PAST WEEK'S NEWS (February 05 – February 09, 2024)

British chip designer Arm Holdings. saw its market value double in days, fundamentally based on strong earnings and AI demand. While Arm doesn't directly make AI chips, its technology complements them, licensing to giants like Nvidia and Apple Inc. This AI boom has propelled Arm's valuation to $153 billion, ranking it among the most valuable chip companies. However, concerns about stretched valuations and potential profit-taking after the surge loom. SoftBank, Arm's majority owner, may also sell shares soon, although there can be no seller without buyer. Despite these risks, Arm's long-term prospects remain positive, driven by AI growth and diversification beyond smartphones.

The recent data suggests that the labour market is standing strong despite multiple announcements of layoffs, especially in the technology and media industries, where tax codes have hurt the cost of employment. At the same time, wholesale inventories data reporting the first increment in over a year, particularly in automotive stocks, points to steady economic momentum that could delay interest rate cuts this year as the Federal Reserve tries to bring inflation down to its 2% target through its policy tightening cycle. Nevertheless, financial markets have tempered predictions of the timing of the next rate cut to May, given signals from Fed officials that they are unlikely to ease policy until clear disinflationary trends emerge.

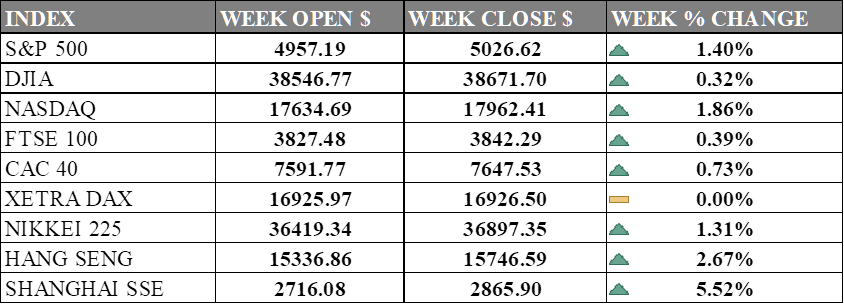

INDICES PERFORMANCE

The major U.S. stock indexes ended mostly higher last week, establishing new all-time highs albeit hawkish rhetoric as investor priced in March rate cut. The S&P 500 advanced 1.40% to close at 5026.62, up from its open of 4957.19. The Dow Jones Industrial Average rose 0.32% to finish at 38671.70 compared to its starting point of 38546.77. The tech-heavy Nasdaq jumped 1.86% to 17962.41 after opening the week at 17634.69. The US economy is currently performing well, with strong earnings growth and healthy economic fundamentals supporting market optimism, but further positive indicators on inflation, Federal Reserve policy, and economic growth are needed for the S&P 500 to potentially reach 5,300 by year-end.

In Europe, the major indexes were mixed. The UK's FTSE 100 rose 0.39% to close at 3842.29 compared to its open of 3827.48. France's CAC 40 advanced 0.73% to end the week at 7647.53 after opening at 7591.77. Germany's XETRA DAX was virtually unchanged, slipping 0.00% to settle at 16926.50 from its starting point of 16925.97. The European economy shows signs of cautious optimism with upbeat trading indices and anticipation of key economic data releases, including updates on GDP and manufacturing PMI, with ongoing challenges such as supply chain disruptions and geopolitical tensions.

Asian indexes were also mixed on the week. Japan's Nikkei 225 rose 1.31%, closing at 36897.35 versus its open of 36419.34 as the yen recovered after falling to a 10-week low, with traders reassessing their bets on how quickly the Bank of Japan might raise rates. Hong Kong's Hang Seng fell 2.67% to finish at 15746.59 from its starting level of 15336.86. China's Shanghai Composite jumped 5.52% to close at 2865.90 compared to its open of 2716.08. Despite a recent positive performance in the Hang Seng index, China's economy faces ongoing challenges, with subdued business sentiments among small and medium-sized enterprises in Hong Kong signalling continued uncertainty and potential obstacles to sustained growth that may put the 2nd largest economy in stasis for a while.

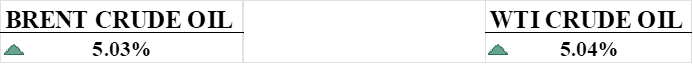

CRUDE OIL PERFORMANCE

Crude benchmarks surged 5% last week, fuelled by a combustible mix of threats to Red Sea shipping, Ukrainian refinery strikes, and U.S. refinery maintenance. Gasoline futures joined the rally, hitting a three-month high after a 9% jump driven by refinery downtime. While Mideast rising tensions after Israeli strike on established safe zone in Rafah raise supply concerns, analysts’ views that disruptions remain modest, with Saudi Arabia emphasizing ample spare capacity and Iraq vowing OPEC compliance. However, rising U.S. shale production in March adds another layer of complexity to the already volatile market landscape.

OTHER IMPORTANT MACRO DATA AND EVENTS

The U.S. monthly consumer prices rose less than previously reported in December, with a 0.2% increase instead of the initially reported 0.3%. Market reactions included a slight gain in U.S. stock futures, a pullback in the U.S. Treasury 10-year yield, and a slight dip in the dollar index, with analysts noting that the revisions are unlikely to prompt the Federal Reserve to cut rates, indicating a steady stance from the central bank amidst positive economic conditions.

Despite a recent increase in announced layoffs, weekly unemployment claims in the US fell more than anticipated, highlighting continued strength in the labour market, and potentially delaying expected interest rate cuts. This resilience suggests sustained economic growth momentum and reinforces expectations of a stable job market, with workers quickly finding new employment opportunities amidst ongoing challenges.

What Can We Expect from The Market This Week

US CPI January: Consumer prices are expected to increase slower from 3.4% to 2.9%, with the core CPI also expected to slightly decrease to 3.8% year-over-year. This reflects a continued, albeit gradual, decrease in inflation compared to the 0.5% increase in January last year, driven by across-the-board increases in shelter, food, and energy prices.

Japan GDP Q4: Economic growth in Q4 may face challenges with high inflation and weak wage growth, leading to a contraction in real GDP and a decline in domestic consumer spending for the second consecutive quarter, which would spell recession. Despite accommodative monetary policy, lower domestic demand is expected to continue until the second quarter of 2024, when wage growth is hopefully to pick up alongside potential changes in the Bank of Japan's policy stance next month.

US Retail Sales: Retail sales data surpassed expectations in December that printed 0.6%, indicating strong holiday spending and a notable shift towards online shopping, leading to an upward revision in economic growth estimates for the fourth quarter, setting a positive momentum for the US economy in 2024.

US PPI January: Manufacturer's price unexpectedly fell 0.1% in December, while the November release was revised to show the PPI falling 0.1% instead of being unchanged as previously reported. This bodes well for lower inflation in the months ahead, as forecasts expect year-on-year figures to reenter below 1%.

US Building Permits: the number of permits issued for new construction projects noted an increase in permits, reaching 1.493 million in December and an expected rise to 1.55 million by the end of the first quarter of 2024. This steady growth in asset creation expectations indicates a resilient economy, although housing starts slowed in the same period.