating a likely overall economic downturn in the euro zone with no quick recovery in sight.

In Asia, market dynamics were shaped by various factors. Japan's Nikkei 225 dropped by 2.69% week-over-week, closing at 32402.19, down from its opening level of 33296.23, partly due to contracted Japanese manufacturing sector. Hong Kong's Hang Seng index supported by stimulus only down 0.06%, closing at 18057.46. China’s Shanghai Composite however rose by 0.71%, closing at 3132.43 after opening at 3110.44. Although Japan’s economy were weigh down on fears by federal reserve policy, Chinese market are supported by giants like Alibaba which rebounded after being oversold.

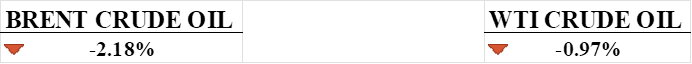

CRUDE OIL PERFORMANCE

Crude oil prices paused its strong rise to $95 per barrel as price enter overbought territory with most analyst expecting the price can rise further. JPMorgan analyst Christyan Malek forecasts that oil prices could spike to $150 per barrel by 2026 due to tight supply and the start of an energy "supercycle" stemming from underinvestment and OPEC cuts, prompting the firm to upgrade the global energy sector to overweight with Shell, Baker Hughes, and ExxonMobil among its top picks. However, JPMorgan still expects Brent to average $80 long-term, with $100 being a risk if supply shortages persist. Technical analysis suggest the price to retreat to $90 per barrel before having a similar rally for the last month excluding last week.

OTHER IMPORTANT MACRO DATA AND EVENTS

The US housing affordability crisis persists, with mortgage rates at multi-decade highs, forcing homeowners in costly cities to relocate. Interest rates may stay elevated through 2024 despite Fed easing, further constraining affordability.

Britain's inflation unexpectedly slowed in August, becoming the main reason for Bank of England to pause its rate which had raised rates steadily since late 2021 to combat high inflation. However, global fuel prices and potential food inflation may still pressure the central bank to continue tightening monetary policy.

Japan's exports fell 0.8% year-on-year in August, marking the second straight month of declines due to slowing demand from China and stoking fears of a downturn amid high global interest rates, while imports also dropped sharply reflecting weak domestic spending.

What Can We Expect from The Market This Week

PCE Price Index: monthly measurement of U.S. consumer prices, encompassing a wide range of expenses, including a core index that excludes food and energy prices. The inflation readings focused by the Fed are expected to grow by 0.5% on a higher oil price this month after a modest growth of 0.2% for two months.

CB Consumer Confidence: key leading indicator of consumer spending and economic growth, with higher confidence levels spurring economic expansion and lower levels potentially signalling a downturn. The gauge fell last month and is expected to continue falling, although slightly.

US Initial Jobless Claims: the number of individuals filing for unemployment insurance for the first time in the past week, serving as a timely indicator of the labour market and economic health. Often used to gauge the Fed's next move, the count trending down asserts uncertainty about rate pivot in the face of a strong labour market.

Eurozone CPI: an indicator of inflation used by policymakers, including both headline and core inflation figures that saw it decline by half over a year after a series of aggressive rate hikes.

US Personal Spending: tracks the total expenditure by individuals and households on goods and services in the United States, which is relentless and supported by the usage of credit cards. Although it has a low impact, the data points can suggest consumer resilience and confidence.