PAST WEEK'S NEWS (April 22 – April 25, 2024)

U.S. economic growth slowed more than anticipated in the first quarter ahead of the PCE measure. The GDP came in at an annualised rate of 1.6%, below economists' forecasts of 2.4%, while the PCE price index is expected to accelerate, presenting a challenging scenario for the Fed as it navigates between taming inflation and avoiding an economic downturn. Analysts view the report as a "toxic mix" for central bankers, with slowing growth and rebounding inflation, potentially pushing back rate cut expectations and injecting uncertainty into bond and stock markets.

Japan is hopeful that inflation will remain around the 2% target for the next three years. This has set expectations of further interest rate hikes by the BOJ after its exit from the Yield Curve Control Easy policy earlier this year. Governor Ueda stated that the BOJ will raise rates if trend inflation accelerates towards the 2% target as projected. As a result, the yen depreciated sharply against the dollar, reaching multi-year lows, putting Japanese authorities in distress. Finance Minister Suzuki has also warned of strong intervention in currency markets, stating that recent trilateral meetings with U.S. and South Korea have paved the way for action against excessive yen weakness.

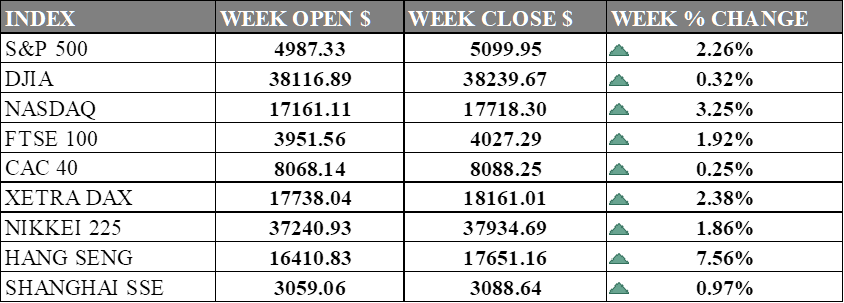

INDICES PERFORMANCE

The major U.S. stock indexes experienced mixed results last week. The S&P 500 rose 2.26% to close at 5099.95, up from its open of 4987.33. The Dow Jones Industrial Average gained 0.32% to finish at 38239.67 compared to its opening level of 38116.89. However, the tech-heavy Nasdaq surged 3.25% to 17718.30 after opening the week at 17161.11. There's optimism among investors after big tech earnings lifted mood, which contributed to Nasdaq's significant rally or recovery.

In Europe, the major indexes also saw gains. The UK's FTSE 100 climbed 1.92% to close at 4027.29 compared to its open of 3951.56. Germany's XETRA DAX surged 2.38% to settle at 18161.01 from its starting point of 17738.04. France's CAC 40 edged up 0.25% to end the week at 8088.25 after opening at 8068.14. European markets rebounded from earlier losses, with some relief regarding ECB monetary policy after eurozone lending data gives support to dovish sentiments.

Asian markets had a mixed performance as well. Japan's Nikkei 225 rose 1.86%, closing at 37934.69 versus its open of 37240.93 as the market tracked tech-related stocks that gained following better earnings report. Hong Kong's Hang Seng surged 7.56% to finish at 17651.16 from its starting level of 16410.83. China's Shanghai Composite gained 0.97%, closing at 3088.64 compared to its open of 3059.06. China market is marking a path to recovery right after fund houses upgrades on China shares, compounded by the fact that it is seeing technical opportunity.

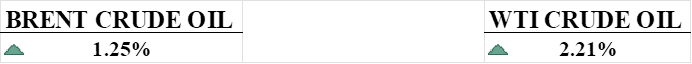

CRUDE OIL PERFORMANCE

Crude closed higher, driven by expectations of higher demand and tighter supply, despite fading hopes for stimulus from lower US interest rates. Tight supply conditions persisted as observed by US inventories which dropped by 6.4 million barrels last week, though prices remained within a narrow range due to ongoing supply restrictions by OPEC+. The US Bureau of Economic Analysis reported a 2.7% increase in the Personal Consumption Expenditures Index (PCE) for March, which is likely to prompt the fed to postpone interest rate cut by as inflation continues to outpace its 2% target.

OTHER IMPORTANT MACRO DATA AND EVENTS

The U.S. reported a moderate inflation in March, particularly in housing and utilities costs, implying the Federal Reserve might maintain elevated interest rates. Despite fears of stagflation, the Commerce Department's report provided relief to financial markets, showing increased consumer spending and inflation in line with expectations.

Some analyst says that chinese deflation is still in play despite improved GDP, prompting concerns of its spillover to export destinations. The analysts attribute this deflation to global commodity price cooling and supply chain improvements, with limited impact on regional inflation due to small Chinese goods consumption and other factors like service price inflation.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: Federal Reserve’s interest rate path has been marked by caution, with the potential for fewer or no rate cuts at all this year due to factors such as job data, inflation rates, and credit spread. However, much lower economic growth pointed towards stagflation, a phenomenon noted by high inflation and stagnant economic growth.

Eurozone CPI April: Europe Consumer Price saw a decrease to 2.4% from February's 2.6%, potentially leading the European Central Bank to consider lowering interest rates. However, the ECB tends to follow the federal reserve in setting its rate.

JOLTs Job Openings: insights into the U.S. labour market by collecting data on job openings, hires, and separations. Recent data from February 2024 showed 8.76 million job openings, slightly below February figures, supporting a rate cut.

US Nonfarm Payroll: The latest report shows employment addition rose by 303,000 in sectors other than farming, indicating healthy job growth. The unemployment rate remained stable at 3.8 percent, with job gains observed in the health care, government, and construction sectors.

China Manufacturing PMI: Over 700 manufacturing enterprises in China showed surprising growth in March, with an index at 50.8, far above expectations and the previous figure of 49.1. It is the first time that the sector has reported expansion after five straight months of contraction, although April figure remains conservative at 50.3.