PAST WEEK'S NEWS (OCTOBER 16 – OCTOBER 20, 2023)

China, the world's top graphite producer, announced export restrictions on certain graphite products crucial for EV batteries to protect national security. This spark concerns about supply chain disruptions as demand for graphite from the surging EV sector soars, with automakers like Tesla rushing to find non-Chinese suppliers. Graphite makes up the largest portion of EV batteries by weight and is used extensively in anodes. Meanwhile, China also dominates refining over 90% of global graphite for battery use. The new curbs mirror July's limits on exports of semiconducting gallium and germanium, which effectively choked shipments. Analysts say graphite prices will likely rise, but the impact remains uncertain as the limits aren't a blanket ban.

The US government claims it can fund two wars abroad while its fiscal position weakens. Treasury Secretary Yellen stated in her latest interview that the economy is doing well despite high inflation and debt. However, many Americans feel the US should focus domestically as poverty rises, though Yellen insists supporting Israel is unconditional. If oil prices spike from the Middle East conflict, it could worsen inflation and prompt higher interest rates. Yellen blames House Republicans for hampering vital aid to Israel and Ukraine by not electing a speaker. She also touts increased IRS funding to audit Americans more and collect trillions in unpaid taxes.

INDICES PERFORMANCE

The major U.S. stock indexes ended lower last week amid concerns over rising interest rates and mixed earnings reports. The S&P 500 declined 2.72% to close at 4,224.15, down from its open of 4,342.37. The Dow Jones Industrial Average fell 2.08% to finish at 33,127.29 compared to its open of 33,832.42. The tech-heavy NASDAQ saw the largest drop, sinking 3.28% to 14,560.88 after opening the week at 15,054.48. The indexes were pressured by disappointing earnings from major companies like Netflix and Tesla as well as continued hawkish messaging from the Federal Reserve about further interest rate hikes to combat inflation. On top of that, concerns over the Israel-Hamas conflict encourage shift into safer commodity although complimented by mixed sector performance, including a negative performance in Consumer Discretionary and a positive performance in Energy.

In Europe, the major indexes also posted weekly declines. The UK's FTSE 100 fell 3.28% to close at 3,463.80 compared to its open of 3,581.34. France's CAC 40 dropped 3.04% to end the week at 6,816.17 after opening at 7,029.75. Germany's DAX declined 2.77% to settle at 14,798.47 from its starting point of 15,219.42. The downbeat performance came as rising geopolitical tensions in Gaza, concerns about oil supply disruptions, and apprehensions about inflation. This poor performance followed a brief uptick in late September when the index rebounded slightly after reaching a six-month low.

Asian indexes were similarly negative on the week. Japan's Nikkei 225 shed 2.26%, closing at 31,259.29 versus its open of 31,983.04. Hong Kong's Hang Seng plunged 3.55% to finish at 17,172.14 from its starting level of 17,803.31 amid China growth fears. China's Shanghai Composite fell 3.49% to close at 2,983.06 compared to its open of 3,091.06 during a volatile week of trading. Overall, Asian market was influenced by Powell's comments, rising bond yields, and Japan's high inflation, while gains were seen due to eased pressure on bonds and a surge in energy and distribution stocks in Japan. China’s central bank kept its benchmark loan rates unchanged for October.

CRUDE OIL PERFORMANCE

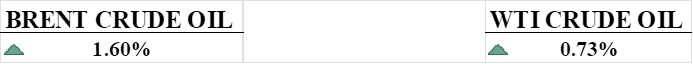

Crude oil prices were volatile this past week, riding on Middle East tensions from the Israel-Palestine conflict before pulling back Friday on news of a small prisoner exchange. Despite ongoing regional unrest, oil markets are questioning whether significant supply disruptions justify further risk premiums when demand factors remain weak. US gasoline prices have steadily declined from summer highs, now below $3.50 a gallon, as ample supply and weak refinery profits limit upside. WTI crude rose 0.73% on the week, adding to prior gains, finishing Friday just at $88 a barrel. Brent also ended slightly lower Friday near $92 a barrel, but still posted a weekly gain of 1.6% after last week's surge. Oil's near-term direction will depend on broader market reaction to Middle East developments and whether prices can hold key technical support levels in the mid-$80s.

OTHER IMPORTANT MACRO DATA AND EVENTS

New claims for unemployment benefits fell to a 9-month low, indicating continued strong job growth in October despite the Fed's aggressive interest rate hikes. However, the housing market continues to struggle with existing home sales dropping to the lowest level since 2010 due to high mortgage rates and tight supply.

China's property market continues to struggle despite government stimulus measures, with homebuyers remaining wary of economic uncertainty and developers reporting soft sales, but policy easing has helped stabilize major cities like Beijing and Shanghai even as smaller cities grapple with excess supply. Broader economic recovery is needed to revive housing demand and expand the market beyond the short-term impact of lower buying costs from stimulus policies.

U.S. retail sales increased more than expected in September, cementing expectations that economic growth accelerated in the third quarter. However, the strong consumer demand raises the risk that the Federal Reserve will hike interest rates in December to tackle inflation.

What Can We Expect from The Market This Week

US PCE Price Index: key U.S. inflation measure used by the Federal Reserve and reported monthly by the BEA. Recently, the BEA introduced two new PCE indexes: one excludes energy and housing, and the other excludes food, energy, and housing categories, with additional inflation data provided in their reports. The core index fell to 3.9% in August and is expected to continue the trend in September to 3.7%.

ECB Interest Rate Decision: The ECB raised its key interest rates by 25 basis points last September, citing the aim of returning inflation to its 2% target, despite acknowledging a weakening euro area economy. This move led to a bond rally and investor expectations of rate cuts in the near future due to concerns about economic growth. However, investors are expecting the ECB to hold the rate at 4.50%, following the Fed's footstep.

US GDP Q3: The US GDP in Q3 is projected to grow by 4.9%, surpassing previous estimates due to resilient consumer spending and strong export gains. However, a significant economic slowdown is expected in 2024 with a 0.9% growth rate, denoting a "soft landing" scenario that the Fed was hoping for that should prompt them to cut rates by around 100 bps then.

US Durable Goods Order: Long-term goods showed a surprising 0.2% increase in August 2023, defying expectations of a 0.5% decline after a huge decline in July, indicating relief in manufacturing sector demand. Unfilled orders for durable goods rose by 0.4% to $1,335.9 billion, and excluding transportation, new orders increased by 0.5%. This data underscores the sector's ongoing resilience and investment in equipment despite economic uncertainties.

BoC Interest Rate Decision: The Bank of Canada last announced a 25-bps rate hike in July and paused in September, while expectations for October are another pause. These decisions are influenced by factors like unrelenting inflation, slowing economic growth, and global economic conditions. Canadian inflation last week was still high at 3.8%, while economic growth for Q2 was flat on its back.