PAST WEEK'S NEWS (June 24 – June 28, 2024)

The new home sales data for May 2024 reveals a worrying trend in the housing market. While sales came in slightly below estimates at a seasonally adjusted annual rate of 619,000, the total active inventory of completed new homes ready for sale has surpassed 2019 levels, reaching 99,000 units. This inventory build-up is causing some builders, particularly smaller ones, to be cautious about issuing new permits, leading to a three-month decline in single-family permits. The majority of the new home supply is still under construction or has not yet started, with builders taking a cautious approach to managing their backlog. Economists expect new home sales to remain limited until mortgage rates get cheaper, with a slight rebound expected in the latter half of 2024 if the Federal Reserve begins to cut rates.

Interest rate projections are tricky, with changing expectations every second. Recently, Federal Reserve Governor Michelle Bowman said interest rates is expected to remain steady "for some time," outright rejecting the notion that there will be rate cuts in 2024, contrary to other members. Bowman warns that lowering rates too quickly could lead to reinflation, and she remains open to further rate hikes instead, if progress on inflation stalls or reverses. Fed officials, like San Francisco Fed President Mary Daly, have also expressed concerns about recent "bumpiness" in inflation data while Federal Reserve Governor Lisa Cook says rate cuts are contingent on economic performance while highlighting the Fed's shift towards considering both inflation and job market conditions in its policy decisions.

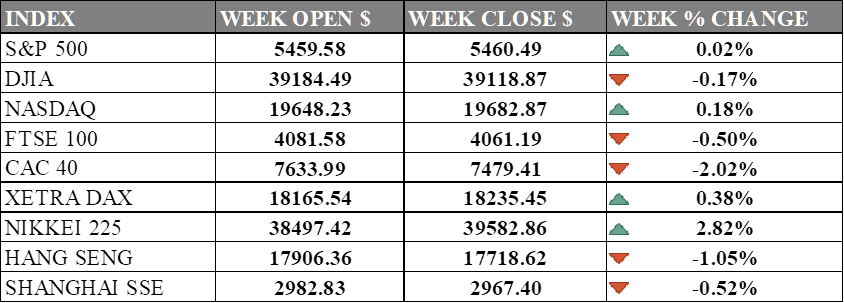

INDICES PERFORMANCE

The major U.S. stock indexes showed mixed performance last week. The S&P 500 gained marginally by 0.02% to close at 5460.49 from its open of 5459.58. The Dow Jones Industrial Average (DJIA) decreased 0.17% to finish at 39118.87 compared to its opening level of 39184.49. The Nasdaq showed the strongest performance among U.S. indexes, with a 0.18% increase to close at 19682.87 after opening the week at 19648.23. Investors digested in-line inflation data and weighed political uncertainty after the U.S. presidential debate. However, monthly inflation was unchanged in May, seen as an encouraging development.

In Europe, results were mostly negative. The UK's FTSE 100 fell 0.50% to close at 4061.19 compared to its open of 4081.58. Germany's XETRA DAX was the only European index in the table to show positive performance, increasing 0.38% to close at 18235.45 from its starting point of 18165.54. France's CAC 40 showed the weakest performance among the European indexes mentioned, declining 2.02% to end the week at 7479.41 after opening at 7633.99. Political uncertainty in France and increasing trade tensions between China and the West haven't significantly impacted Q2 earnings expectations.

Asian markets saw mixed performances. Japan's Nikkei 225 posted the strongest gain of all indexes in the table, rising 2.82% to close at 39582.86 versus its open of 38497.42 although yen's weakness has raised concerns about rising import costs in Japan. Hong Kong's Hang Seng declined 1.05%, finishing off at 17718.62 from its starting level of 17906.36. China's Shanghai SSE also posted a loss, declining 0.52% to end the week at 2967.40 compared to an opening figure of 2982.83. Chinese stocks declined even as a private survey showed improved manufacturing activity, with the Shanghai Composite Index rising 0.9%, contrasting with the official manufacturing PMI that indicated contraction.

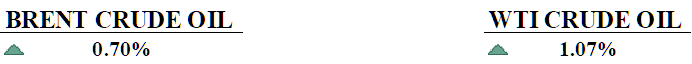

CRUDE OIL PERFORMANCE

Oil prices dipped Friday due to weak U.S. fuel demand and quarter-end profit-taking. Brent and WTI futures saw minimal weekly changes but gained about 6% monthly. Analysts predict stable oil prices for the latter half of 2024, balancing Chinese demand concerns and increased supply against geopolitical risks. A Reuters poll forecasts Brent crude averaging $83.93 and U.S. crude $79.72 per barrel in 2024. OPEC+ production decisions and rising non-OPEC output may lead to a small market surplus by late 2025. U.S. gasoline demand hit its lowest since February, dampening buying interest.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. inflation stalled in May with flat PCE price index readings, as rising service costs offset falling goods prices, potentially paving the way for Fed rate cuts later this year. This data, combined with modest consumer spending growth and slowing core inflation, has boosted hopes for a economic "soft landing" and increased market expectations for a September rate cut.

Tokyo's core inflation rose to 2.1% in June, exceeding forecasts and strengthening the case for a BOJ rate hike. Factory output rebounded in May, signalling economic recovery and further supporting potential monetary tightening.

What Can We Expect from The Market This Week

US Nonfarm Payrolls: The nonfarm job position is expected to report lower at 189K after it surged by 272K, beating expectations of 182K, which may set a new trend if it breaks again. However, the unemployment rate unexpectedly rose to 4%, ending a 27-month streak of sub-4% joblessness.

ISM Non-Manufacturing PMI: Generally used as the economy's leading indicator, the index rebounded out of contraction into expansion, currently at 53.8 vs. 49.4 in April. This rebound came after the first contraction since December 2022. Key drivers included higher business activity, faster new order growth, and slower supplier deliveries. However, employment continued to contract.

JOLTs Job Openings: The U.S. labour market reported approximately 8.06 million job openings in April, with the hire rate standing at 3.6% and the total separation rate at 3.4%, a mere 0.2% job growth rate. June data is expecting 7.86 million openings in a declining trend as the labour market cools.

FOMC Meeting Minutes: The Federal Reserve’s May meeting minutes revealed a cautious approach, balancing inflation concerns with support for economic growth. The Committee emphasised a date-dependent policy, remaining open to adjustments based on future data. The June meeting is expected to provide clues as to changing expectations from a two-rate cut to only once this year.

Eurozone CPI June: Consumer inflation in the Eurozone rose to 2.6% in May, stagnant progress since early this year. The decline in Eurozone manufacturing PMI and services sector activity further impacted the region’s economic outlook.